Reserve Bank of India – Press Releases

[ad_1]

Read More/Less

Ajit Prasad Press Release: 2021-2022/1029 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[ad_2]

Get Bank IFSC & MICR codes here.

[ad_1]

Ajit Prasad Press Release: 2021-2022/1029 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[ad_2]

[ad_1]

Shriram Transport Finance enables recurring deposits with terms ranging from 12 to 60 months. All resident individuals and HUFs can open a recurring deposit (RD) account based on their personal financial goals to receive a variety of benefits such as premature withdrawal, auto refund, auto-renewal, online account opening feature, online recurring deposit calculator, and a minimum deposit amount of Rs 500 per installment.

Recurring Deposits at Shriram Transport Finance can also be opened on behalf of a minor or in joint names of two to three residents. Senior citizens are not allowed to get additional rate benefits on their deposits, and also loans against deposits are not allowed by Shriram Transport Finance.

Keeping aside the interest rate component for a moment, I’d like to inform our readers and investors that Shriram Transport Finance Recurring Deposit has been rated “FAAA/Stable” by Credit Rating Information Services of India Limited (CRISIL) and “MAA+ / with Stable Outlook” by Investment Information and Credit Rating Agency of India Limited (ICRA).

This rating demonstrates us a comprehensive perspective on deposit safety and good credit health. Investing in recurring deposits of Shriram Transport Finance can be a smart choice because AAA is the highest rating and is healthier than those with AA, A, or BBB ratings. However, investors should bear in mind that, unlike bank FDs, corporate FDs do not cover deposit insurance benefits provided by DICGC.

However, we would like investors to not look at the attractive interest rates first and invest only for the short term to minimize both interest and principal risk in case of default as we have seen 2 years back with Dewan Housing Finance Ltd. (DHFL).

| Period (months) | Rate in % |

|---|---|

| 12 | 7.03 |

| 24 | 7.12 |

| 36 | 8.18 |

| 48 | 8.34 |

| 60 | 8.50 |

| With effect from 1st August 2021 |

North East Small Finance Bank is presently offering the highest interest rate of 7.50 percent to the general public and 8.00 percent to senior people on recurring deposits maturing in two years among all small finance banks, including private and public sector banks. Investing in a recurring deposit with North East Small Finance Bank to achieve an unbeatable interest rate and DICGC deposit safety is a good option for investors who don’t want to take any risk with their principal amount and applicable interest rates based on their chosen maturity term

| TENURE | Interest Rates In % For Regular Customers | Interest Rates In % For Senior Citizens |

|---|---|---|

| 3 Months | 4.25 | 4.75 |

| 6 Months | 4.50 | 5.00 |

| 9 Months | 5.50 | 6.00 |

| 1 Year | 5.50 | 6.00 |

| 2 Year | 7.50 | 8.00 |

| 3 Year | 7.00 | 7.50 |

| 4 Year | 7.00 | 7.50 |

| 5 Years | 6.50 | 7.00 |

| More than 5 years upto 10 years | 6.50 | 7.00 |

| Source: Bank Website, Effective from 19th April 2021 |

[ad_2]

[ad_1]

Ajit Prasad Press Release: 2021-2022/1028 |

[ad_2]

[ad_1]

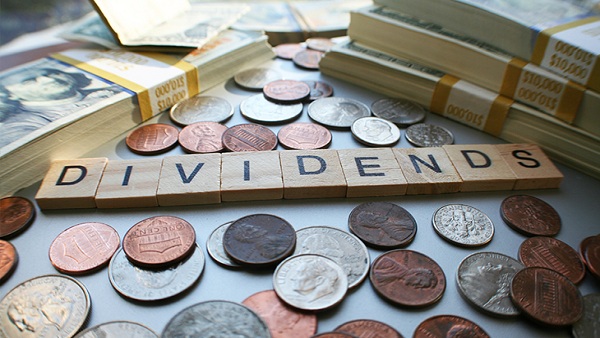

The Satluj Jal Vidyut Nigam, or SJVN, is an Indian government-owned company that generates and transmits hydroelectric power.

