Banks need to up their game on IT investments, says IBA chief Mehta

[ad_1]

Read More/Less

They should also enhance their focus on cybersecurity, he said

[ad_2]

Get Bank IFSC & MICR codes here.

[ad_1]

They should also enhance their focus on cybersecurity, he said

[ad_2]

[ad_1]

The downgrading of growth projections was triggered largely due to restrictions being imposed by different states.

“India managed the first wave of pandemic well. However, the country is now facing an unprecedented second wave. There is no doubt India could have done better,” said economists at SBI.

The second wave of Covid-19 pandemic has shattered all records. The number of active cases crossed the 30 lakh mark for the first time since the beginning of the pandemic. In the past 24 hours, 3.79 lakh fresh cases and 3,596 deaths were reported in the country, highest for a single day.

With rising cases, the recovery rate of Covid-19 patients has also plummeted sharply from 97 per cent at the beginning of the second wave to 82.5 per cent now. This 14.5 per cent drop in recovery rate has happened over the past 69 days.

However, SBI is sensing “good news amidst all the gloom” and believes the peak of the pandemic is near.

“Given that every 1 per cent reduction in recovery rate takes around 4.5 days, it translates into around 20 days from now. Also, our estimate shows every 1 per cent reduction in recovery rate increases active cases by 1.85 lakhs. Thus we believe the peak of the second wave would come around mid-May with active cases reaching around 36 lakh at that point,” the economists wrote.

The economists say they have started noticing some deeper impact of the second wave on economic activity in the country. Its business activity index in April dipped to a new low level of 75.7, a level last attained in August 2020.

This indicates the disruption caused by increased restrictions imposed in various states. All the indicators, except for labour participation and electricity consumption have declined significantly during April.

“Given the current circumstances of partial/local/weekend lockdowns in almost all states, our growth forecast is now revised downwards. SBI’ revised FY22 growth projection now stands at 10.4 per cent for real GDP and 14.2 per cent for nominal GDP,” the economists said.

Earlier, SBI had projected real GDP growth for FY22 at 11 per cent (RBI:10.5 per cent) and nominal GDP at 15 per cent (Union Budget: 14.4 per cent) on the back of a low base effect and renewed economic momentum.

Total loss due to the second wave lockdowns is estimated at Rs 1.86 lakh crore, of which Maharashtra, Madhya Pradesh, Karnataka and Rajasthan account for 75 per cent. Maharashtra’s loss alone stands at 43 per cent.

Vaccine as public good

SBI advocated declaring Covid-19 vaccine as a public good, which it believes is the only way to fight this dreadful pandemic. In economic parlance, ‘public goods’ are defined as non-excludable and nonrival in nature.

“The primary idea of a public good is that agents must cooperate and not be combative, and then only all the players will have the opportunity to get a better payoff…When both Centre and state government cooperate with each other, both will receive benefit in the form of more vaccination, better medical facilities, and less number of cases. When both [are non-cooperative], the payoffs will be zero for both,” said SBI economists.

In the last couple of months, there have been instances when some states and central government have tussled over managing the pandemic, with each blaming the other for any mishaps.

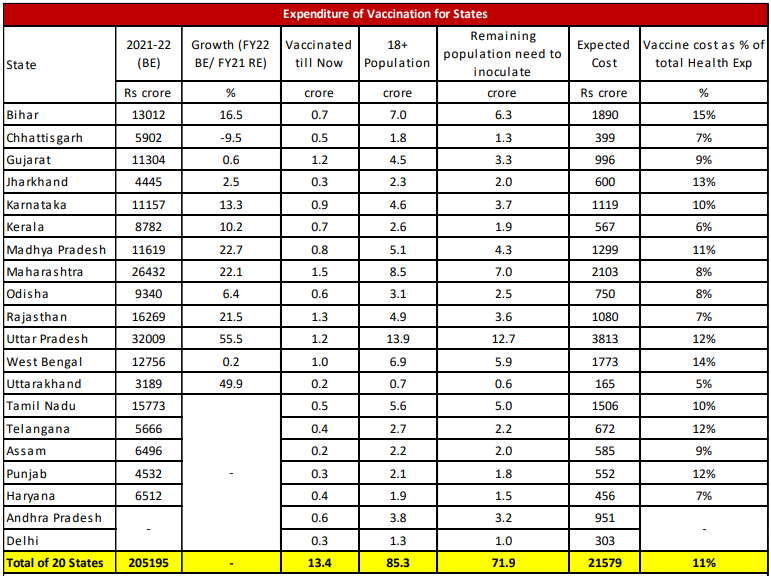

The bank said for the 20 states it analysed, the cost of vaccines is almost 10-15 per cent of their health expenditure budget, assuming half of the population in these states will get vaccinated by the central government.

This cost is, however, only 0.1 per cent of GDP and much lower than the economic loss if restrictions occur to control the spread of pandemic which is already around 0.8 per cent of GDP.

“In some states like Maharashtra, Delhi and Chhattisgarh, even as mobility has declined significantly, cases increased and they have shown some stabilization only recently, indicating the transmission may not be possible only through humans, but it is airborne. This makes a strong case mass sanitisation of public places for disinfection,” said SBI.

[ad_2]

[ad_1]

He said the bank intends to put in place 1,000 beds with 50 ICU facilities in the states that are the worst affected.

So, he said, it could be 120 beds at some places, while 150 at others with adequate healthcare facilities, depending on a hospital’s capacity to scale up.

It is to be noted that the Ministry of Corporate Affairs last week permitted makeshift hospitals and temporary COVID care facilities to be treated as an eligible Corporate Social Responsibility (CSR) activity.

India is reeling under the impact of the second wave of COVID-19 with over 3 lakh cases being reported for the past 8 days in a row. With each passing day, the death toll is rising.

The country witnessed a record single-day rise of 3,79,257 new coronavirus infections pushing the total tally of COVID-19 cases to 1,83,76,524, while active cases crossed the 30-lakh mark, according to the Union Health Ministry data updated on Thursday.

Speaking about various initiatives taken by the country’s largest lender in its fight against COVID-19, Khara said SBI is also collaborating with hospitals and NGOs to provide oxygen concentrators for the patients.

“We have put in place an action plan. We have earmarked Rs 70 crore plus out of which we are giving Rs 21 crore to 17 circles for COVID-19 related initiatives,” he said.

Last year, the bank had donated to the Prime Minister’s Citizen Assistance and Relief in Emergency Situations (PM CARES) Fund. SBI had contributed 0.25 per cent of annual profit, while employees collected over Rs 100 crore for the fund. In addition, Rs 11 crore contribution was towards supporting vaccination drive.

For the safety of employees and their families, he said, the bank has tied up with hospitals across the country to facilitate treatment of those who have fallen sick on a priority basis.

“We are also ensuring the supply of important medicines etc. so that the staff are not put to inconvenience. Various teams of medical officers are active at Local Head Offices and Zonal Offices, to oversee and coordinate COVID-19 support activities in the area under their jurisdiction,” he said.

A quick response team (QRT) headed by a general manager at the corporate centre is monitoring the COVID position at the entire bank-level and providing assistance at the shortest possible timeframe, he added.

With regard to vaccination, Khara said, the bank has collaborated with various hospitals for the jab.

“So far, 70,000 staff have been vaccinated out of 2.5 lakh. We are closely monitoring this number and this is expected to go up post-May 1 when it will be opened for all beyond 18 years,” he said.

The bank has decided to bear the cost of vaccination for its employees and their dependent family members. In case of unfortunate death of employees, he said, it is very difficult to replace the loss but some assistance is being provided immediately.

“We have also liberalised appointments on compassionate ground as part of assistance to dependents of those who have lost their life due to this pandemic,” he said.

The bank pays an ex-gratia lump sum amount of Rs 20 lakh to the family of the employee who dies due to COVID-19 infection.

At the same time, Khara said, the bank is sensitive to the health of its customers.

The bank has been doing customer awareness campaigns on digital banking amid pandemic, he said, adding local level engagements of distributing hand sanitisers, masks, PPE kits, donation of ambulances, etc are being undertaken.

[ad_2]

[ad_1]

Post the announcement of fourth quarter results by banks and finance companies, it has come to light that many have made provisions for refunding the interest on interest on the loan moratorium to all borrowers.

Private sector lender HDFC Bank has kept aside ₹500 crore for interest on interest provisions while ICICI Bank said it has provided ₹175 crore for the purpose. For Axis Bank, the estimated impact of the interest on interest refund is ₹160 crore.

Mahindra Finance has kept aside ₹32 crore for this purpose.

In its fourth quarter results, PNB Housing Finance had said that the methodology for calculation of the amount of such ‘interest on interest’ has been recently circulated by the IBA.

“The company is in the process of suitably implementing this methodology and has created a liability towards estimated interest relief and reduced the same from the interest income for the year ended March 31, 2021,” it had said.

In a recent note, ICICI Securities had said that the waiving ‘interest on interest’ on loans above ₹2 crore during the moratorium period on all loans will lead to a fresh burden of ₹11,200 crore on the industry. This will include about ₹3,200 crore for private banks and small finance banks, ₹5,500 crore for public sector lenders and ₹2,000 crore for all NBFCs and housing finance companies, it had said.

IBA finalises methodology

While some lenders have sought clarifications, the IBA has recently finalised the uniform methodology for refund or adjustment as per the Supreme Court judgement.

Under the norms, borrower accounts which were standard as on February 29, 2020 including SMA-0, SMA-1 and SMA-2 will be eligible for the refund. All loans, working capital, trade products, which had outstanding during the moratorium period shall be considered.

The Supreme Court, in its judgement in March, had ruled that all borrowers will be eligible for waiver of interest on interest for the loan moratorium due to the Covid-19 pandemic.

On April 7, the Reserve Bank of India had asked all lenders to compensate borrowers for the interest on interest during the moratorium whether they had taken the moratorium or not. Earlier, the Centre had picked up the tab for waiver of interest on interest for loans up to ₹2 crore.

[ad_2]

[ad_1]

Moody’s Investors Service on Thursday said sustained weakening of the Indian rupee against the dollar will be credit negative for rated Indian companies that generate revenue in rupees but rely heavily on US-dollar debt to fund operations and thus have significant dollar-based costs.

However, the global credit rating agency expects that the negative credit implications will be limited.

Rupee view: INR positive as Fed maintains status quo

The observation comes in the backdrop of the Indian rupee closing around 74.66 against the US dollar on April 27, 2021, or about 3 per cent lower than levels in mid-March. The rupee has fallen over 15 per cent since January 2018, Moody’s said in a note.

“Most companies have protections to limit the effect of currency fluctuations. These include natural hedges, where companies generate revenue in US dollars or have contracts priced in US dollars; some US dollar revenue and financial hedges; or a combination of these factors to help limit the strain on cash flow and leverage, even under a more severe deprecation scenario,” said Annalisa Di Chiara, Senior Vice-President.

Rupee extends gains for second day; closes up by 7 paise at 74.66 against dollar

As a result, weaker credit metrics under a scenario in which the rupee depreciates a further 15 per cent against the dollar can be accommodated in the companies’ current rating levels.

Moody’s observed that refinancing risk associated with US dollar debt over the next 18 months also appears manageable, as most companies are well-known in the markets as repeat issuers and others are government-owned or government-linked entities with good access to the capital markets.

The agency noted that India is reporting new record daily increases in coronavirus infections, prompting new lockdowns and restrictive measures to curb the spread of the pandemic and raising concerns on their impact on the country’s pace of economic recovery.

[ad_2]

[ad_1]

Private sector lender ICICI Bank on Thursday announced the launch of a comprehensive digital banking service that aims to empower over two crore retail merchants in the country.

Called Merchant Stack, it provides a bouquet of banking solutions and value-added services in ‘one single place’ for the retailer ecosystem.

“The main pillars of the stack are a new account named Super Merchant Current Account; two instant credit facilities called Merchant Overdraft and Express Credit — both are based on POS transactions, Digital Store Management facility to help merchants take their business online; exclusive loyalty rewards programme and value added services like alliances with major e-commerce and digital marketing platforms for expansion of online presence,” ICICI Bank said in a statement.

10 lakh customers of other banks using ICICI Bank’s mobile app

The facility will enable merchants — grocers, supermarkets, large retail store chains, online businesses and large e-commerce firms — to meet their banking requirements seamlessly so that they can continue to serve their customers in challenging times during the pandemic, ICICI Bank further said.

Retail merchants can avail of these contactless services without visiting the Bank’s branches, at a time when people are advised to stay home and maintain social distancing. They can avail of these facilities instantly, on InstaBIZ, the Bank’s mobile banking application for businesses.

Banks coming together for new umbrella entity for retail payments

“There are over two crore merchants in the country with approximately $780 billion in value of transactions in 2020. They are expected to grow rapidly in the coming years. Through these trying times of the pandemic, it is our endeavour to enable the merchants with a digital banking platform that will help them to continue to serve their customers,” said Anup Bagchi, Executive Director, ICICI Bank.

