The Indian Institute of Insolvency Professionals of ICAI (IIIPI) is working on a four-point plan for insolvency professionals.

The plan includes setting limits on the number of permissible assignments for each executive and their role in the prepack package for MSMEs.

The plan

IIPI has conducted study groups on four matters of contemporary topics on enhancing the role of small-sized IPs, response of insolvency regime to Covid, clarifying roles of IPs in respect of prepack framework for MSMEs, and creating code of ethics for our professional members.

The reports of these study groups are may take a month to complete.

The self-regulator and IBBI are aiming to strike a balance between resolution professionals coming from large institutions and standalone individual IPs, with the latter often finding themselves at a relative disadvantage in comparison with executives from top-draw consultancies.

IIIPI is also set to recommend urgent covid-response measures that IPs will likely follow in proposing any resolution plan. The quasi-judicial body is also defining a prudent role of IPs in the pre-packs.

IIIPI is drawing on best practices to craft a role for MSMEs, where promoters face default occasions due to macroeconomic environment or policy changes.

It has tapped legal expertise in the UK where prepack packages are a hit.

IIIPI is drawing a code of ethics by adding more clauses to the IBBI statute already available.

The recommendations would need to be approved by both the Insolvency and Bankruptcy Code of India (IBBI) and the government.

There are 3,500 insolvency professionals, three insolvency professional agencies, 80 insolvency professional entities, 4,000 registered valuers, 16 registered valuers’ organisations and one information utility.

IBC so far

Since the provisions of the Corporate Insolvency Resolution Process (CIRP) came into force on December 1, 2016, a total of 4,376 CIRPs have commenced till the end of March this year.

Out of the total, 2,653 have been closed, including 348 CIRPs that ended in approval of resolution plans. As many as 617 CIRPs were closed on appeal or review or settled, while 411 were withdrawn and 1,277 ended in orders for liquidation, as per IBBI’s latest quarterly newsletter.

Significant improvements in the score for resolving insolvency made doing business in India easier and the emergence of new markets for resolution plans, interim finance and liquidation assets are among others.

Apart from the few missing elements such as cross border and group insolvency to complement corporate insolvency, an institutional framework for grooming a cadre of valuers is sometime away.

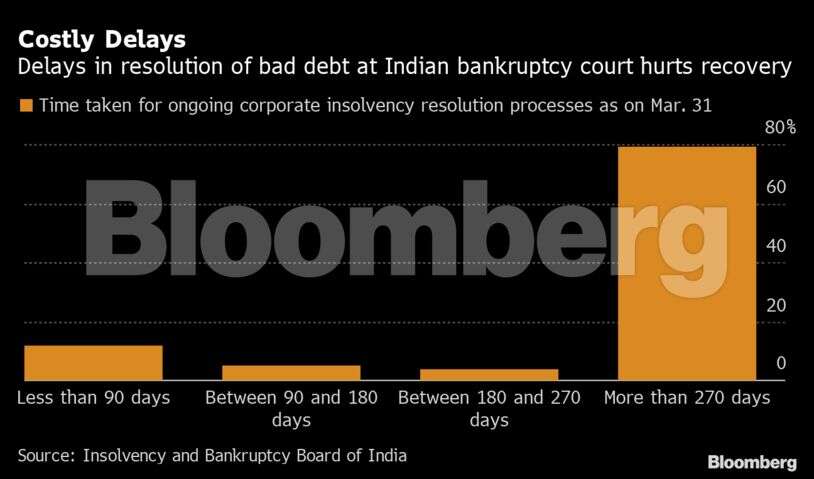

As compared to the previous regime which took nearly five years for a conclusion, the process under the Code yielding a resolution plan takes on average 400 days. It, however, falls short of intended 180/270 days.