Only 0.71 percent of trading sessions in the last 11 years had intraday gains of more than 5%. The stock returned 5.47 percent over three years, compared to 96.44 percent for the Nifty Midcap 100. Over a three-year period, the stock returned 5.47 percent, whereas the S&P BSE Power provided investors a 75.42 percent gain. SJVN Ltd., founded in 1988, is a Mid Cap business in the Power sector with a market capitalization of Rs 11,082.02 crore.

SJVN Ltd. has declared an equity dividend of Rs 2.20 per share in the last 12 months. Since September 1, 2010, SJVN Ltd. has issued 19 dividends. This equates to a dividend yield of 7.8 percent at the current share price of Rs 28.20.

Steel City Securities Limited is a stockbroking firm that deals with regular investors. The company offers a wide range of financial goods and services, including mutual fund distribution, fixed income, initial public offerings (IPOs), and corporate debt, as well as securities and commodity trading.

Steel City Securities Ltd., founded in 1995, is a Small Cap business in the Financial Services industry with a market cap of Rs 90.11 crore. Stock returned -15.05 percent during a three-year period, compared to 96.41 percent for the Nifty Smallcap 100. Since March 21, 2017, Steel City Securities Ltd. has declared 13 dividends.

Steel City Securities Ltd. has issued an equity dividend of Rs 3.00 per share in the last 12 months. This equals a dividend yield of 5.03 percent at the current share price of Rs 59.65.

Choksi Imaging Ltd., founded in 1992, is a Small Cap company in the Miscellaneous category with a market capitalization of Rs 19.60 crore. Since the last five years, the company has had no debt. Photographic items are offered by Choksi Imaging Limited. X-ray films, chemicals, and accessories, as well as ultrasound and colour doppler, are all available from the company.

Choksi Imaging Ltd., founded in 1992, is a Small Cap company in the Miscellaneous category with a market capitalization of Rs 19.60 crore. Since the last five years, the company has had no debt. Photographic items are offered by Choksi Imaging Limited. X-ray films, chemicals, and accessories, as well as ultrasound and colour doppler, are all available from the company.

Sales have decreased by 6.41 percent. For the first time in three years, the company’s revenue has decreased. Gothi Plascon (India) Ltd., founded in 1994, is a Small Cap company in the Plastics industry with a market capitalization of Rs 25.30 crore. Since March 26, 2020, Gothi Plascon (India) Ltd. has declared two dividends. It has issued an equity dividend of Rs 1.00 per share in the last 12 months.

This equates to a dividend yield of 4.03 percent at the current share price of Rs 24.80.

Since September 6, 2019, Rail Vikas Nigam Ltd. has issued three dividends. Rail Vikas Nigam Ltd. has declared an equity dividend of Rs 2.28 per share in the last 12 months. This equates to a dividend yield of 7.52 percent at the current share price of Rs 30.30. Rail Vikas Nigam Limited is a subsidiary of Indian Railways, Ministry of Railways, Government of India, which is responsible for developing rail infrastructure for the railways.

TCFC Finance Ltd., founded in 1990, is a Small Cap business in the Financial Services industry with a market capitalization of Rs 43.82 crore. Since the last five years, the company has had no debt. The company’s annual sales increase of 772.13% surpassed its three-year compound annual growth rate of -43.79 percent. Since July 15, 2004, TCFC Finance Ltd. has declared 13 dividends.

TCFC Finance Ltd. has issued an equity dividend of Rs 1.50 per share in the last 12 months. This equates to a dividend yield of 3.65% at the current share price of Rs 41.15.

Pressman Advertising Ltd., founded in 1983, is a Small Cap company in the Media & Entertainment sector with a market capitalization of Rs 69.98 crore. Since the last five years, the company has had no debt. In comparison to the Nifty Smallcap 100, which returned 96.41 percent over three years, the stock returned -12.65 percent. In comparison to the Nifty Smallcap 100, which returned 96.41 percent over three years, the stock returned -12.65 percent.

