Equity benchmark indices close in green, BFSI News, ET BFSI

[ad_1]

Read More/Less

The special trading window marks the beginning of Samvat 2078. It is the Hindu calendar that starts on Diwali.

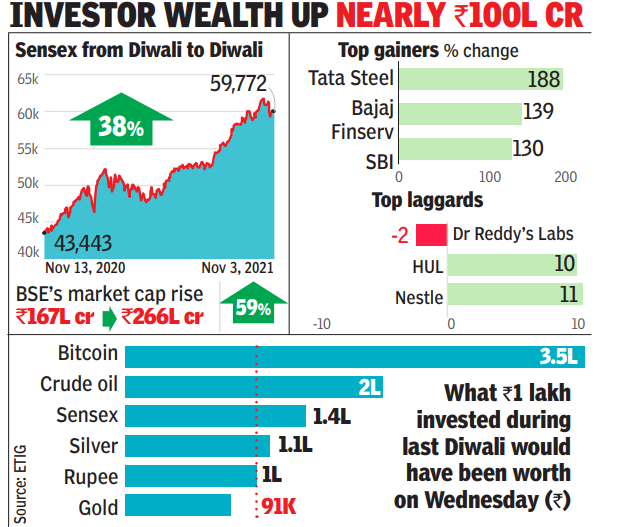

At the closing bell, the BSE S&P Sensex was up by 295.70 points or 0.49 per cent, while the Nifty 50 gained by 87.60 points or 0.49 per cent.

In BSE Sensex all the sectors gained. The sectors that saw maximum gain were the auto sector that was up by 1.54 per cent, the telecom sector that was up by 1.19 per cent, the capital goods that was up by 1.16 and industrials was up by 1.13 per cent.

Among stocks, the top contributor was Mahindra and Mahindra, which surged 2.87 per cent to Rs 872.95 per share, followed by ITC which surged 1.82 per cent to Rs 226.55 per share. Bajaj Auto, Larsen and Kotak Mahindra too traded with a positive bias.

However, ICICI Bank cracked by 0.43 per cent, followed by Ultra TechCement by 0.34 per cent and Asian Paints by 0.13 per cent.

The stock market will remain closed on November 5 due to Diwali Balipratipada.

Actor Bhagyashree rang the opening bell along with the Managing Director and Chief Executive Officer of the BSE Ashish Chauhan.

“Bollywood Actress Bhagyashree with Ashish Chauhan, MD & CEO BSE India and others Ringing the Opening Bell to mark the Deepavali Muhurat Trading,” BSE India tweeted.

Before the opening, a Laxmi puja was also performed here in Mumbai.

Ashish Chauhan performed the puja along with his family members at BSE office located at Dalal Street in Mumbai’s Kala Ghoda. Bhagyashree was also present during the puja and offered prayers to Goddess Laxmi.

With the completion of this Puja, the special one-hour long Mahurat Trading session commences in BSE. The market closed at 7.15 pm. (ANI)

[ad_2]