New regulations that require a second factor authentication for certain auto debit transactions are becoming operational from October 1, 2021. How will this impact all your automated transactions such as EMIs, phone, gas and electricity bill payments and SIPs? How can you work around the new rules if your bank or merchant is not yet compliant? Read on to know.

Affected transactions

To begin with, not all your automated payments will be affected. RBI’s new guidelines will impact only all recurring contactless payments made through debit/credit cards, UPI and prepaid instruments and this, when done from third party websites and apps.

Transactions initiated on the bank’s website or app will continue hassle-free. For example, if you have automated a payment on your HDFC Bank debit/credit card through their BillPay Service, this can go on.

Also read: Auto debit norms: Payments Council of India seeks extension for smooth transition

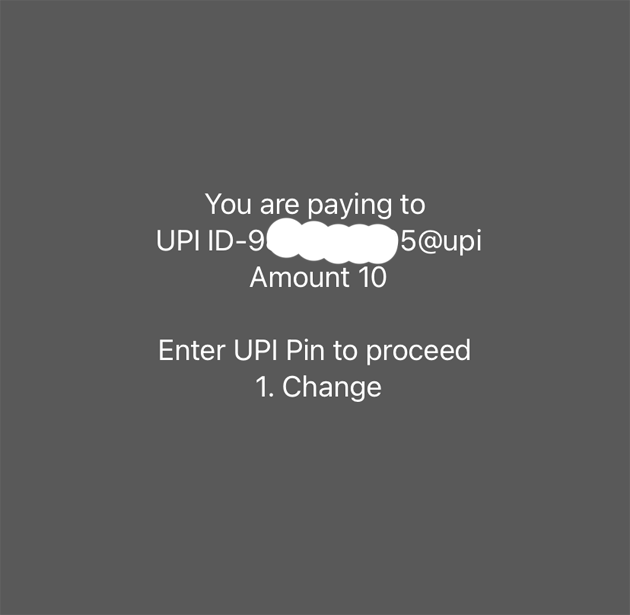

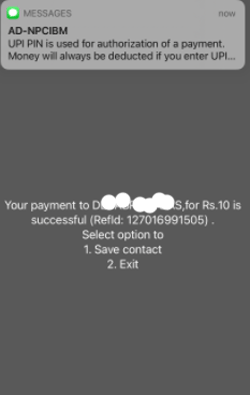

Payments initiated through third party apps, that do not comply with RBI’s guidelines may not go through henceforth. This is because the new RBI guidelines mandate such transactions to undergo additional factor authentication. This means that every recurring transaction automated from outside a bank’s portal will now require a second factor authentication by way of an OTP.

For all your automated debits exceeding ₹5,000 per transaction, you will henceforth be required to authorise the banks to carry out the transaction every time the transaction falls due. An OTP will be sent to you 24 hours prior to the transaction, for every payment to go through.

The OTP will be sent on your registered email address and phone number, along with details of the merchant, transaction amount. A link that enables you to modify or cancel the transaction or the recurring mandate itself will also be sent alongside.

Additional factor authentication will only be one-time in nature for payments below ₹5,000 (required at the time of registering the mandate). If you have already registered such mandates with third party apps/websites that are compliant with the new guidelines, your payments will continue hassle free. In case the merchant is not compliant, banks will intimate you to give the one-time additional authentication for such transactions.

It is noteworthy that large private banks, such as HDFC Bank, ICICI Bank, and Axis Bank have been enabling automated payments with additional factor authentication, for e-mandates across various merchants.

In many other banks, this was only available for transactions or standing instructions placed through bank’s net banking, phone banking or UPI portal. Examples for these include your loan EMIs and monthly investments such as SIPs, where in you either signed the NACH/ECS mandate or providing a standing instruction through the bank’s net banking portal.

Following the October 1 deadline, more banks have tied up with select merchants to enable such two-factor authentication as mandated by the RBI. But some are yet to comply.