In the fiscal year ended March 31, 2021, PrCompany generated an ROE of 18.44 percent, surpassing its five-year average of 8.65 percent. Revenue increased by 57.41 percent year over year, the greatest in the prior three years. The stock returned 39.52 percent over three years, compared to 96.41 percent for the Nifty Smallcap 100. The company’s yearly sales growth of 10.59 percent surpassed its three-year compound annual growth rate (CAGR) of -2.65 percent.

Since the last five years, the company has had no debt. Revenue fell 47.73 percent on a quarter-over-quarter basis, the lowest level in the last three years. The stock returned 95.01 percent over three years, compared to 96.41 percent for the Nifty Smallcap 100. Over a three-year period, the stock returned 95.01 percent, while the Nifty Auto provided investors a 26.87 percent return.

Jullundur Motor Agency (Delhi) Ltd., founded in 1948, is a Small Cap company in the Auto Ancillaries sector with a market cap of Rs 144.70 crore.

B N Rathi Securities Ltd., founded in 1985, is a Small Cap firm in the Financial Services industry with a market capitalization of Rs 19.20 crore. In the fiscal year ended March 31, 2021, the company generated a return on equity of 14.64 percent, surpassing its five-year average of 11.21 percent. Annual sales growth of 25.3 percent surpassed the company’s three-year CAGR of 3.65 percent. The stock returned 35.33 percent over three years, compared to 96.41 percent for the Nifty Smallcap 100.

| Company | Price in Rs | Dividend Yield |

| SJVN | 28.20 | 7.8% |

| Steel City Securities | 60.15 | 4.99% |

| Choksi Imaging | 50.50 | 4.95% |

| Gothi Plascon | 26 | 3.85% |

| Rail Vikas | 30.15 | 7.56% |

| TCFC Finance | 41.15 | 3.65% |

| Pressman Advertising | 29.35 | 3.44% |

| Sumedha Fiscal | 30.75 | 3.25% |

| Jullundur Motor | 63.40 | 3.15% |

| B N Rathi Securities | 39.10 | 3.07% |

Please note investing in penny stocks is subject to market risks and one needs to be cautious at this point of time as markets have gone-up sharply. Neither the author, nor Greynium Information technologies Pvt Ltd would be responsible for losses incurred based on a decision made from this article.

[ad_2]

[ad_1]

|

The Reserve Bank of India (RBI) in exercise of the powers vested under section 45MAA of the Reserve Bank of India Act, 1934, has, by an order dated September 23, 2021, debarred M/s Haribhakti & Co. LLP, Chartered Accountants (ICAI Firm Registration No. 103523W / W100048), from undertaking any type of audit assignment/s in any of the entities regulated by RBI for a period of two years with effect from April 1, 2022. This action has been taken on account of the failure on the part of the audit firm to comply with a specific direction issued by RBI with respect to its statutory audit of a Systemically Important Non-Banking Financial Company. 2. This will not impact audit assignment/s of M/s Haribhakti & Co. LLP in RBI regulated entities for the financial year 2021-22. (Yogesh Dayal) Press Release: 2021-2022/1027 |

[ad_2]

[ad_1]

The investors which have made presentations include Los Angeles based $149 billion Ares-SSG Capital, $15 billion alternative investment firm Varde Partners, US based $55 billion Ceberus Capital and distressed asset giants $156 billion Oaktree Capital and private equity company JC Flowers, three people familiar with the move said. Individual investors and Yes Bank could not be immediately reached.

Yes Bank will likely hold a minority share in the proposed ARC in line with Reserve Bank of India (RBI) directions. The selected investor is likely to hold a majority as much as 80% to 85% in the new venture, one of the persons said. EY is helping Yes Bank with the process.

“The model is more of a NARC type. Banks are not encouraged to hold a major share in any ARC. That’s why they are selling it,” said a second senior executive involved in the matter.

He was referring to the government backed National Asset Reconstruction Co (NARC) which has been formed to resolve legacy bad loans from the banking sector.

“Investors have not yet been officially informed about the short listed firms so the process will take some more before the partner is selected,” said a third person familiar with the matter.

