The detritus of over

Rs 10 lakh cores

NPA has been inviting the ire of the public and pundits. The fact that over 90% of NPAs were contributed by large borrowers has only infuriated and fueled suspicion on the skills and integrity of borrowers,

lenders, rating agencies , auditors, government, supervisors and all the stakeholders.

Well one may wonder whether this is appropriate time to discuss about NPAs, when the pandemic is ravaging the lives and livelihoods with such ferocity. Health care is the top of the mind of every citizen and the governments. At the same time financial sector has to play an important role in economic recovery. Livelihoods and businesses need financial oxygen (money) to recover, rehabilitate and resume their lives and businesses.

Reeling under massive burden of NPAs, lenders are naturally risk and loss averse. This behavior only compounds problems for themselves as well the economy. Unless lenders resume their business and grow by at least 15%, no nation can grow and more so in an economy dominated by financial institutions and not debt markets. But it cannot be business as usual in their lending process, operations and decisions.

Smart lenders ask themselves of what has gone wrong and learn lessons and avoid repetition of mistakes in their decisions.

Forensic audit reports, internal reports and RBI’s Asset Quality reviews have brought out fault lines in lending process and operations besides malfeasance. Successful underwriting process revolves around primarily assessment of (3C s) Character, Capital and Capacity of the borrower. If any borrower is short on any or all of the 3C-s, the probability of default (PD) is very high.

Credit underwriting is no rocket science. One may not be faulted in asking — Did the lenders questions wrongly on 3Cs to borrowers while evaluating credit decisions/ Or did the borrowers give wrong answers deliberately or otherwise and this led to faulty assessment of 3C-s ending up in NPA/ Or Are the lenders plain credulous and believed whatever these NPA borrowers had said and did?

3Cs framework looks blindingly obvious but their assessment is tricky. The most difficult is assessing the intent and character of the borrower. This is evident from the fact that banks /auditors have flagged as much as Rs Three-lakh crores as frauds. There are a large number of willful defaulters as well.

Audits and investigations both internal and external have revealed, of course quite late in the day that many of the large borrowers had no adequate capital of their own as a buffer and defense against adverse business developments and faltered badly. Many of these borrowers have round tripped borrowing from one bank as capital in another project of another lender. This elevated leverage led to liquidity and ultimately solvency crisis turning the lending as NPA.

Capacity of the borrowers to run the business successfully is a moving target in this fast moving business landscape/ models and disruptions. Many could not handle expansions and diversification of their businesses. Past experience and credit history does not help most of the time.

It is time that lenders beef up their 3C assessment capabilities lest they repeat the story. Many lenders add more Cs like Collaterals, Covenants and Controls to protect their lending. 3C framework captures the essential risk characteristics and traits of borrowers. This tool may be sharpened by deploying AI and digitization of the entire process.

Even Global Finance Crisis that cost more than a Trillion to global banks is a failure to adhere to 3C-s framework.

Supervisors in turn evaluate lenders on 3 C frameworks besides their own self assessment. Nothing prevents owners and regulators embracing 3 C framework in their own context.

This tool is relevant to other lenders like Mutual funds, Insurance companies, funds etc.

The 3C framework is as old as lending. But it is not atavistic

The blog has been authored by B Sambamurthy a Nominee Director from Reserve Bank of India and an ex Director and CEO of Institute for Development and Research in Banking Technology (IDRBT), Hyderabad.

DISCLAIMER: The views expressed are solely of the author and ETBFSI.com does not necessarily subscribe to it. ETBFSI.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.

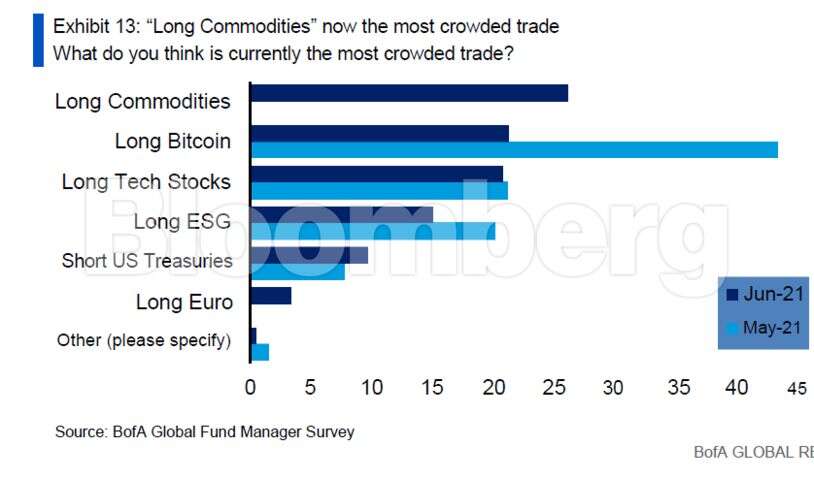

Other highlights from survey, which was conducted June 4 to 10, include:

Other highlights from survey, which was conducted June 4 to 10, include: