No HC relief for Tatas on use of their trademark as crypto coin, BFSI News, ET BFSI

[ad_1]

Read More/Less

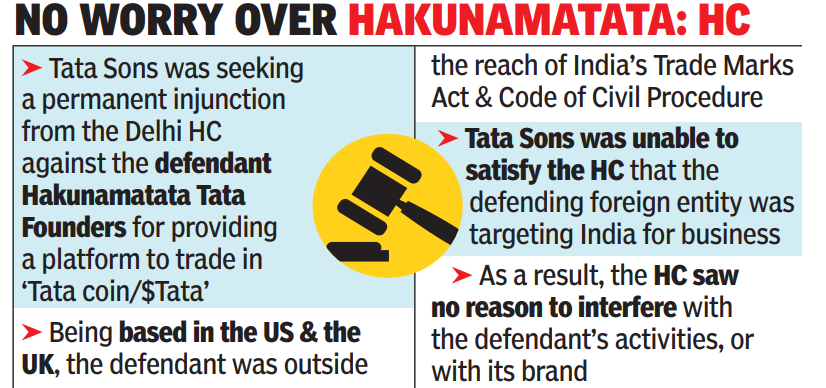

Tata Sons, the holding company of the Tata Group, was unsuccessful in its bid to seek a permanent injunction from the Delhi high court restraining Hakunamatata Tata Founders and others from using the trademark ‘Tata’ as part of the name under which the cryptocurrency was made available to the public or as part of their corporate or domain name.

The domain names tatabonus.com and hakunamatata.finance that enabled the purchase and sale of the ‘Tata’ cryptocurrency were set up in June and May of 2021 respectively. The reason Tata Sons could not succeed is because it could not prove to the satisfaction of the court that the foreign parties (the defendants) intended to target India as a customer base.

“The mere fact that the defendants’ cryptocurrency can be purchased by customers located in India and that, as a result, the plaintiff’s brand value may be diluted, even seen cumulatively, cannot in my view justify this court interfering with the defendants’ activities, or with its brand or mark,” held Justice C Hari Shankar.

Apparently, the defendants’ cryptocurrency could be purchased — using the QR Code and the methodology indicated on the defendants’ website — by a customer located anywhere in the world. This factor therefore, too, cannot indicate any conscious targeting of the Indian customer base by the defendants. Nor do the websites or social media accounts prove any intent to target customers covered by the high court’s jurisdiction. “If at all they target customers, they target customers across the world,” the judge observed.

Tata Sons didn’t respond to an emailed query on the issue. Sources told TOI that Tata Sons is considering to pursue this case in the UK court.

[ad_2]