There’s a new generation of investors in town. They’re young, they get their tips on YouTube, and they’re armed with apps that make the stock markets more accessible than ever before.

US investment app Robinhood has made a splash in the West with its mission to open the markets to “everyday people”, but from Nigeria to India, Gen Z are flocking to homegrown equivalents.

“I don’t really care about my college, to be honest. It’s all market, market and market,” said Delhi student Ishan Srivastava, who started trading last December.

Srivastava uses a handful of Indian trading apps, including Zerodha and Upstox, and often gets his financial advice from YouTube. The ambitious 20-year-old hopes to build a diverse investment portfolio and then retire by 45.

In India in particular, the investment revolution has been aided by a boom in “demat” accounts — easy-to-open electronic accounts for holding financial securities, equity or debt.

But a similar app-led investment craze is also underway 8,000 kilometres (5,000 miles) away, in Nigeria.

– Banks ‘less attractive by the month’ – The country’s economic hub Lagos has long been known for its hustle and celebration of success, but the weakness of the naira currency has put extra pressure on youths to make cash as the cost of living has rocketed.

Nigerians have flocked to local apps such as Trove and Risevest which allow them to invest in US stocks, widely seen as a means of protecting wealth as the naira nightmare continues.

“I had the option of putting the money in the bank, but that is looking less attractive by the month,” said 23-year-old Dahunsi Oyedele.

“Sometimes I put my money in Risevest and get some returns in a week. Imagine getting one or two percent returns on 100,000 naira ($240) each week — that’s small, but it means a lot.”

For a few months after losing his job as a tech journalist due to the pandemic, Oyedele covered his rent by trading cryptocurrencies.

He is far from alone in turning to speculation during the Covid-19 crisis, as a combination of mass joblessness, stay-at-home orders and — for the fortunate — underused savings have encouraged people worldwide to dabble in trading for the first time.

In the US alone more than 10 million new investors entered the markets in the first half of 2021, according to JMP Securities, some of them drawn in by social media hype around “meme stocks” like GameStop.

Worldwide, the new arrivals are largely young. Robinhood’s median US customer age is 31; India’s Upstox says more than 80 percent of its users are 35 or under, a figure matched by Nigeria’s Bamboo (83 percent).

Trading apps have lowered the barriers to entry for youngsters in part by offering fractional trade.

A share in Amazon, for instance, is currently worth more than $3,000 — unaffordable for the average Gen Z or slightly older millennial. But a small fraction of that share might be within reach, particularly on an app that charges zero commission.

– Flirting with danger? – Trading apps may have been hailed as democratising access to the markets, but critics say they could also make it easier for inexperienced young investors to get into hot water.

In the US, the Securities and Exchange Commission is investigating whether apps are irresponsibly encouraging overtrading using excessive email alerts and by making investment feel like a game.

And Britain’s Financial Conduct Authority warned in March that the new cohort of young investors — who skew in the UK towards being women and from minority backgrounds — have more to lose.

Nearly two thirds of the new investors it surveyed said “a significant investment loss would have a fundamental impact on their current or future lifestyle”, the FCA found.

“This newer group of self-investors are more reliant on contemporary media (e.g. YouTube, social media) for tips and news,” the watchdog noted.

“This trend appears to be prompted by the accessibility offered by new investment apps.”

Some young investors have already been burned.

Mumbai-based product designer Ali Attarwala is giving trading a break after a bad experience with cryptocurrencies earlier this year.

“These apps make it easy to buy speculative assets like crypto, but there is still a lot of volatility in these new assets,” the 30-year-old told AFP.

Srivastava has also had ups and downs, but he sees his losses as part of the learning experience.

“When I started, I blew up almost 50 percent of the capital,” he said.

“I don’t treat them as my losses, but like education fees.”

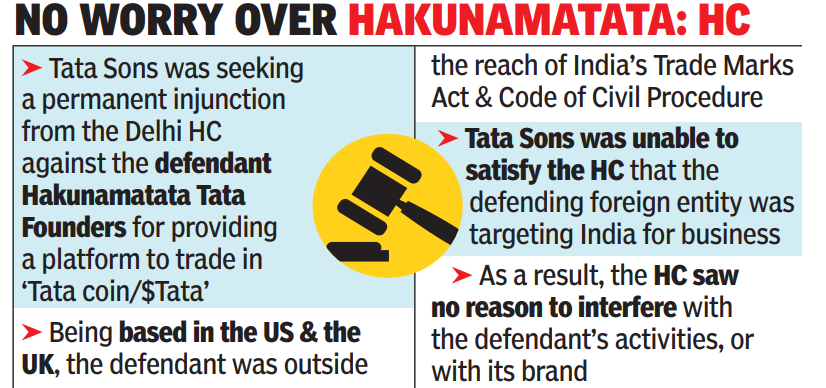

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.