[ad_2]

[ad_1]

Customers of all banks who possess a debit card can use a Kotak Micro ATM for key banking services such as cash withdrawals and checking account balances. A mini version of an ATM, micro ATMs are small handheld devices. The bank will use its extensive Business Correspondents (BC) network to launch micro ATMs.

“The micro ATM is a simple, innovative and highly effective solution to deliver essential banking services such as cash withdrawals in a convenient manner to people residing in relatively remote locations,” said Puneet Kapoor, President – Products, Alternate Channels and Customer Experience Delivery, Kotak Mahindra Bank. “It is a viable alternative to a regular ATM, allowing for faster expansion and increasing banking touchpoints for consumers. Kotak’s network of micro ATMs across the country will help customers of all banks (Kotak and non-Kotak customers) get easy access to their bank accounts and promote financial inclusion.”

At the end of August, there were 2.13 lakh ATMs in the country, up from 2.09 lakh same time last year, a meagre growth of 1.5%. On the flip side, micro-ATMs have grown to 4.94 lakh as against 3.07 lakh in August last year, a rise of over 60%.

In the first phase, Kotak Mahindra Bank is introducing micro ATMs in the outskirts of the top 8 metro cities – locations where the demand for cash withdrawal services is high but the prevalence of ATMs is low.

[ad_2]

[ad_1]

Opening a savings account with Airtel Payments Bank is completely a digital process through a video-based KYC process from the Airtel Thanks app and you will get over 5 Lac banking points to manage your accounts, complimentary personal accident insurance cover of Rs. 1 Lac, no minimum balance requirement, free Virtual Debit Card, and a plethora of services including easy cash deposit/withdrawal facility at more than 1 Lac ATMs in the country, money transfer service, mobile/DTH recharges, utility bill payments, online/offline shopping, and a multitude of facilities.

Apart from the aforementioned perks, Airtel Payments Bank offers an annual interest rate of 2.5 percent for end-of-day balances up to 1 lakh and 6% for balances over 1 lakh and up to 2 lakhs. Customers can earn considerably better returns if we compare these interest rates to the State Bank of India’s (SBI) savings account interest rates.

SBI is now giving a 2.70 percent interest rate on deposit accounts with balances up to Rs. 1 lakh and a 2.75 percent interest rate on deposits with balances beyond Rs. 1 lakh. Apart from these rates, SBI is presently offering a fixed deposit interest rate of 5.40 percent, which implies that customers who establish a savings account with Airtel Payments Bank would receive higher interest rates on their deposits than customers who open a savings account or fixed deposit account with SBI. With effect from May 1, 2021, Airtel Payments Bank is offering the below-framed interest rates on savings accounts.

| Rs 1-2 lakhs | 6% p.a. |

|---|---|

| Upto Rs 1 lakh | 2.5% p.a. |

| Source: airtel.in |

The service charges for Airtel Payments Bank Savings Bank Accounts are listed below.

| Service | Fee/Charges (Rs) |

|---|---|

| Account Opening | Rs. 50 |

| Cash Deposit / Load Cash (Internet banking, Mobile App) | Free |

| Cash Deposit / Load Cash (Banking Points) | For amounts Rs.0 – Rs.25,000: Free. Rs.25,000 – Rs.50,000: 0.5% of the deposit amount. Beyond Rs.50,000: 0.75% of the deposit amount |

| Cash Withdrawal | Rs.0 – Rs.10,000 (cumulative transactions per month): Free. Beyond Rs.10,000: 0.65% of withdrawal amount |

| Cardless Cash withdrawal via IMT ( app only) | Self-withdrawal and Send money to Others: Free |

| Cash Withdrawal via AEPS | 2 Transactions/Day(max), 10 Transactions/Month or Rs 50,000 Cash Withdrawal per Month ( Whichever is Minimum), Rs. 10,000 per transaction(Max) |

| Payment for IRCTC Train Booking (via Airtel Thanks App) | 1.8% of the ticket fare (exclusive of GST) |

| Funds Transfer | Charges |

| Within Airtel Payments Bank (Internet banking, Mobile App & USSD) | Free |

| From Airtel Payments Bank to another Bank (Internet banking, Mobile App & USSD)-IMPS | 1% of amount transferred |