The Merchant Overdraft facility would enable pre-qualified merchants with a linked ICICI Bank POS machine to get upto ₹25 lakh digitally, instantly and in a completely online and paperless manner.

[ad_2]

[ad_1]

| Farmizo Khata assisting Farmers of the Future |

Shivrai Technologies, Indian AgTech company, recently announced the launch of their B2C Farm accounting mobile application, Farmizo Khata. Joining hands with Yono by SBI, they aim to help farmers across the country to manage their accounts efficiently, thus cutting down on losses. Shivrai also owns their own B2B brand, FarmERP.

Shivrai Technologies recently coined their 25-year mark of incorporation. Known for their formidable solutions in the space of AgriTech, they are all set to dip their foot into the B2C pool. Through this new venture with Yono by SBI, they aim to make their application increasingly accessible.

Farmers incur massive losses due to the lack of knowledge, disorganised book-keeping skills, and inability to manage their expenses in the most profitable manner. To aid this process, Shivrai Technologies partnered with leading digital banking platform, Yono SBI to help smallholder, marginal, and large-holder farmers by way of a free application. This will allow them to focus on their costs incurred, as well as the bookkeeping of total profits that are in line.

This free-of-cost application will not only efficiently manage their accounts but will also give them a platform to analyse and calculate their profits, losses, and expenses, thus enabling them to make wiser purchase, harvest, and production decisions. It is curated in the simplest possible way for smallholder farmers to benefit from it.

Aapki Kheti Ka Hisaab Kitaab- Available on Google Playstore and Appstore, as well as in the form of a digital portal, this accounting software has a simple User Interface and Experience for its audience. Shivrai is offering this software to farmers all across the nation at no cost.

How Does It Work?

Users can create their profile by entering basic information. Post that, the software will guide them to register their plot by entering Plot details and Crop Information. This software will also assist the farmers in Geo-Tagging their crops. In the next step, the farmers would be required to add their expenses incurred on each plot, along with their income details and profit and loss amounts on the software’s dashboard. After doing this, the software would automatically generate the Exact Cost of Production of each crop as per kg and acre. This would include the Auditor cost, the marketing and housekeeping cost, etc. In the end, the software would create a ‘Khata’ with a complete view of all the transactions in a simple ledger.

Sanjay Borkar, CEO and Co-Founder of Shivrai Technologies commented on the launch of the software, “We are very excited to announce the launch of this application. Inconsistent cost sheets, poor calculations of expenses and income, faulty accounts are a pain for farmers, resulting in massive financial setbacks. Farmizo Khata has entered the market with the sole purpose of reducing these financial setbacks for smallholder farmers, in turn increasing their yearly turnovers.,

Under the umbrella of Farmizo, Shivrai also plans on launching applications catering to various sub-verticals within the agricultural industry. In the year 2021, the brand is focusing on the upliftment of smallholder farmers by way of launching various applications personalised for their use. In the coming months, Shivrai is gearing itself to launch its new D2C application. The app that is in the final stages of testing, would be directly selling fresh fruits and vegetables to end-consumers, bypassing all and any third-party retailers or middlemen. In the next two years, the brand has a target to onboard 2 million agricultural stakeholders on their platforms.

Santosh Shinde, COO, and Co-Founder of Shivrai Technologies stated, “We believe Farmizo Khata will pave a way for smallholder farmers giving them the right support they need to make wise financial decisions. This being the 25th year of the inception of our parent company, Shivrai Technologies, we have some exciting projects in the pipeline. Farmizo is one such project that we can’t wait to share with the market.,

Shivrai Technologies is best known for their B2B Farm Business Management Platform, FarmERP. The platform has its presence in over 25 countries today, catering to stakeholders across the entire agricultural value chain. Their comprehensive platform acts as a solution for various agribusinesses and aims to vastly grow in the future with their personalised solutions.![]()

[ad_2]

[ad_1]

Indian Overseas Bank (IOB) on Thursday announced the launch of its retail loans such as home, personal and clean loans across the bank’s digital platform. The launch was presided over by the bank’s MD & CEO Partha Pratim Sengupta.

In a press release, IOB said its retail loans are now available in IOB website, internet Banking and mobile banking app. While IOB customers can apply for these loans on any of these platforms, non-customers can apply only through the bank website.

Also read: IOB appoints EY as its digital consultant

Applicants may apply for housing loans and home loans under the PMAY schemes (subsidy linked home loans) and applicants will also have the option to switch over their home loans from other Banks to IOB, the bank said.

“On submission of the application after accepting the terms & conditions of the loan, an In-principle sanction letter having a reference number will be generated and will be intimated to applicant through SMS/e-mail,” IOB said, adding that applicants can then visit the nearest branch to avail the loan with the required documents and the in-principle sanction letter.

The branch will disburse the loan after verifying the details entered by the borrower, due diligence, appraisal of the loan and execution of documents.

[ad_2]

[ad_1]

Retail loan restructuring by top three private banks, HDFC Bank, ICICI Bank and Axis Bank, at Rs 6,600 crore, was three times the Rs 2,100 crore restructured loans by corporates, according to a report.

However, while the retail loan restructuring ended by March 31, corporate loan recasts are allowed till June end.

Fresh concerns

With a fresh surge in Covid infections and subsequent lockdowns, lenders are staring at renewed stress in loan accounts.

Sameer Narang, Chief Economist of Bank of Baroda, recently told ETBFSI that the salaried segment is still alright but the informal sector will be impacted. “Banks may not be that impacted as banks do not cater the informal sector in a big way as NBFCs does. There will be an impact on NBFCs, and they would require some degree of support. It also depends upon the pace of the second wave. We should wait and see how things pan out. If it is a phenomenon for 6-8 weeks then most of the segments will ride it over. If it lasts longer then this might be an issue for segments. It is very difficult to create a policy in an uncertain environment.”

Asset quality

Ratings agency Icra too had raised concerns over the asset quality of retail loans.

The rising Covid cases have again raised concerns on the asset quality of retail loans from non-banking financial companies (NBFCs) and housing finance companies (HFCs), according to investment information agency ICRA.

The restrictions on movement will have a bearing on the collection efforts of NBFCs especially for microfinance loans where cash collections still remain dominant, it said in a report.

Commercial vehicle loans can also face stress if the inter-state restrictions are re-imposed, though even the current restrictions put in place in key geographies like Maharashtra and Delhi where non-essential services are closed will lead to lower fleet utilisation for operators.

However, said ICRA, housing loans are expected to remain most resilient as was seen even last year given the secured nature of asset class and priority given by borrowers to repay them.

No relief measures

Banks, which got protection and support by a swift moratorium on loans when the pandemic first struck, have no such cover this time.

As the second wave intensifies, most of the relief measures and schemes announced by the government and Reserve Bank of India have expired. On top of it, the central bank is non-committal on moratoriums.

“In today’s conditions, there is no need for a moratorium,” RBI governor Shaktikanta Das had said after the central bank’s monetary policy review.

Also, a spike in overdue loans after the lifting of the moratorium has been worrying analysts.

“The level of loans in overdue categories has increased after the moratorium has been lifted and the impact on asset quality will be spread over FY2021 and FY2022 as various interventions and relief measures have prevented a large one-time hit on profitability and capital of banks,” Icra said in a report.

Subscribe to ETBFSI Daily Newsletter and stay updated.

https://bfsi.economictimes.indiatimes.com/etnewsletter.php

[ad_2]

[ad_1]

Merchant Stack offers a variety of banking solutions and value-added services at one single place curated for the retailer eco-system. The stack’s key pillars are 1) a new account called “Super Merchant Current Account”; and 2) two instant credit facilities called “Merchant Overdraft” and “Express Credit,” both of which are focused on POS transactions and are industry firsts.) ‘Digital Store Management’ facility to help merchants take their business online; 4) exclusive loyalty rewards programme, an industry first feature; 5) value added services like alliances with major e-commerce and digital marketing platforms for expansion of online presence.

Anup Bagchi, ICICI Bank, on the launch, said, “There are over 2 crore merchants in the country with approximately USD 780 billion in value of transactions in 2020. They are expected to grow rapidly in the coming years. During these difficult times of the pandemic, it is our endeavour to enable the merchants banking platform that will help them to continue serve their customers. We have thus launched the ‘Merchant Stack’, which most importantly offers a range of ‘contactless’ banking services, providing safety to the merchants and their customers alike. It is also a continuation of ICICI Stack, which we introduced a year ago to provide all digital banking services to retail customers on a single platform.”

Furthermore, the Bank offers ‘Express Credit,’ which allows for immediate settlement of POS transactions. It provides greater convenience because retailers can immediately access funds, as compared to the industry practice of waiting a few days for credit for transactions made at POS machines.

[ad_2]