World shares dip as China growth disappoints, oil extends rally, BFSI News, ET BFSI

[ad_1]

Read More/Less

Calls by China’s President Xi Jinping on Friday to make progress on a long-awaited property tax to help reduce wealth gaps also soured the mood.

An MSCI gauge of global stocks eased 0.2% by 1207 GMT as losses in Asia and Europe erased part of the gains seen last week on a strong start to the earnings season.

U.S. stock futures were also lower with S&P 500 and Nasdaq e-minis both down 0.3%.

China’s gross domestic product grew 4.9% in the July-September quarter from a year earlier, its weakest pace since the third quarter of 2020.

The world’s second-largest economy is grappling with power shortages, supply bottlenecks, sporadic COVID-19 outbreaks and debt problems in its property sector.

Oil prices extended a recent rally amid a global energy shortage with U.S. crude touching a seven-year high and Brent a three-year peak.

Europe’s STOXX 600 equity benchmark index fell 0.7%, dragged by luxury stocks, which are heavily exposed to China, and some poor earning updates. [.EU]

Chinese blue chips fell 1.2% and the Shanghai Composite Index lost 0.1%.

“The Chinese economy grew slower in the third quarter, mainly because of policy challenges and high base effects from last year,” said Iris Pang, economist at Dutch bank ING.

“We expect these two factors will continue to be in play for the fourth quarter, which means the slow growth of the Chinese economy will continue,” she added.

Investors also continued to worry about global inflation, which was being driven by the reopening of many economies after COVID-19 restrictions and supply chain issues, and prospects central banks will tighten policy sooner rather than later.

Kevin Boscher, CIO of Ravenscroft, said given the current climate they held more cash than usual in their portfolios.

“We remain optimistic on the longer-term outlook, but expect this volatility and uncertainty to persist for the next few weeks as we await more clarity on the outlook for global growth, inflation, China, U.S. policy and the Fed,” he said.

“For now, it makes sense to stay reasonably defensively positioned but I expect markets to eventually ‘climb the wall of worry’,” he added.

On Monday, data showed New Zealand’s consumer price index rose 2.2% in the third quarter, its biggest rise in over a decade, causing the local dollar to jump as much as 0.5% before changing course.

Some other currencies are also responding to rising inflation expectations, as investors increasingly bet central banks will have to raise rates.

The dollar rose 0.1% against a basket of peers to 94.04, in sight of a one-year high hit last Monday, as traders position themselves for a looming tapering of the Federal Reserve’s massive bond buying programme.

Sterling fell 0.1% against a stronger dollar but touched a 20-month high versus the euro after Bank of England Governor Andrew Bailey sent a fresh signal over the weekend that the central bank is gearing up to raise interest rates as inflation risks mount.

The yen meanwhile traded near its lowest in nearly three years against the dollar, as the Japanese central bank looked increasingly likely to trail behind other monetary authorities in terms of rate hikes.

On debt markets, global repricing of interest rate expectations pushed euro zone bond yields back towards recent multi-month highs. Germany’s 10-year Bund yields, the benchmark for the region, was up 3 basis points at -0.139%.

High energy costs are driving some of the inflation fears and Brent crude was last up 1% at $85.7 per barrel and U.S. crude up 1.3% to $83.6.

Gold fell 0.3% at $1,761 an ounce, after falling 1.5% on Friday as upbeat retail sales drove U.S. bond yields higher.

Bitcoin fell 1.3% to $60,747. It gained last week on hopes that U.S. regulators would allow a cryptocurrency exchange-traded fund to trade.

(Reporting by Danilo Masoni and Alun John; editing by Jason Neely, William Maclean)

[ad_2]

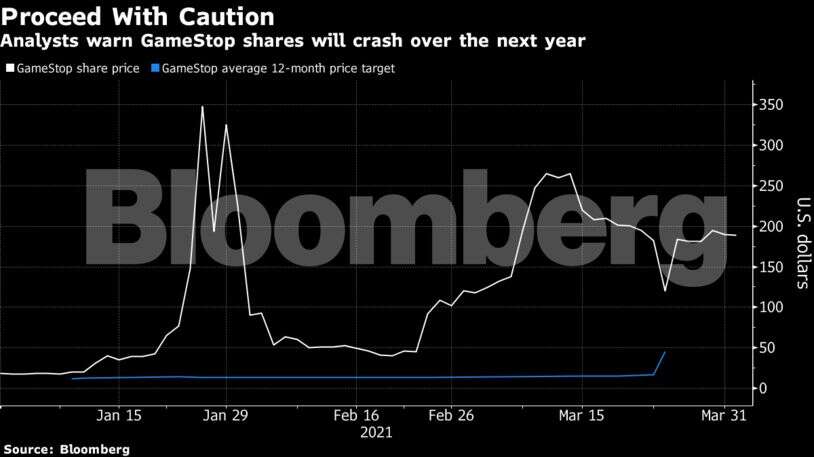

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.”

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.” But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen.

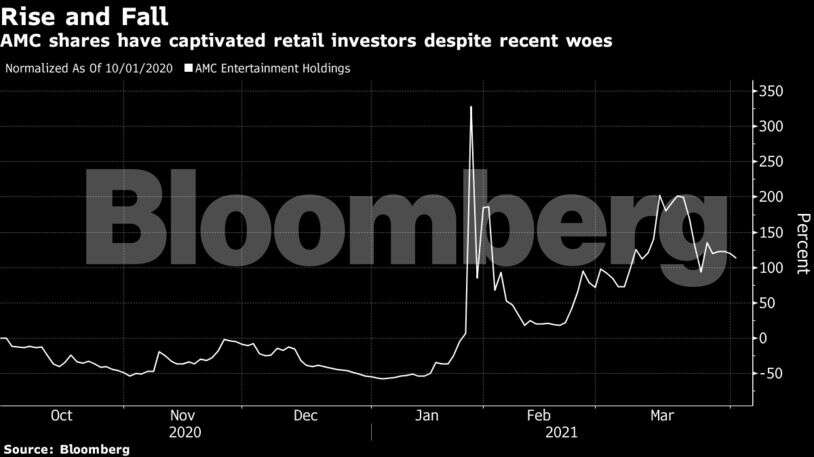

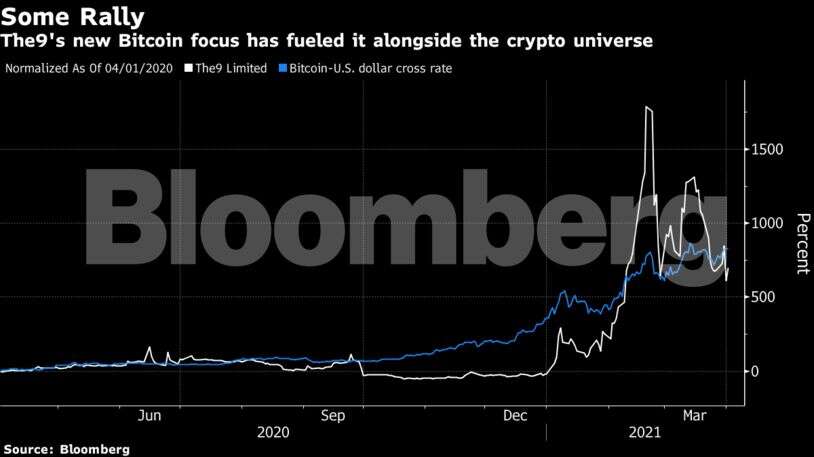

But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen. Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.

Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.