-By Ishwari Chavan

Conventionally, investors have evaluated their performance and made decisions solely on financial measures and have neglected environmental and social impacts that come along with it.

Sustainable finance gained interest from the mid-2010s, especially after the Paris Climate Protection Agreement, 2015. In the agreement, 195 countries, including India, have committed to drive economic growth in a climate-friendly manner and reduce greenhouse gas emissions.

Environmental, social, and governance (ESG) issues, along with the associated opportunities and risks, are becoming more relevant for financial institutions. A common way to opt for sustainable finance is by investing in segments such as energy generation, which include solar photovoltaics, on and offshore wind, hydropower and broader energy services.

Here’s a rundown of all that you need to know.

What is sustainable finance?

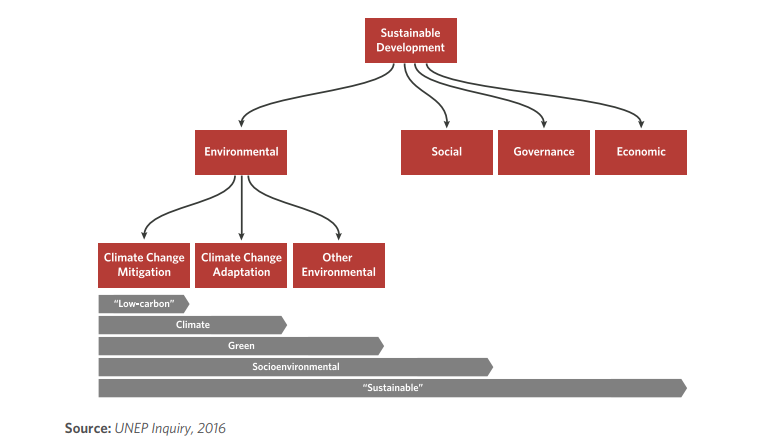

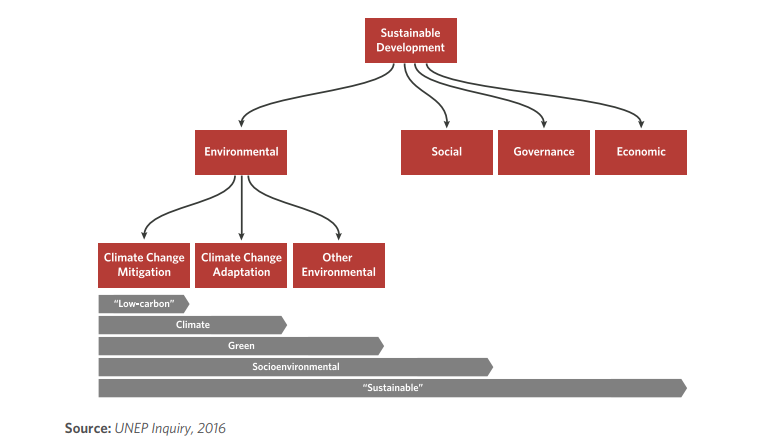

Sustainable finance includes making business or investment decisions that take into consideration not only financial returns but also environmental, social and governance (ESG) factors.

Sustainable finance is defined as supporting economic growth while reducing pressures on the environment and taking into account social and corporate governance aspects, such as inequality, human rights, management structures and executive remuneration. Environmental considerations, including climate mitigation and adaptation, conservation of biodiversity and circular economy, are under its bandwidth.

One of the key objectives of sustainable finance is to improve economic efficiency on a long-term basis.

What does sustainable finance include?

Operational and labelling standards

1. Green labelled financial securities, products and services

2. Social-labelled financial securities, products and services

3. Sustainability- labelled financial securities, products and services

4. Unlabelled multilateral development banks financing of sustainability oriented projects

Industry oriented frameworks

1. Inclusion of ESG considerations in investment decisions

2. Sustainable and responsible investment (SRI)

3. Impact finance and impact investing

4. Equator principles-aligned projects

Wider Policy framework

1. Sustainable development goals-aligned finance (SDG Finance)

2. Principles of positive impact finance-aligned investments

3. Principles for responsible banking-aligned finance

4. Paris agreement-aligned finance

5. Climate Finance and Green Finance

6. Government sustainability related spending programmes

How has sustainable finance fared around the world so far?

