A collapse of Voda Idea will hurt IDFC First Bank, YES Bank most, BFSI News, ET BFSI

[ad_1]

Read More/Less

The refusal by existing promoters of Vodafone Idea to infuse cash in the debt-laden company and the Supreme Court’s recent dismissal of a plea for rectification of alleged miscalculation in adjusted gross revenue dues payable by the company to the government have condemned the telecom operator to bankruptcy, unless it can raise fresh capital.

Prospects of fund raising for the company look grim given that any new strategic investor will have to pour in billions of dollars that will largely be channelled to the government coffers and will not be reinvested in the company to prepare it for the new 5G world.

The resignation of Kumar Mangalam Birla as head of the company and his offer to the government to buy out Aditya Birla group’s stake is likely to further discourage potential investors.

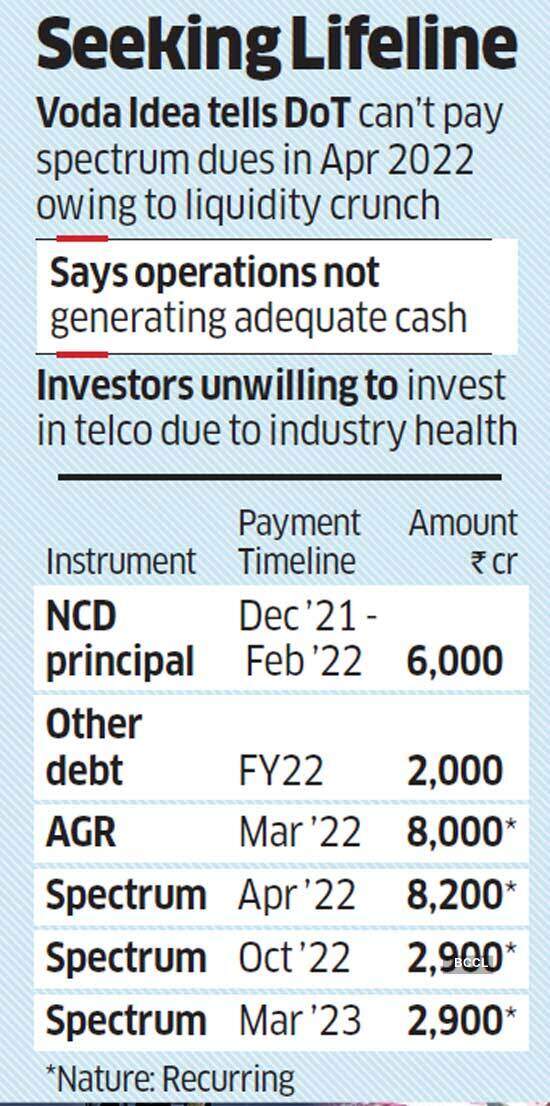

In that backdrop, Vodafone Idea is unlikely to be able to service its gross debt of over Rs 1.8 lakh crore. The telecom operator owes at least Rs 28,700 crore to several state-owned and private sector lenders.

The highest exposure is with State Bank of India at Rs 11,000 crore followed by Yes Bank at Rs 4,000 crore and IndusInd Bank at Rs 3,500 crore. However, in terms of percentage of loan book, the biggest hit from Vodafone Idea’s default will be to IDFC First Bank as it has an exposure of 2.9 per cent of its loan book followed by YES Bank at 2.4 per cent and IndusInd Bank at 1.65 per cent.

According to media reports, IDFC First Bank has already marked Vodafone Idea as stressed and provided for 15 per cent of the outstanding debt.

While Vodafone Idea is a one-off large account instead of the torrent of defaults seen over the past 10 years, it could have a bearing on the earnings performance of these banks in the coming quarters, as they will have to make hefty provisions against these loan accounts.

No surprise then that SBI was the worst Nifty50 performer today, down 3.3 per cent. Shares of IDFC First Bank tanked over 5 per cent, while those of YES Bank 2 per cent.

[ad_2]