Seven steps to reignite India’s growth, according to RBI, BFSI News, ET BFSI

[ad_1]

Read More/Less

The prospects for the economy though impacted by the second wave remain resilient backed by prospects of another bumper rabi crop, gathering momentum of activity in several sectors, especially housing and road construction, and services activity in construction, freight transportation and information technology, the central bank said in its annual report.

Here are seven ways that put India on the growth path again, according to the central bank.

Public and private investment

“A virtuous combination of public and private investment can ignite a shift towards investment and thereby to a trajectory of sustained growth. Fiscal policy, with the largest capex budget ever and emphasis on doing business better, has swung into a crowding-in role. It is apposite now for Indian industry to pick up the gauntlet.’’

RBI will persist with easy monetary policy during the year to ensure that growth gains traction. The conduct of monetary policy in 2021-22 would be guided by evolving macroeconomic conditions, with a bias to remain supportive of growth till it gains traction on a durable basis,” said the report. The central bank will ensure that system-level liquidity remains comfortable during 2021-22 in alignment with the stance of monetary policy, and monetary transmission continues unimpeded while maintaining financial stability,” according to the annual report 2020-21.

Recovery of private demand

“The recovery of the economy from Covid-19 will critically depend on the robust revival of private demand that may be led by consumption in short-run but will require acceleration of investment to sustain the recovery,” said the report. For a self-sustaining GDP growth trajectory post-COVID-19, a durable revival in private consumption and investment demand together would be critical as they account for around 85 per cent of GDP. Typically, post-crisis recoveries are led more by consumption than investment, it said.

Limiting costs to Q1

The macroeconomic costs of this wave can be limited to Q1 with possible spillovers into July, RBI said, adding that that is the most optimistic scenario that can be envisaged at this juncture.”

Rekindling animal spirits

Private investment is the missing piece in the story of the Indian economy in 2020-21; reviving it awaits an environment in which “animal spirits” are rekindled and entrepreneurial energies are released so that backward and forward linkages and multipliers prepare the ground for a durable investment-driven recovery

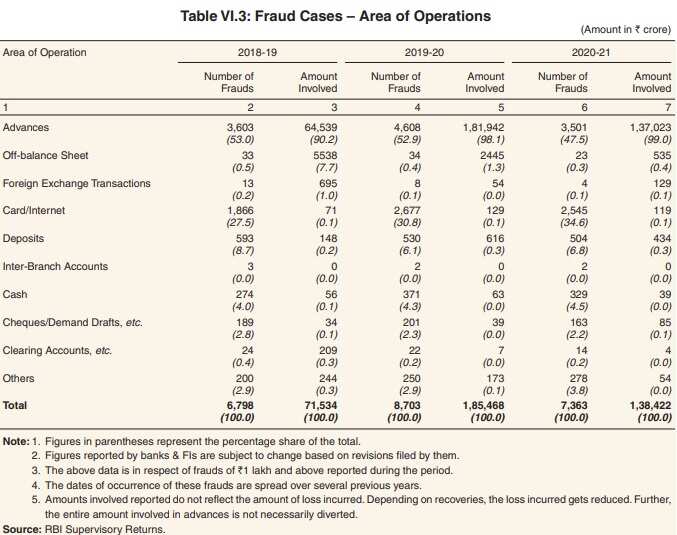

Monitor asset quality

Stress tests indicate that Indian banks have sufficient capital at the aggregate level even in a severe stress scenario. Bank-wise as well as system-wide supervisory stress testing provide clues for a forward-looking identification of vulnerable areas,” RBI said. Banks should keep a tab on the Non-Performing Assets (NPAs) and accordingly earmark capital for provisioning, according to the central bank.

Unleashing services demand

The services sector is still “wounded,” but the focus of government spending on infrastructure could unleash pent-up demand in the economy and create a sufficient climate for all-round development, it said.

[ad_2]