Reserve Bank of India – Press Releases

[ad_1]

Read More/Less

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[ad_2]

Get Bank IFSC & MICR codes here.

[ad_1]

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[ad_2]

[ad_1]

PVR Limited (PVR) is India’s largest multiplex player in terms of screen counts, which stand at 9% and 27% of its total screens in India and total multiplex screens, respectively and has the strong brand equity value. According to Sharekhan, PVR is India’s premier multiplex player that leads with the most number of screens, clocks higher revenue per screen and has a premium screen portfolio. It has 98 luxury screens (12% of total) and is expected to grow going ahead.

Except a few states including Maharashtra, Kerala, etc, many states have permitted resumption of operations in cinema halls from July 30, 2021.

“Given a huge content line-up, we believe PVR is well-placed to capitalise on strong pent-up demand and is expected to report strong revenue growth in FY2023E,” Sharekhan has said.

The broking firm sees an upside potential of nearly Rs 1,900 from the current market price of Rs 1566. “The strong recovery of occupancy rate with the release of big-starrer movies and anticipated improvement in its profitability and return ratios are expected to re-rate its multiples going ahead. We also believe the multiplex business is going to be a sustainable model in the long term given Indian movie-goers’ strong appetite for the silver screen. Hence, we initiate Buy rating on PVR with a price target of Rs. 1,900,” says broking firm Sharekhan.

ZEE Entertainment& Sony Pictures Networks India have entered into a non-binding term sheet to merge themselves. This will create the largest media company with a market share of 25% in India.

According to Sharekhan, the merged entity will be well-placed to maximize revenue given its strong potential to reach a larger number of advertisers. Synergies would have an impact of 6-10% on revenue.

According to Sharekhan, the proposed merger would be a strategic fit from a revenue perspective as it would strengthen Zee Entertainment’s portfolio with sport, kids and English movie properties.

“Further, with the infusion of growth capital of $1.6 billion by Sony Pictures, the combined entity’s cash balance would increase to $1.8 billion, which would be used to accelerate its digital platform growth and invest in premier content including sports. We believe that corporate governance concerns will get addressed with the controlling stake of Sony Pictures and this will trigger multiple re-ratings for Zee Entertainment. The stock is currently trading at a reasonable valuation at 20x/18x of FY2023E/FY2024E earnings estimates. Hence, we maintain a Buy rating on Zee Entertainment with a revised rice target of Rs. 400,” the brokerage has said.

The above stocks are picked from the brokerage report of Sharekhan. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution. Greynium Information Technologies, the author, and the brokerage house are not liable for any losses caused as a result of decisions based on the article.

[ad_2]

[ad_1]

This comes as most lenders are struggling to meet their priority sector targets with premium on lending certificates rising by almost 200 basis points in the last one year. At present only, regional rural banks or RRBs are suppliers of priority sector lending credit.

“We have had informal discussions with the Reserve Bank of India, and have made representation to the government as well,” said a bank executive, aware of the developments, adding that there was a need to broaden the priority sector.

At present lending towards eight sectors including agriculture, micro and small medium enterprises, export credit, housing, education, renewable energy and social infrastructure is considered eligible for priority sector loans. Commercial lenders have to mandatorily deploy 40% of their adjusted net bank credit (ANBC) towards these sectors, of which 18% is allocated towards agriculture.

The latest data from RBI indicates that overall priority sector lending for scheduled commercial banks stood at 40.54% in 2020-21 (as at the end of December 2020) even though there was a marginal shortfall for private sector and foreign banks.

“There are various subcategories within this structure and most banks are unable to meet these requirements and hence there is a need to identify new potential sectors,” the above quoted executive said adding that most big lenders resort to buying priority sector lending certificates (PSLCs) to meet their regulatory requirements. A bank running short of meeting targets can purchase priority sector lending certificates from a lender having surplus for a fee.

“Today, only regional rural banks (RRBs) are suppliers of PSLC and most sponsoring banks buy it from their RRBs,” he said, adding that non-banking finance companies or NBFCs also have underwriting limitations.

