Happy Friday! Big Tech firms are up in arms against some provisions of the

Personal Data Protection Bill. The biggest bone of contention has been the proposal to classify social media platforms as publishers. Companies are mulling legal action if lawmakers accept all the recommendations of the Joint Committee of Parliament in the final legislation.

Also in this letter

Tech firms may go to court over data protection bill

Top technology and internet companies may go to court to challenge certain provisions in the data protection bill if lawmakers accept and adopt all the recommendations of the Joint Committee of Parliament (JCP) in the final legislation, sources told us.

- The Joint Committee on the Personal Data Protection Bill, 2019 – headed by BJP Member of Parliament PP Chaudhary – adopted a draft report on November 22 with seven of its 31 members moving dissent notes against various clauses.

Why now? The biggest point of contention is the proposal to classify social media platforms as publishers as it places the onus for user generated content on internet companies and will impact a host of global majors including Facebook, Google’s YouTube, Twitter and WhatsApp, all of whom stand to lose the safe harbor or immunity currently provided by Information Technology Act, 2000, the sources said.

Quote: “Any new concept of privacy introduced as an amendment should be based on consensus approach, and is therefore important that all stakeholders, including key industry bodies, are engaged before a robust data protection legislation is put in place by the government,” said Kumar Deep, country manager, India, ITI Information Technology Industry Council, which counts companies Intel, Amazon, and Apple as its members.

Other clauses such as the inclusion of non-personal data in the privacy law as well as provisions for certifying hardware devices and the demand that sensitive personal data and critical personal data be stored locally, are also stoking concern, sources said.

What are experts saying? Privacy experts said the clause that classifies social media platforms as publishers is worrying for companies like Facebook and Google as it may directly impact their business model.

Civil society could also go to court over sweeping exemptions granted to government and law enforcement agencies in the recommendations made by the committee, according to public policy expert Prasanto K Roy.

Cryptocurrency exchanges eye targeted ads

Cryptocurrency exchanges are turning to targeted advertising and marketing campaigns to soothe the nerves of investors who are exiting their investments amid regulatory uncertainty on the virtual currencies.

What’s happening? Some of the exchanges, including CoinDCX and CoinSwitch Kuber, have re-started advertising and marketing campaigns, albeit not as aggressively as earlier, industry insiders said. In most cases, the advertisements are aired on social media and other digital platforms.

According to a person part of the Blockchain and Crypto Assets Council, an industry advisory body, several exchanges wanted to restart advertising, especially targeting their existing investors. Some of them are looking to roll out advertisements across platforms in the coming week as they hope to get some clarity on the legality of crypto assets.

Last month, we reported that several crypto exchanges in India have decided to refrain from launching fresh advertisements on print, television and radio.

Financial and legal experts had sounded an alarm over some of the advertisements by crypto companies that are towing a fine line between “puffery” and “misrepresentation”.

In October, the Advertising Standards Council of India chairman Subhash Kamath told us that celebrities must do their due diligence before endorsing cryptocurrency companies as they could be held accountable for misleading claims.

Why is it significant? Indian cryptocurrency exchanges are estimated to have collectively spent more than Rs 50 crore during the recently concluded ICC T20 World Cup, ET reported last month.

Tweet of the day

Paytm founder to start PMS scheme

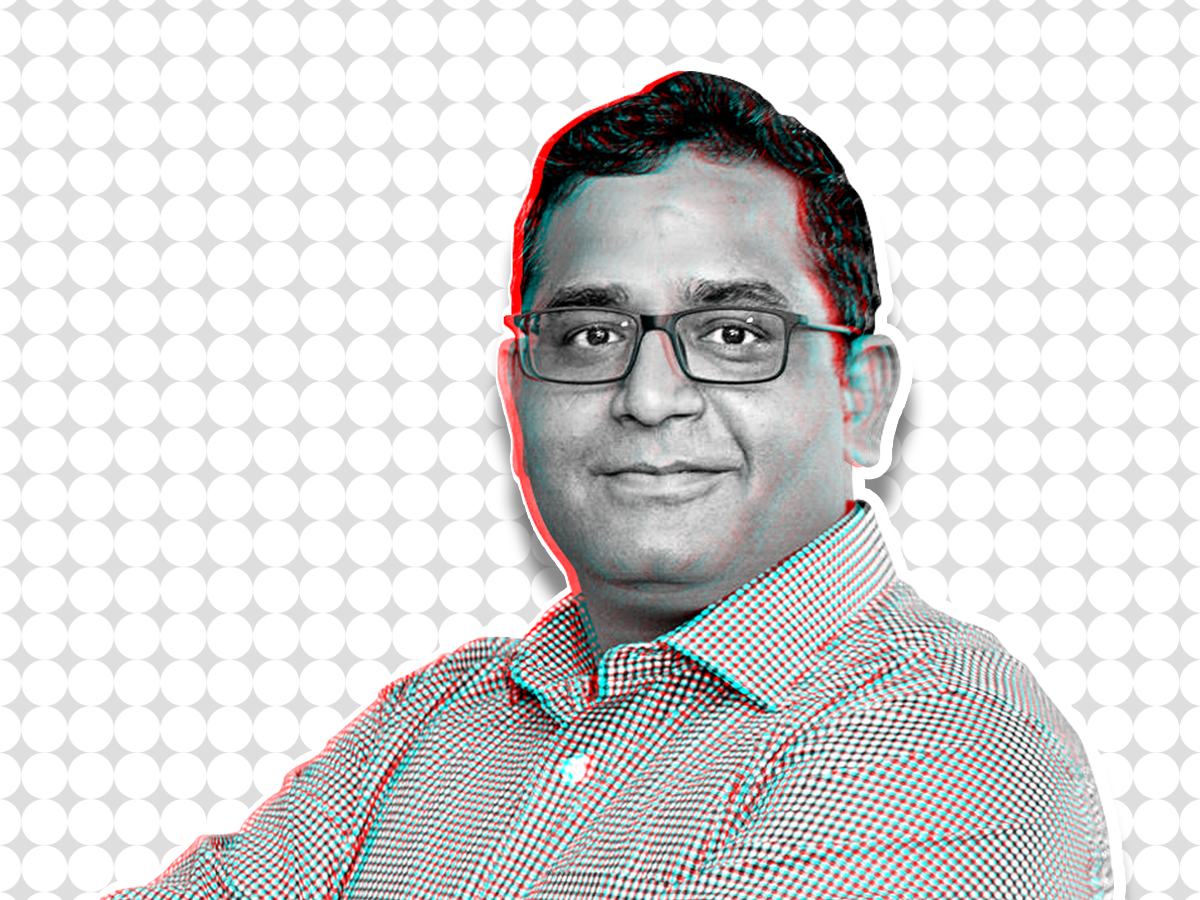

Paytm founder Vijay Shekhar Sharma

Paytm founder Vijay Shekhar Sharma

Paytm founder Vijay Shekar Sharma is starting a Portfolio Management Scheme (PMS) in an alliance with PMS Bazaar, a Mumbai-based startup that would devise investment strategies.

What’s the plan? It will primarily focus on equities, with 95% of the funds invested in large, mid and small cap companies. Besides, gold, exchange traded funds and debt are other asset classes.

Quote: “At Paytm Money, we have leveraged technology to make investing & trading efficient and transparent,” said Varun Sridhar, CEO, Paytm Money. “Extending the same to HNI investors, we have partnered PMS Bazaar to launch PMS Marketplace, offering a one-stop shop.”

Meanwhile, Paytm has received the first buy rating from a brokerage that expects the company to turn profitable by March 2026

Brokerage’s view: Dolat Capital Market Pvt, the third brokerage to initiate coverage on the digital payments giant after Macquarie Capital Securities and JM Financial Institutional Securities Ltd., said its transition to a “manufacturer” of financial services from an agent, cross-selling of services, and strong growth in the number of users will help the company.

Paytm’s “super app” has emerged from a pure “want” category to reach to the “need” status, Dolat analysts, led by Rahul Jain, said.

On the Street: The brokerage has set a target price of Rs 2,500, which is 16% higher than the company’s issue price. Paytm dropped as much as 2.7% to Rs 1,592 on Thursday, the fifth day of declines, after plummeting 37% in the first two sessions of trading. JM Financial has a sell rating on the stock, while Macquarie has rated it as underperform.

