Stocks To Buy After Their Quarterly Results

[ad_1]

Read More/Less

LIC Housing Finance

Motilal Oswal has a buy call on the stock of LIC Housing post its quarterly numbers. “LIC Housing Finance surprised positively on growth, spreads, and addressing capitalization issues in 4QFY21. However, asset quality surprised negatively. We await clarification on the same. Given its parentage, it has been able to raise debt capital at low rates, which should keep margin healthy in a highly competitive environment. The sharp pick-up in disbursements is encouraging. Valuations at 1x price to book value is attractive. We look to revise our estimates post the earnings call,” the brokerage has said.

The housing finance company stock was last trading at Rs 510, down almost 2% in trade, post quarterly numbers of the firm.

Lemon Tree Hotels

Lemon Tree Hotels is a midscale business and leisure hotel. Again, Motilal Oswal has a buy rating on the stock.

“Revenue fell 46% YoY to Rs 951 million (estimated Rs 889 million) in 4QFY21. ARR declined by 45% YoY (to Rs 2,498) and occupancy fell 170 basis points (to 59.3%). RevPAR fell 46% YoY to Rs 1,481. On a QoQ basis, RevPAR grew 38% on the back of a 17 pp improvement in occupancy rate, marginally offset by a 1% decline in ARR.

EBITDA fell 55% YoY to Rs 285 milion (estimates Rs 302 million; v/s Rs 201 million in 3QFY21). On a QoQ basis, revenue/EBITDA grew 39%/42%. Adjusted loss stood at Rs 168 million v/s a loss of Rs 179 million in FY20,” the brokerage firm said.

Following its results, the shares of Lemon Tree was trading at Rs 42.60, up nearly 2% in trade.

Whirlpool of India

Whirlpool of India is a stock Motilal Oswa has a buy, following a decent set of quarterly results.

“As the economy recovers from the lockdowns, operating leverage should aid margin normalization by FY23E to 11.4%. While topline growth has been at par with our coverage universe companies, the low base of FY21 should help in faster earnings growth as peers witness margin erosion from a high base of FY21. This should help the stock catch-up with its peers. To account for the second COVID wave, we cut our FY22E/23E EPS by 20%/4% and price target to Rs 2,900 (from Rs 3,020 earlier) based on unchanged target FY23E P/E of 55 times. Maintain Buy,” the brokerage has said.

The shares of Whirlpool of India were at Rs 2,340 down 0.50%.

Disclaimer

The above mentioned stocks have been picked from brokerage reports. The author, the brokerage or Greynium Information Technologies do not take any responsibility for losses that maybe incurred. The above article is for informational purposes only

[ad_2]

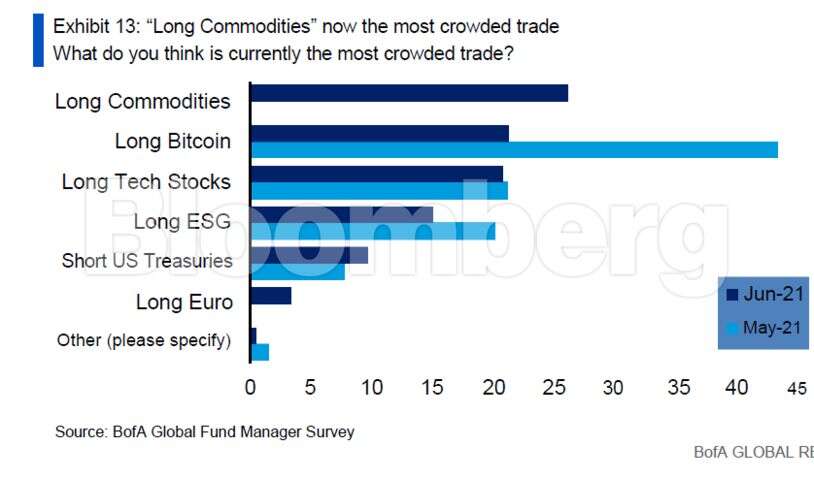

Other highlights from survey, which was conducted June 4 to 10, include:

Other highlights from survey, which was conducted June 4 to 10, include: