What Robinhood’s IPO filing says about the Reddit army, BFSI News, ET BFSI

[ad_1]

Read More/Less

Those broad strokes describing retail traders are among the nuggets found in the July 1 filing by online brokerage firm Robinhood Markets, which is aiming for an initial public offering worth over $40 billion.

In its filing, the firm includes facts about its more than 18 million customers and describes some of the potential risks of investing in the company, which increased its headcount from 289 in December, 2018 to more than 2,100 in March of this year as retail trading took off.

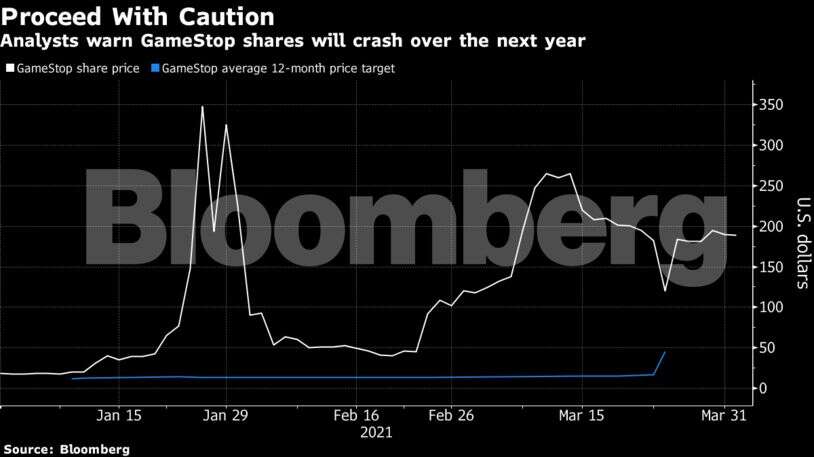

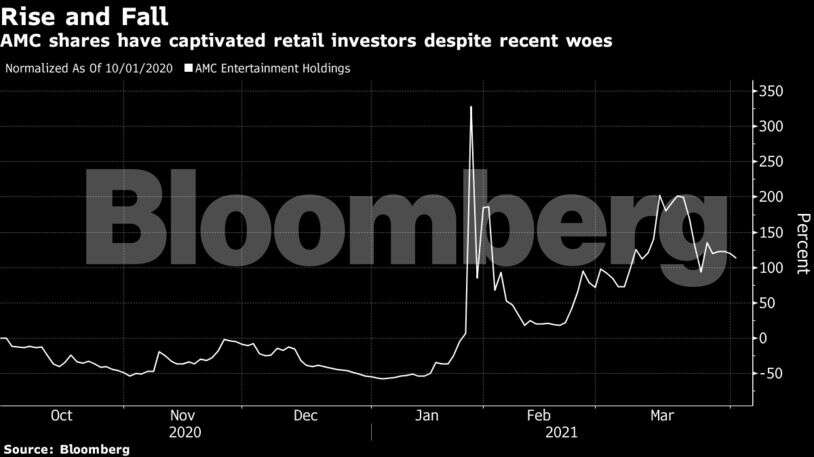

The detailed breakdown of Robinhood‘s user base offers a glimpse at the individual traders gathering in online forums such as Reddit’s WallStreetBets, whose activity has helped fuel wild rides in shares of video game retailer GameStop, movie theater chain AMC Entertainment Holdings and a slew of other so-called meme stocks.

Here are a few highlights from the filing:

— As of March 31, 2021, the median age of customers on the company’s platform was 31.

— From January 1, 2015 to March 31, 2021, over half of the customers funding accounts on the platform said Robinhood was their first brokerage account.

— Customers visited the app an average of nearly seven times a day in 2020, a year that saw wild swings in markets in the wake of the coronavirus pandemic.

— The firm believes that close to 50% of all new retail funded accounts opened in the United States from 2016 to 2021 were new accounts created on Robinhood.

— Robinhood’s assets under custody at the end of 2021’s first quarter include roughly $65 billion in equities, $2 billion in options, $11.6 billion in cryptocurrencies and $7.6 billion in cash.

— Cryptocurrencies have been huge for the company. In the first quarter, Robinhood saw over 9.5 million customers trade about $88 billion of cryptocurrency on the platform. Crypto assets have grown 23-fold between March 31, 2020 and the end of this year’s first quarter.

— A substantial portion of the recent growth in Robinhood’s net revenue is earned from transactions attributable to Dogecoin, the company said. The price of Dogecoin, which has been touted by billionaire entrepreneur Elon Musk, has surged by more than 10,000% in the past year, according to Coingecko.com.

“If demand for transactions in Dogecoin declines and is not replaced by new demand for other cryptocurrencies available for trading on our platform, our business, financial condition and results of operations could be adversely affected,” the filing said.

— Most Robinhood customers are primarily buy-and-hold investors, the company said, echoing a refrain often heard on WallStreetBets, where users exhort each other to hold onto their favorite meme stocks in the face of eye-popping volatility.

[ad_2]

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.”

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.” But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen.

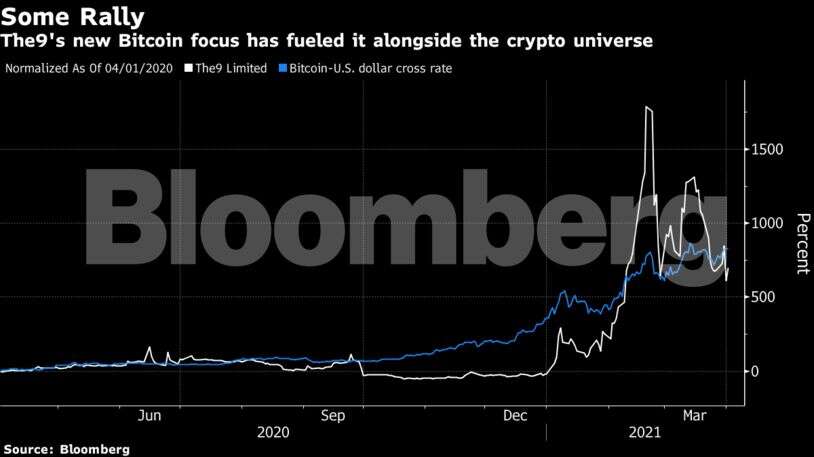

But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen. Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.

Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.