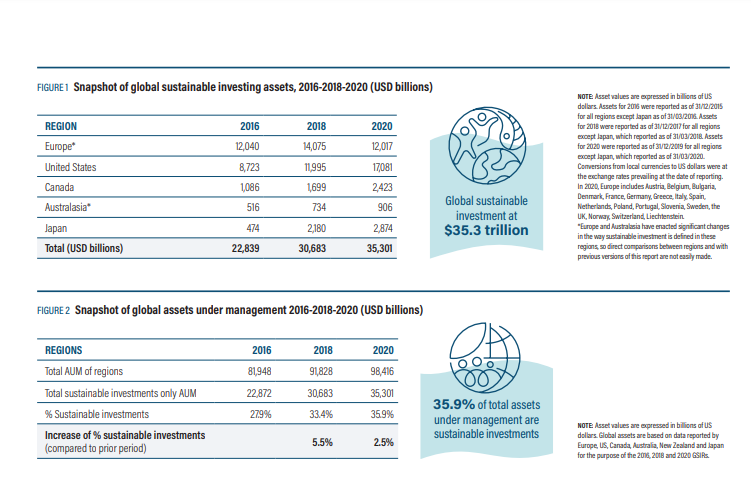

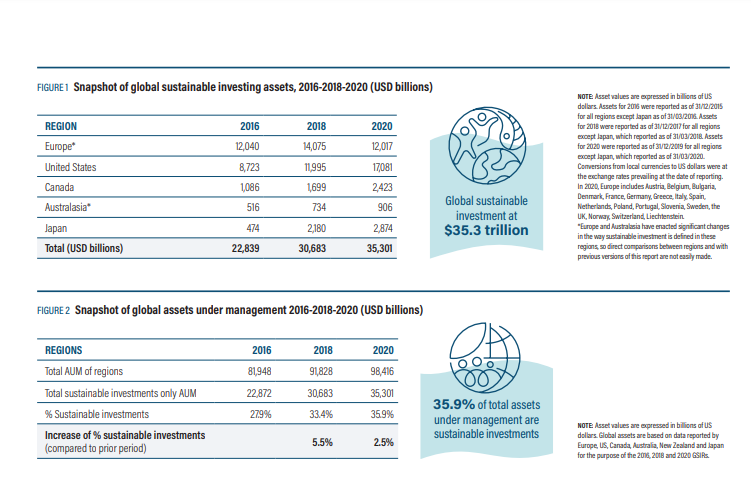

According to the Global Sustainable Investment Alliance, at the start of 2020, global sustainable investment reached $35.3 trillion in five major markets – US, Canada, Japan, Australasia and Europe – reporting a 15% increase in the past two years (2018-2020).

Source: Global Sustainable Investment Alliance

Source: Global Sustainable Investment Alliance

Sustainable investment assets under management make up 35.9% of total assets under management, up from 33.4% in 2018.

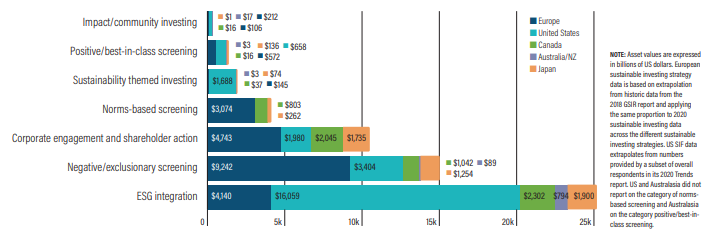

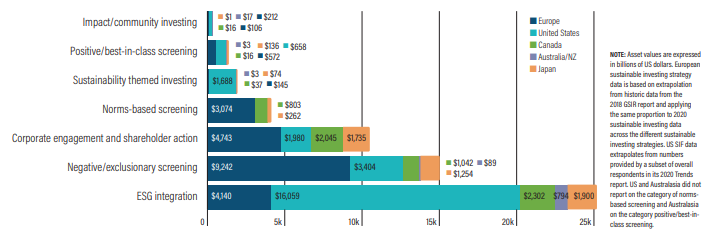

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

Sustainable investment assets continue to grow in most regions, with Canada experiencing the largest increase in absolute terms over the past two years (48%), followed by the US (42%), Japan (34%) and Australasia (25%) from 2018 to 2020.

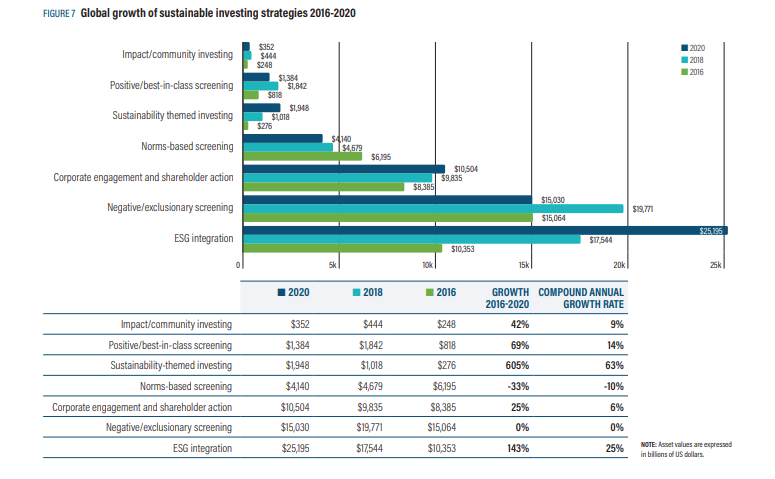

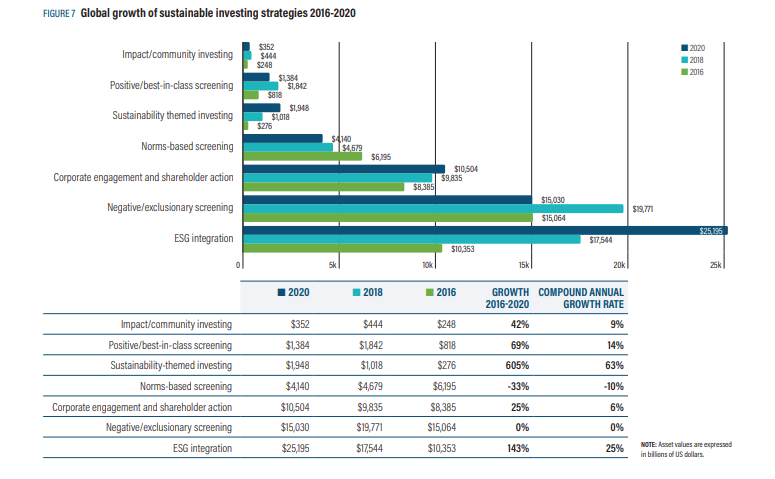

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

According to the Global Sustainable Investment Alliance, at the start of 2020, global sustainable investment reached $35.3 trillion in five major markets – US, Canada, Japan, Australasia and Europe – reporting a 15% increase in the past two years (2018-2020).

Source: Global Sustainable Investment Alliance

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)