Tackling non-compliant transactions

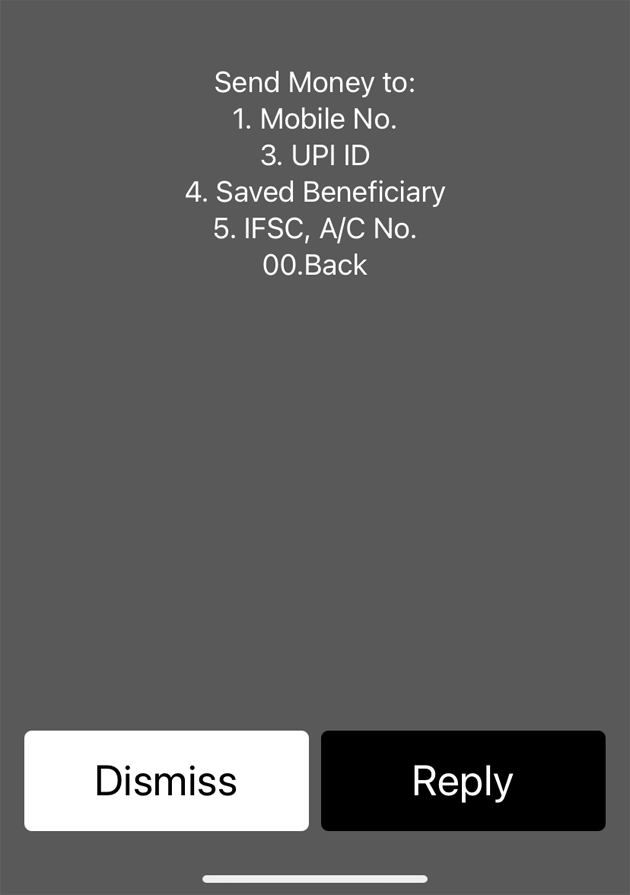

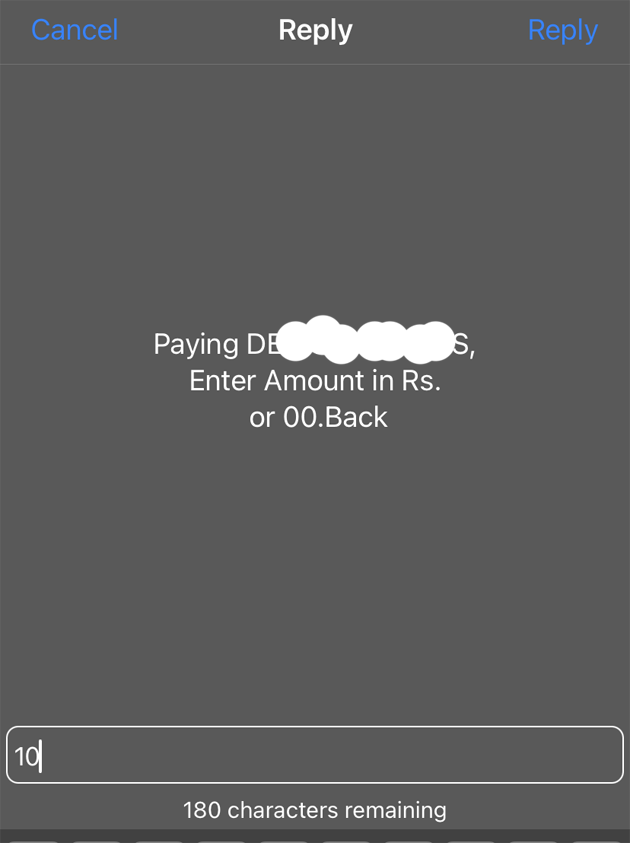

Transactions initiated with non-compliant merchants may not go through, starting October 1, 2021. You can make direct payments on the app/ website of the merchant or choose the merchant under your UPI, net banking or card account and pay them when the dues come up.

However, if you want to continue automating transactions with such non-compliant merchants, banks may require you to register the recurring payments on the bank’s portal.

For instance, if you opted for an auto-renewal of your OTT platform subscription, the same may not go through starting October 1, if the same is not compliant with the new guidelines issued by RBI. Do note that while Amazon Prime, Netflix and Hotstar are currently integrated into the common platform, other OTTs haven’t.

How will you know whether your merchant is compliant or not? Fret not. Banks will intimate customers regarding the same through text and email. Customers can then issue the standing instructions afresh to banks, to continue automating the transactions, hassle free.

Leave alone non-compliant merchants, many banks themselves have not yet upgraded their software to comply with the new guidelines. Customers of such banks who have authorised automated payments to merchants need to check with their banks on the status recurring payments.

In the interim, you can make direct payments on the app/ website or choose the merchant under your UPI /net banking/card account and make the payment each time the payment it is due.