Banks’ bad loan provisioning falls for fourth consecutive quarter in Q3, BFSI News, ET BFSI

[ad_1]

Read More/Less

The loan loss provisioning by banks has been benign in the current fiscal year so far on account of various schemes launched by the central bank to reduce the impact of the pandemic. “Bank NPAs this year would tend to be a bit nebulous given the various forbearance dispensations that have been made besides the restructuring schemes that have been introduced,” noted CARE Ratings in a report.

A majority of the sample banks, 19 to be precise, reported lower NPA provisioning compared with the previous quarter. Among them were public sector banks (PSBs) including State Bank of India (SBI), Punjab National Bank (PNB), Union Bank, Indian Bank and Canara Bank and their private sector counterparts such as HDFC Bank, ICICI Bank, and IndusInd Bank. These banks recorded a double digit sequential drop in NPA provisions for the December quarter. Banks including Kotak Bank, Axis Bank, and Yes Bank showed a sequential jump in bad loan provisioning.

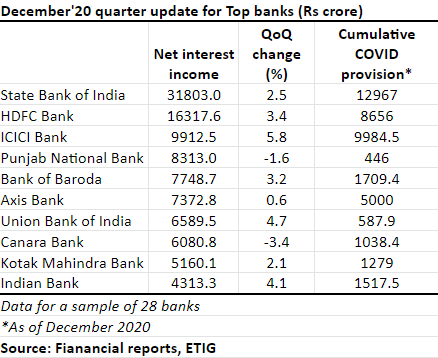

The sample’s COVID-19 provisioning increased by 22.7% sequentially to Rs 14,291.1 crore in the December quarter led by a higher provisioning by SBI, HDFC Bank, and ICICI Bank. The sample’s net interest income fell marginally by 1.4% to Rs 1.3 lakh crore.

According to the CARE Ratings report, the gross NPAs of the banking system fell to Rs 7.4 lakh crore in the December quarter from Rs 7.9 lakh crore in the previous quarter while the NPA ratio fell to 7% from 7.7% by similar comparison.

The banking, finance and insurance (BFSI) sector reported a gradual recovery in credit offtake amid buoyant festive demand in the December quarter. “The BFSI sector saw robust operational delivery, especially in the large-cap banks, with above 70% provisioning coverage ratio and minimal restructuring in the loan books,” said Gautam Duggad, rresearch head, Motilal Oswal Institutional Equities.

[ad_2]