The total trading volume of PSLCs recorded a growth of 25.9% and stood at Rs 5.89 lakh crore in 2020-21 as compared with 43.1% growth a year ago.

[ad_2]

[ad_1]

Conventionally, investors have evaluated their performance and made decisions solely on financial measures and have neglected environmental and social impacts that come along with it.

Sustainable finance gained interest from the mid-2010s, especially after the Paris Climate Protection Agreement, 2015. In the agreement, 195 countries, including India, have committed to drive economic growth in a climate-friendly manner and reduce greenhouse gas emissions.

Environmental, social, and governance (ESG) issues, along with the associated opportunities and risks, are becoming more relevant for financial institutions. A common way to opt for sustainable finance is by investing in segments such as energy generation, which include solar photovoltaics, on and offshore wind, hydropower and broader energy services.

Here’s a rundown of all that you need to know.

What is sustainable finance?

Sustainable finance includes making business or investment decisions that take into consideration not only financial returns but also environmental, social and governance (ESG) factors.

Sustainable finance is defined as supporting economic growth while reducing pressures on the environment and taking into account social and corporate governance aspects, such as inequality, human rights, management structures and executive remuneration. Environmental considerations, including climate mitigation and adaptation, conservation of biodiversity and circular economy, are under its bandwidth.

One of the key objectives of sustainable finance is to improve economic efficiency on a long-term basis.

What does sustainable finance include?

Operational and labelling standards

1. Green labelled financial securities, products and services

2. Social-labelled financial securities, products and services

3. Sustainability- labelled financial securities, products and services

4. Unlabelled multilateral development banks financing of sustainability oriented projects

Industry oriented frameworks

1. Inclusion of ESG considerations in investment decisions

2. Sustainable and responsible investment (SRI)

3. Impact finance and impact investing

4. Equator principles-aligned projects

Wider Policy framework

1. Sustainable development goals-aligned finance (SDG Finance)

2. Principles of positive impact finance-aligned investments

3. Principles for responsible banking-aligned finance

4. Paris agreement-aligned finance

5. Climate Finance and Green Finance

6. Government sustainability related spending programmes

How has sustainable finance fared around the world so far?

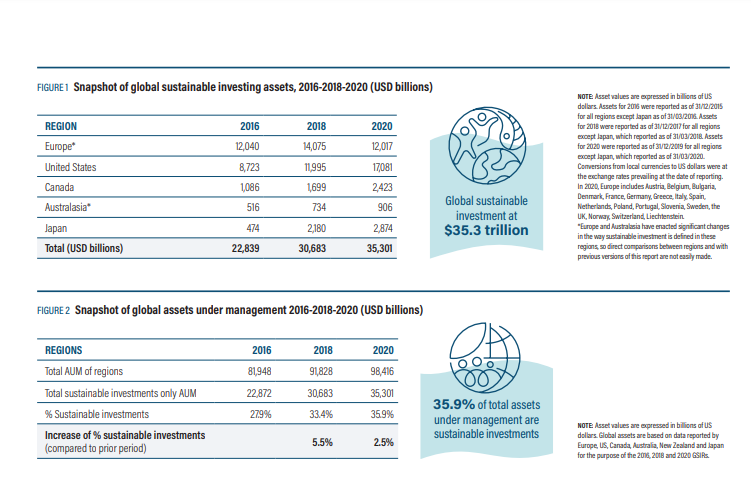

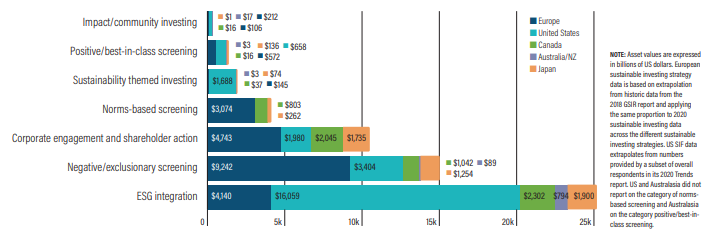

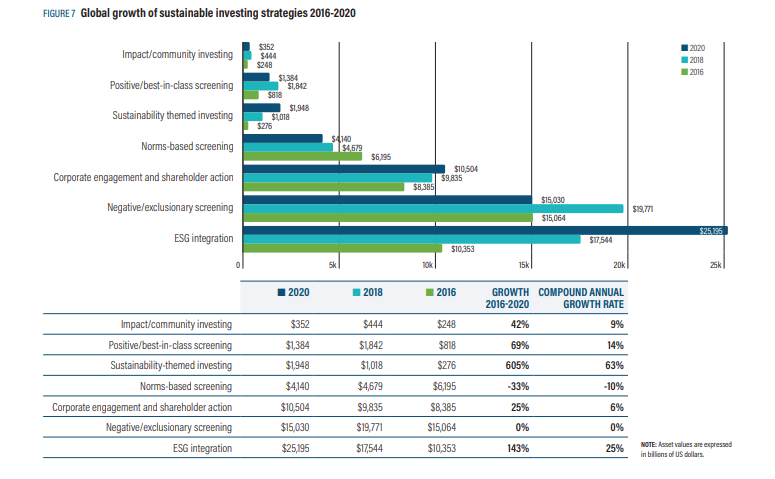

According to the Global Sustainable Investment Alliance, at the start of 2020, global sustainable investment reached $35.3 trillion in five major markets – US, Canada, Japan, Australasia and Europe – reporting a 15% increase in the past two years (2018-2020).

Sustainable investment assets under management make up 35.9% of total assets under management, up from 33.4% in 2018.

Sustainable investment assets continue to grow in most regions, with Canada experiencing the largest increase in absolute terms over the past two years (48%), followed by the US (42%), Japan (34%) and Australasia (25%) from 2018 to 2020.

According to the Global Sustainable Investment Alliance, at the start of 2020, global sustainable investment reached $35.3 trillion in five major markets – US, Canada, Japan, Australasia and Europe – reporting a 15% increase in the past two years (2018-2020).

[ad_2]

[ad_1]

If not for all the depositors, the taxation review should be carried out for at least the deposits made by senior citizens who depend on the interest for their daily needs, the economists led by Soumya Kanti Ghosh said in a note, which pegged the overall retail deposits in the system at Rs 102 lakh crore.

Senior citizens hit most

At present, banks deduct tax at source at the time of crediting interest income of over Rs 40,000 for all the depositors, while for senior citizens the taxes set-in if the income exceeds Rs 50,000 per year. As the policy focus has shifted to growth, the interest rates are going down in the system which pinches a depositor.

“Clearly, real rate of return on bank deposits has been negative for a sizeable period of time and with RBI making it abundantly clear that supporting growth is the primary goal, the low banking rate of interest is unlikely to make a northbound movement anytime soon as liquidity continues to be plentiful,” the note said.

Bull run gives leeway

It said the current bull run in financial markets is possibly a break from the past as households may have got into the bandwagon of self-fulfilling prophecy of a decent return on their investment.

“We thus believe, it is now the opportune time to revisit the taxation of interest on bank deposits, or at least increasing the threshold of exemption for senior citizens,” the note said.

The RBI can also relook at the regulation that does not allow interest rates of banks to be determined as per age-wise demographics, it said.

It can be noted that at present, banks are lending for as low as under 7 per cent for retail loans and have been public with their preference to lend to highly-rated corporate borrowers, where the lending rates get very competitive.

[ad_2]

[ad_1]

Problems seem to be never ending for Dhanlaxmi Bank, with major shareholders, including NRI Ravi Pillai, engaging in conflict with the board of directors.

A shareholder and two others have approached the court against the board’s decision of rejecting their candidature for the office of director, to be placed before members during the annual general meeting scheduled for September 29.

KN Madhusoodan, a shareholder of the company, P Mohanan and Prakash D L have approached the court seeking a direction to the respondents – RBI and Dhanlaxmi bank – to discharge their statutory responsibilities under Section 160 of the Companies Act to inform the members about the candidature of the petitioners for the office of the director as mandated under Section 160(2) of the Companies Act.

The board of the bank arbitrarily rejected the applications of all five candidates, including prominent shareholder Ravi Pillai ( B Ravindran Pillai) and former independent director PK Vijayakumar, filed under Section 160 of the Companies Act, a highly-placed source told FE.

The petitioners had to move their candidature under Section 160 of the Companies Act after the board decided to defer their candidatures.

“The action of the board has no basis in law as the names of P Mohanan and Prakash were previously cleared by the Nomination and Remuneration Committee during its meeting held on July 23, 2021,” sources said.

“It is a truncated board and they want to keep it that way to have a controlling stake. There are only 8 directors, including 2 RBI nominees, and it helps them to take unilateral decisions against shareholders’ interests,”sources added.

Ravi Pillai holds a 10% stake in the lender and was on the board till May 2020. He had to exit on turning 70. Later, the RBI raised the age limit for non-executive directors, including the chair, to 75. CK Gopinathan and his two family members together hold close to 10% in the bank. NRI MA Yussuffali and Kapil Wadhawan own a 5% stake.

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

[ad_2]

[ad_1]

A shareholder and two others have approached the court against the board’s decision of rejecting their candidature for the office of director, to be placed before members during the annual general meeting scheduled for September 29.

A shareholder and two others have approached the court against the board’s decision of rejecting their candidature for the office of director, to be placed before members during the annual general meeting scheduled for September 29.

Problems seem to be never ending for Dhanlaxmi Bank, with major shareholders, including NRI Ravi Pillai, engaging in conflict with the board of directors.

A shareholder and two others have approached the court against the board’s decision of rejecting their candidature for the office of director, to be placed before members during the annual general meeting scheduled for September 29.

KN Madhusoodan, a shareholder of the company, P Mohanan and Prakash D L have approached the court seeking a direction to the respondents – RBI and Dhanlaxmi bank – to discharge their statutory responsibilities under Section 160 of the Companies Act to inform the members about the candidature of the petitioners for the office of the director as mandated under Section 160(2) of the Companies Act.

The board of the bank arbitrarily rejected the applications of all five candidates, including prominent shareholder Ravi Pillai ( B Ravindran Pillai) and former independent director PK Vijayakumar, filed under Section 160 of the Companies Act, a highly-placed source told FE.

The petitioners had to move their candidature under Section 160 of the Companies Act after the board decided to defer their candidatures.

“The action of the board has no basis in law as the names of P Mohanan and Prakash were previously cleared by the Nomination and Remuneration Committee during its meeting held on July 23, 2021,” sources said.

“It is a truncated board and they want to keep it that way to have a controlling stake. There are only 8 directors, including 2 RBI nominees, and it helps them to take unilateral decisions against shareholders’ interests,”sources added.

Ravi Pillai holds a 10% stake in the lender and was on the board till May 2020. He had to exit on turning 70. Later, the RBI raised the age limit for non-executive directors, including the chair, to 75. CK Gopinathan and his two family members together hold close to 10% in the bank. NRI MA Yussuffali and Kapil Wadhawan own a 5% stake.

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

[ad_2]

[ad_1]

A shareholder and two others have approached the court against the board’s decision of rejecting their candidature for the office of director, to be placed before members during the annual general meeting scheduled for September 29.

A shareholder and two others have approached the court against the board’s decision of rejecting their candidature for the office of director, to be placed before members during the annual general meeting scheduled for September 29.

Problems seem to be never ending for Dhanlaxmi Bank, with major shareholders, including NRI Ravi Pillai, engaging in conflict with the board of directors.

A shareholder and two others have approached the court against the board’s decision of rejecting their candidature for the office of director, to be placed before members during the annual general meeting scheduled for September 29.

KN Madhusoodan, a shareholder of the company, P Mohanan and Prakash D L have approached the court seeking a direction to the respondents – RBI and Dhanlaxmi bank – to discharge their statutory responsibilities under Section 160 of the Companies Act to inform the members about the candidature of the petitioners for the office of the director as mandated under Section 160(2) of the Companies Act.

