‘Disbursements set to grow, while NPAs will decline’

[ad_1]

Read More/Less

Mahindra and Mahindra Financial Services has seen an improvement in rural sentiment as the second Covid-19 wave ebbs. Ramesh Iyer, Managing Director and Vice-Chairman, Mahindra Finance, says demand is picking up and collection efficiencies are improving. In an interview with BusinessLine, Iyer said the company will look at expansion in the second half of the fiscal and is well capitalised for its business plans. Edited excerpts:

What kind of growth do you expect this fiscal?

Compared to previous years, the disbursement will be high. I see that volumes will pick up for auto loans, tractors, pre-owned vehicles. Disbursements will see a growth trajectory and NPAs [non-performing assets] will have a declining trajectory.

How confident are you of a reduction in NPA levels?

NPAs in the first quarter were purely due to a liquidity problem for customers, where they couldn’t earn enough and delayed payments. Otherwise, they are not defaulting customers. I would call them as a delay and not a default. We are confident that the customers who have delayed their instalments would definitely pay back.

Mahindra Finance: Macro sentiments turning positive in July

Are there more restructuring requests since the first quarter?

We had about six lakh eligible customers, but we did restructuring for only 60,000 in the first quarter. I would not expect the restructuring numbers to be very high this quarter but there could be some demand from commercial and passenger vehicles. It could be 30,000 to 35,000 customers. In terms of exposure, along with what we did in June, it should not account more than 4-5 per cent of the book.

Is demand picking up?

Even during this pandemic, we didn’t see too many cancellations, but dealerships were closed. With the opening-up in June, we did see volumes pick up and it continued in July. Normally, July and August are not great months for vehicle purchase. People wait for the festival season. This could also be pent-up demand from the first quarter. We all hope and pray there is no severe third wave; and with a good monsoon one could expect both September and October to do well, especially as infrastructure work gathers pace. With both of that happening, it could be a good buoyant story from a rural perspective.

Mahindra Finance posts Q1 net loss of ₹1,573 crore

Will this be a year of expansion for you?

It will be a mix in terms of people and branches. We will definitely add in the second half. By then we will know, the third-wave behaviour, if any, and we will also know how the harvest is panning out. We are also ensuring adequate investment in technology. We have built a very strong digital and AI team, and they are looking at various processes that can be digitised. Our data team is looking at the millions of data we have and coming out with forecasts based on trends.

Are you looking at new products or focus areas?

From our point of view, it’s important to capture three areas for further growth. We have created a very strong SME [small and medium-sized enterprises] vertical, where we are working with a large Mahindra ecosystem, and other OEM [original equipment manufacturer] ecosystem, where we will support suppliers for their capex or working capital requirements. We have chosen three industries to work with — auto, agriculture and engineering — where we think there is a lot of play for SME players. In the vehicle segment, pre-owned vehicles will be a good growth segment. As infrastructure opens up, tractor volumes will pick up. Many OEMs in cars are also reaching out to rural markets with their launches and that can become a natural synergy for us to gain volume. We do believe that leasing in the next three years will become a prominent play. We have set up a digital finco for small-ticket consumer durable and personal loans. The platform is live but this is a testing year. While we have done some loans, from April you will see a lot of aggression in this business.

Are there any outstanding issues for NBFCs?

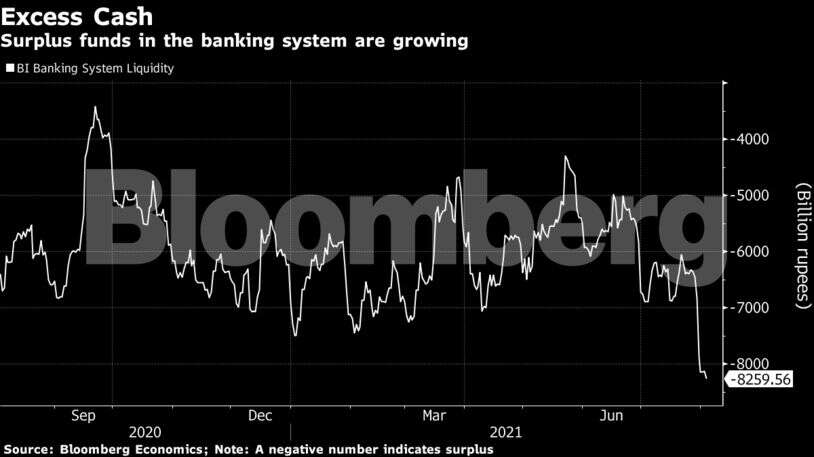

The issue of liquidity has been addressed now. If at all the third wave happens and impacts customers, then expectations would be for a moratorium for customers. In restructuring, typically, customers are a little worried about the interest burden; but in a moratorium, they are very clear that they will not have to pay an instalment for a certain period. It helps both the company and the customer.

[ad_2]