| From Airtel Payments Bank to another Bank (Internet banking, Mobile App & USSD) – NEFT | Free |

| Source: airtel.in |

| Description | Limits |

|---|---|

| Minimum Cash Deposit Amount | 10 |

| Minimum Cash Withdrawal Amount | 10 |

| Minimum Amount for Funds Transfer (Mobile App) | 10 |

| Maximum Cash Withdrawal per transaction | 25,000 |

| Maximum Savings Account Balance | 2,00,000 (*terms and conditions apply) |

| Maximum Money can be added using same Debit Card per transaction | 25,000 |

| Maximum number of transactions allowed per month | 10,000 |

| For customers where cumulative load in last 60 days is greater than INR 50,000 | 2,000 per transaction using Net Banking or Debit Card |

| Money Transfer To Airtel Payments Bank Account/Other Account (per day) | 15 |

| Online Transactions using MasterCard (Per Day) | 15 |

| Maximum Amount that can be added by Non-PAN SBA A/c holders (Per Month) | 10,000 |

| Maximum Amount that can be sent by SBA A/c holders without adding beneficiary (Per Month) | 10,000 |

| Source: airtel.in |

| Description | Limits | |

|---|---|---|

| Per transaction Limit | Monthly Limit ( per sender) | |

| IMT from App Self withdrawal | 10000 | 75000 |

| IMT from App send money to Others | 10000 | 75000 |

| Limits on the receiver end : Self : Rs 1,00,000, Others : Rs 25 ,000 | ||

| Source: airtel.in |

| From (Rs) | To (Rs) | Charges (Rs) |

|---|---|---|

| 0 | 1 | 0 |

| 2 | 9 | 1 |

| 10 | 100 | 1 |

| 101 | 1,000 | 10 |

| 1,001 | 1,100 | 11 |

| 1,101 | 1,200 | 12 |

| 1,201 | 1,300 | 13 |

| 1,301 | 1,400 | 14 |

| 1,401 | 1,500 | 15 |

| 1,501 | 1,600 | 16 |

| 1,601 | 1,700 | 17 |

| 1,701 | 1,800 | 18 |

| 1,801 | 1,900 | 19 |

| 1,901 | 2,000 | 20 |

| 2,001 | 2,100 | 21 |

| 2,101 | 2,200 | 22 |

| 2,201 | 2,300 | 23 |

| 2,301 | 2,400 | 24 |

| 24,01 | 2,500 | 25 |

| 2,501 | 2,600 | 26 |

| 2,601 | 2,700 | 27 |

| 2,701 | 2,800 | 28 |

| 2,801 | 2,900 | 29 |

| 2,901 | 3,000 | 30 |

| 3,001 | 3,100 | 31 |

| 3,101 | 3,200 | 32 |

| 3,201 | 3,300 | 33 |

| 3,301 | 3,400 | 34 |

| 3,401 | 3,500 | 35 |

| 3,501 | 3,600 | 36 |

| 3,601 | 3,700 | 37 |

| 3,701 | 3,800 | 38 |

| 3,801 | 3,900 | 39 |

| 3,901 | 4,000 | 40 |

| 4,001 | 4,100 | 41 |

| 4,101 | 4,200 | 42 |

| 4,201 | 4,300 | 43 |

| 4,301 | 4,400 | 44 |

| 4,401 | 4,500 | 45 |

| 4,501 | 4,600 | 46 |

| 4,601 | 4,700 | 47 |

| 4,701 | 4,800 | 48 |

| 4,801 | 4,900 | 49 |

| 4,901 | 5,000 | 50 |

| 5,001 | 5,100 | 51 |

| 5,101 | 5,200 | 52 |

| 5,201 | 5,300 | 53 |

| 5,301 | 5,400 | 54 |

| 5,401 | 5,500 | 55 |

| 5,501 | 5,600 | 56 |

| 5,601 | 5,700 | 57 |

| 5,701 | 5,800 | 58 |

| 5,801 | 5,900 | 59 |

| 5,901 | 6,000 | 60 |

| 6,001 | 6,100 | 61 |

| 6,101 | 6,200 | 62 |

| 6,201 | 6,300 | 63 |

| 6,301 | 6,400 | 64 |

| 6,401 | 6,500 | 65 |

| 6,501 | 6,600 | 66 |

| 6,601 | 6,700 | 67 |

| 6,701 | 6,800 | 68 |

| 6,801 | 6,900 | 69 |

| 6,901 | 7,000 | 70 |

| 7,001 | 7,100 | 71 |

| 7,101 | 7,200 | 72 |

| 7,201 | 7,300 | 73 |

| 7,301 | 7,400 | 74 |

| 7,401 | 7,500 | 75 |

| 7,501 | 7,600 | 76 |

| 7,601 | 7,700 | 77 |

| 7,701 | 7,800 | 78 |

| 7,801 | 7,900 | 79 |

| 7,901 | 8,000 | 80 |

| 8,001 | 8,100 | 81 |

| 8,101 | 8,200 | 82 |

| 8,201 | 8,300 | 83 |

| 8,301 | 8,400 | 84 |

| 8,401 | 8,500 | 85 |

| 8,501 | 8,600 | 86 |

| 8,601 | 8,700 | 87 |

| 8,701 | 8,800 | 88 |

| 8,801 | 8,900 | 89 |

| 8,901 | 9,000 | 90 |

| 9,001 | 9,100 | 91 |

| 9,101 | 9,200 | 92 |

| 9,201 | 9,300 | 93 |

| 9,301 | 9,400 | 94 |

| 9,401 | 9,500 | 95 |

| 9,501 | 9,600 | 96 |

| 9,601 | 9,700 | 97 |

| 9,701 | 9,800 | 98 |

| 9,801 | 9,900 | 99 |

| 9,901 | 10,000 | 100 |

| 10,001 | 10,100 | 101 |

| 10,101 | 10,200 | 102 |

| 10,201 | 10,300 | 103 |

| 10,301 | 10,400 | 104 |

| 10,401 | 10,500 | 105 |

| 10,501 | 10,600 | 106 |

| 10,601 | 10,700 | 107 |

| 10,701 | 10,800 | 108 |

| 10,801 | 10,900 | 109 |

| 10,901 | 11,900 | 110 |

| 11,001 | 11,100 | 111 |

| 11,101 | 11,200 | 112 |

| 11,201 | 11,300 | 113 |

| 11,301 | 11,400 | 114 |

| 11,401 | 11,500 | 115 |

| 11,501 | 11,600 | 116 |

| 11,601 | 11,700 | 117 |

| 11,701 | 11,800 | 118 |

| 11,801 | 11,900 | 119 |

| 11,901 | 12,000 | 120 |

| 12,001 | 12,100 | 121 |

| 12,101 | 12,200 | 122 |

| 12,201 | 12,300 | 123 |

| 12,301 | 12,400 | 124 |

| 12,401 | 12,500 | 125 |

| 12,501 | 12,600 | 126 |

| 12,601 | 12,700 | 127 |

| 12,701 | 12,800 | 128 |

| 12,801 | 12,900 | 129 |

| 12,901 | 13,000 | 130 |

| 13,001 | 13,100 | 131 |

| 13,101 | 13,200 | 132 |

| 13,201 | 13,300 | 133 |

| 13,301 | 13,400 | 134 |

| 13,401 | 13,500 | 135 |

| 13,501 | 13,600 | 136 |

| 13,601 | 13,700 | 137 |

| 13,701 | 13,800 | 138 |

| 13,801 | 13,900 | 139 |

| 13,901 | 14,000 | 140 |

| 14,001 | 14,100 | 141 |

| 14,101 | 14,200 | 142 |

| 14,201 | 14,300 | 143 |

| 14,301 | 14,400 | 144 |

| 14,401 | 14,500 | 145 |

| 14,501 | 14,600 | 146 |

| 14,601 | 14,700 | 147 |

| 14,701 | 14,800 | 148 |

| 14,801 | 14,900 | 149 |

| 14,901 | 15,000 | 150 |

| 15,001 | 15,100 | 151 |

| 15,101 | 15,200 | 152 |

| 15,201 | 15,300 | 153 |

| 15,301 | 15,400 | 154 |

| 15,401 | 15,500 | 155 |

| 15,501 | 15,600 | 156 |

| 15,601 | 15,700 | 157 |

| 15,701 | 15,800 | 158 |

| 15,801 | 15,900 | 159 |

| 15,901 | 16,000 | 160 |

| 16,001 | 16,100 | 161 |

| 16,101 | 16,200 | 162 |

| 16,201 | 16,300 | 163 |

| 16,301 | 16,400 | 164 |

| 16,401 | 16,500 | 165 |

| 16,501 | 16,600 | 166 |

| 16,601 | 16,700 | 167 |

| 16,701 | 16,800 | 168 |

| 16,801 | 16,900 | 169 |

| 16,901 | 17,000 | 170 |

| 17,001 | 17,100 | 171 |

| 17,101 | 17,200 | 172 |

| 17,201 | 17,300 | 173 |

| 17,301 | 17,400 | 174 |

| 17,401 | 17,500 | 175 |

| 17,501 | 17,600 | 176 |

| 17,601 | 17,700 | 177 |

| 17,701 | 17,800 | 178 |

| 17,801 | 17,900 | 179 |

| 17,901 | 18,000 | 180 |

| 18,001 | 18,100 | 181 |

| 18,101 | 18,200 | 182 |

| 18,201 | 18,300 | 183 |

| 18,301 | 18,400 | 184 |

| 18,401 | 18,500 | 185 |

| 18,501 | 18,600 | 186 |

| 18,601 | 18,700 | 187 |

| 18,701 | 18,800 | 188 |

| 18,801 | 18,900 | 189 |

| 18,901 | 19,000 | 190 |

| 19,001 | 19,100 | 191 |

| 19,101 | 19,200 | 192 |

| 19,201 | 19,300 | 193 |

| 19,301 | 19,400 | 194 |

| 19,401 | 19,500 | 195 |

| 19,501 | 19,600 | 196 |

| 19,601 | 19,700 | 197 |

| 19,701 | 19,800 | 198 |

| 19,801 | 19,900 | 199 |

| 19,901 | 20,000 | 200 |

| 20,001 | 20,100 | 201 |

| 20,101 | 20,200 | 202 |

| 20,201 | 20,300 | 203 |

| 20,301 | 20,400 | 204 |

| 20,401 | 20,500 | 205 |

| 20,501 | 20,600 | 206 |

| 20,601 | 20,700 | 207 |

| 20,701 | 20,800 | 208 |

| 20,801 | 20,900 | 209 |

| 20,901 | 21,000 | 210 |

| 21,001 | 21,100 | 211 |

| 21,101 | 21,200 | 212 |

| 21,201 | 21,300 | 213 |

| 21,301 | 21,400 | 214 |

| 21,401 | 21,500 | 215 |

| 21,501 | 21,600 | 216 |

| 21,601 | 21,700 | 217 |

| 21,701 | 21,800 | 218 |

| 21,801 | 21,900 | 219 |

| 21,901 | 22,000 | 220 |

| 22,001 | 22,100 | 221 |

| 22,101 | 22,200 | 222 |

| 22,201 | 22,300 | 223 |

| 22,301 | 22,400 | 224 |

| 22,401 | 22,500 | 225 |

| 22,501 | 22,600 | 226 |

| 22,601 | 22,700 | 227 |

| 22,701 | 22,800 | 228 |

| 22,801 | 22,900 | 229 |

| 22,901 | 23,000 | 230 |

| 23,001 | 23,100 | 231 |

| 23,101 | 23,200 | 232 |

| 23,201 | 23,300 | 233 |

| 23,301 | 23,400 | 234 |

| 23,401 | 23,500 | 235 |

| 23,501 | 23,600 | 236 |

| 23,601 | 23,700 | 237 |

| 23,701 | 23,800 | 238 |

| 23,801 | 23,900 | 239 |

| 23,901 | 24,000 | 240 |

| 24,001 | 24,100 | 241 |

| 24,101 | 24,200 | 242 |

| 24,201 | 24,300 | 243 |

| 24,301 | 24,400 | 244 |

| 24,401 | 24,500 | 245 |

| 24,501 | 24,600 | 246 |

| 24,601 | 24,700 | 247 |

| 24,701 | 24,800 | 248 |

| 24,801 | 24,900 | 249 |

| 24,901 | 25,000 | 250 |

| The maximum amount per sender is Rs 25,000 per month, Source: airtel.in |

Airtel Payments Bank Service Charges have been imposed on all IMPS Outgoing Transactions via B2B Portal commencing from March 18, 2021.

| IMPS Slab | Charges |

|---|---|

| Upto Rs 25000 | Rs 2.5 +GST |

| Above Rs 25000 upto Rs 200000 | Rs 8 +GST |

| Source: airtel.in |

[ad_2]

[ad_1]

The Reserve Bank of India (RBI) has debarred Haribhakti & Co. LLP, Chartered Accountants, from undertaking any type of audit assignments in any of the entities regulated by RBI for a period of two years with effect from April 1, 2022.

This is the first case of debarment of a CA firm under section 45MAA of the Reserve Bank of India Act, 1934.

