Should you go for Shriram Transport FDs that offer up to 7.5% interest?

[ad_1]

Read More/Less

Shriram Transport Finance Company (STFC) revised the interest rates on its fixed deposits last month. The company now offers 6.5 per cent and 6.75 per cent per annum, respectively on its one-year and two-year deposits. Three-year deposits can fetch you 7.5 per cent interest per annum. Senior citizens get an additional 0.3 per cent over these rates. Besides, the company offers an additional 0.25 per cent on all renewals.

At the current juncture, the STFC FD rates seem better than those offered by most banks and other similar-rated NBFCs. Though the company has never defaulted on its deposits, its current financials indicate some near-to-medium term stress in operations. Hence, investors with a high-risk appetite who seek additional returns, can invest in this FD. Do note, that unlike FDs offered by banks, those by NBFCs are not covered by the DICGC’s ₹5 lakh cover.

Investors can choose from monthly, quarterly, half yearly or annual interest payout options or the cumulative option where interest gets compounded and is paid at the time of maturity.

The minimum deposit amount is ₹5,000 and in multiples of ₹1,000 thereafter.

Investors who opt for the online route can choose from additional tenure deposits such as 15-month and 30-month deposits. The company offers 6.75 per cent and 7.5 per cent, respectively on such tenures, same as that offered on its two and three year deposits, respectively.

How they fare

As interest rates have bottomed out, rates are likely to inch up in the next two or three years. Hence, at the current juncture, it will be wise to lock into deposits with a tenure of one or two years only.

Currently banks (including most small finance banks) offer rates of up to 6.35 per cent per annum for one-year deposits and up to 6.5 per cent for two-year deposits. Suryoday Small Finance Bank however, offers 6.5 per cent on its one-to-two year deposits (both inclusive). While the rates offered by STFC are at par with those of Suryoday on the one-year FD, the former offers superior rates on deposits of other tenures. The rates on STFC’s deposits are also superior to those offered by similar-rated NBFCs.

The company’s FDs are rated FAAA(Stable) by CRISIL and MAA+ (Stable) by ICRA. Other AAA-rated NBFCs offer interest rates in the range of 5.25 to 5.7 per cent on their one-year deposits and up to 6.2 per cent on their two-year deposits.

About STFC

The company has a 42-year old track record of providing finance for commercial vehicles, predominantly in the high-yielding pre-owned HCV segment.

As of June 2021, its assets under management (AUM) totalled ₹ 1.19 lakh crore (up 6.75 per cent y-o-y ). About 90 per cent of the AUM was towards pre-owned vehicle loans and the rest was towards new vehicle loans (6 per cent), business loans (1.6 per cent), working capital loans (1.9 per cent) and other loans (0.1 per cent).

STFC has a strong branch network of 1,821 branch offices and 809 rural centres covering all states.

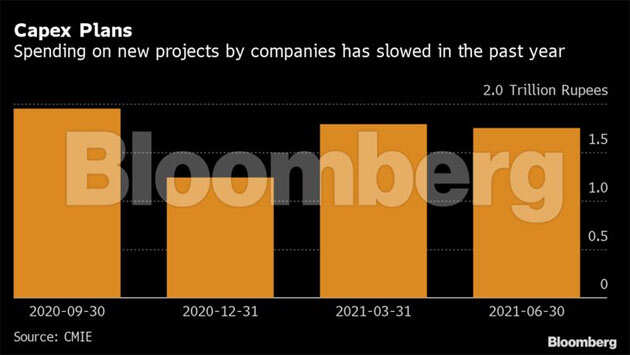

Given its heavy reliance on fleet and transport operators (HCV and construction equipment comprise about 48 per cent of its AUM and medium and light commercial vehicles constitute another 25.3 per cent), the company saw deterioration in asset quality in the recent quarter on account of lockdowns. In the June 2021 quarter, its gross Stage-3 assets worsened to 8.18 per cent from 7.06 per cent in the March 2021 quarter.

Even gross Stage-2 assets, which may slip to Stage-3 in the coming quarters, spiked to 14.53 per cent of the AUM compared to 11.9 per cent in the March quarter.

However, the company has a decent provision coverage ratio of 44 per cent and about 10 per cent for Stage 3 and Stage- 2 assets, respectively. Its is due to the spike in provisioning (up 35 per cent y-o-y) that the company saw a 47 per cent (y-o-y) drop in its net profit to ₹170 crore in the June 2021 quarter.

Besides, its proven past track record, strong capital and liquidity position offer additional comfort.

The company’s Capital to Risk Weighted Assets Ratio (CRAR) stood at 23.27 per cent in the June 2021 quarter and it has a positive asset liability mismatch in all buckets—ranging from one month to 5 years.

[ad_2]