The board of the bank arbitrarily rejected the applications of all five candidates, including prominent shareholder Ravi Pillai ( B Ravindran Pillai) and former independent director PK Vijayakumar, filed under Section 160 of the Companies Act, a highly-placed source told FE.

The petitioners had to move their candidature under Section 160 of the Companies Act after the board decided to defer their candidatures.

“The action of the board has no basis in law as the names of P Mohanan and Prakash were previously cleared by the Nomination and Remuneration Committee during its meeting held on July 23, 2021,” sources said.

“It is a truncated board and they want to keep it that way to have a controlling stake. There are only 8 directors, including 2 RBI nominees, and it helps them to take unilateral decisions against shareholders’ interests,”sources added.

Ravi Pillai holds a 10% stake in the lender and was on the board till May 2020. He had to exit on turning 70. Later, the RBI raised the age limit for non-executive directors, including the chair, to 75. CK Gopinathan and his two family members together hold close to 10% in the bank. NRI MA Yussuffali and Kapil Wadhawan own a 5% stake.

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

[ad_2]

[ad_1]

The government has extended the term of Kotak Mahindra Bank managing director Uday Kotak as the non-executive chairman of the IL&FS group by six months through April 2, 2022.

In a gazette notification, the Department of Financial Services said: “…whereas the Central government, on the recommendations of the Reserve Bank of India, has considered it necessary to grant said exemption to Kotak Mahindra Bank Limited for a further period of six months with effect from the 3rd day of October, 2021.”

According to the Banking Regulation Act, a bank cannot be managed by any person who is a director of any other company. He can be granted a temporary exception for three months or nine months with the approval of the RBI.

The Centre had appointed Kotak as the head of the lender’s board in 2018 to help the debt-laden firm come out of stress, after the government took over the board. He was initially allowed to be at the helm of IL&FS for three months, which was extended by nine months. Subsequently, he got two extensions of one year each.

CS Rajan, managing director of IL& FS, hailed the move and said under Kotak’s continued leadership, IL&FS will accomplish the resolution targets.

In fact, following the Evergrande crisis in China, Kotak had tweeted on September 21 that the trouble at the property developer seems like China’s Lehman moment and reminds him of IL&FS.

He tweeted: “Indian Government acted swiftly. Provided calm to financial markets. The Government appointed board estimates 61% recovery at IL&FS.”

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

[ad_2]

[ad_1]

CS Rajan, managing director of IL& FS, hailed the move and said under Kotak’s continued leadership, IL&FS will accomplish the resolution targets.

CS Rajan, managing director of IL& FS, hailed the move and said under Kotak’s continued leadership, IL&FS will accomplish the resolution targets.

The government has extended the term of Kotak Mahindra Bank managing director Uday Kotak as the non-executive chairman of the IL&FS group by six months through April 2, 2022.

In a gazette notification, the Department of Financial Services said: “…whereas the Central government, on the recommendations of the Reserve Bank of India, has considered it necessary to grant said exemption to Kotak Mahindra Bank Limited for a further period of six months with effect from the 3rd day of October, 2021.”

According to the Banking Regulation Act, a bank cannot be managed by any person who is a director of any other company. He can be granted a temporary exception for three months or nine months with the approval of the RBI.

The Centre had appointed Kotak as the head of the lender’s board in 2018 to help the debt-laden firm come out of stress, after the government took over the board. He was initially allowed to be at the helm of IL&FS for three months, which was extended by nine months. Subsequently, he got two extensions of one year each.

CS Rajan, managing director of IL& FS, hailed the move and said under Kotak’s continued leadership, IL&FS will accomplish the resolution targets.

In fact, following the Evergrande crisis in China, Kotak had tweeted on September 21 that the trouble at the property developer seems like China’s Lehman moment and reminds him of IL&FS.

He tweeted: “Indian Government acted swiftly. Provided calm to financial markets. The Government appointed board estimates 61% recovery at IL&FS.”

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

[ad_2]