“This action has been taken on account of the failure on the part of the audit firm to comply with a specific direction issued by RBI with respect to its statutory audit of a Systemically Important Non-Banking Financial Company,” RBI said in a statement titled “Action against Statutory Auditors of NBFC under section 45MAA of RBI Act, 1934”.

The central bank said its action will not impact audit assignment/s of Haribhakti & Co. LLP in RBI regulated entities for the financial year 2021-22.

[ad_2]

[ad_1]

Personal Finance

oi-Kuntala Sarkar

Today, on October 12, Indian gold prices have gained only by Rs. 90/10 grams than yesterday and have passed the immediate impacts of a weak US employment data of September. Today, 22 carat gold rates are quoted at Rs. 46,030/10 grams and 24 carat gold rates are quoted at Rs. 47,030/10 grams. The Comex gold future hiked by 1.20% and was quoted at $1756, while the spot gold prices hiked by 0.23% and were quoted at $1758/oz till 2.04 PM IST. On the other hand, the US dollar index in the spot market fell 0.08% and stayed at 94.29 at the same time. In India, the Mumbai MCX gold in October future gained by 0.30% today till 2.25 PM IST and was quoted at Rs. 47,190/10 grams. However, during the festive season, IBJA is trying to keep the gold rates in a surging position, and in most Indian cities, gold prices have increased marginally.

The international gold rates immediately hiked as the US published weak employment data, expecting the economy is not recovering as fast as was expected. But now, the international rates have again came under pressure as the US bond yield is rising. ABN AMRO senior precious metals strategist Georgette Boele stated in a report.”So far this year, gold prices have declined by 7.5%. The gold price outlook remains negative. We keep our year-end forecast at US $1,700/oz and end of 2022 at US $1,500/oz.”

Gold rates in different Indian cities are quoted differently, daily. Today’s gold rates in major Indian cities follow:

| City | 22 carat (INR/10 Grams) | 24 carat (INR/10 Grams) |

|---|---|---|

| Mumbai | 46,030/- | 47,030/- |

| Delhi | 46,300/- | 50,510/- |

| Bangalore | 44,150/- | 48,160/- |

| Hyderabad | 44,150/- | 48,160/- |

| Chennai | 44,300/- | 48,320/- |

| Kerala | 44,150/- | 48,160/- |

| Kolkata | 46,500/- | 49,200/- |

“Investors have adjusted their expectations regarding the Fed. They expect the Fed to hike rates quicker than they had earlier expected. Moreover, 2y U.S. Treasury yields and 2y real yields have risen to reflect this. In addition, the U.S. dollar has risen by 5% this year. Gold prices tend to weaken when the dollar rises.” Georgette Boele added in the report, “We expect the Fed to start hiking early 2023.”

Story first published: Tuesday, October 12, 2021, 14:45 [IST]

[ad_2]