By the numbers: In its first earnings report since going public earlier this month, Paytm said expenses rose 37.1% year-on-year to Rs 1,599 crore and consolidated net loss increased to Rs 474 crore from Rs 437 crore a year ago. Revenue from operations surged 63.6% to Rs 1,086 crore for the quarter ended September.

Swiggy to invest $700 million in quick commerce biz

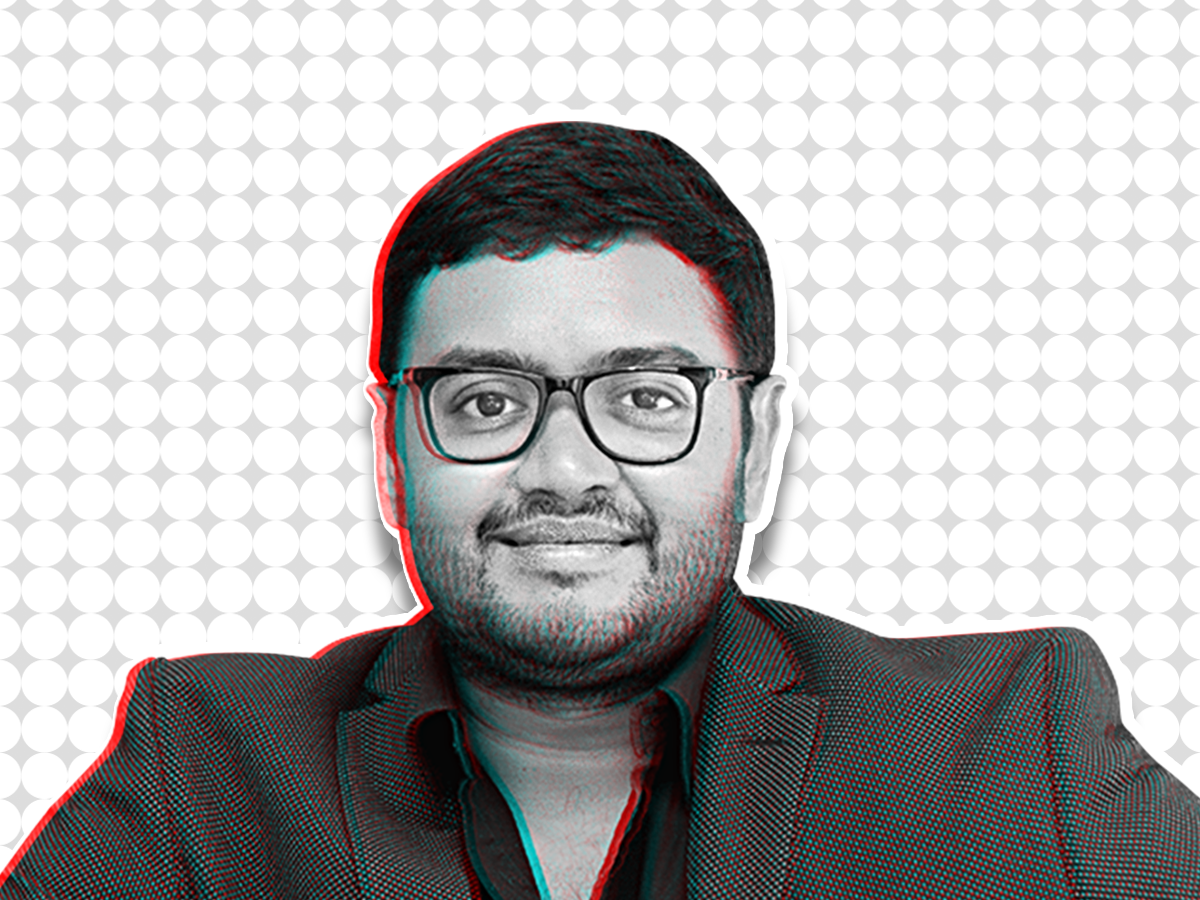

Sriharsha Majety, cofounder and CEO, Swiggy

Sriharsha Majety, cofounder and CEO, Swiggy

Swiggy has earmarked $700 million for its Instamart service, amid heightened investor interest and growing competition in the instant grocery delivery segment, cofounder and chief executive Sriharsha Majety said.

Instamart, launched in August last year as Swiggy’s quick commerce vertical, is set to reach an annualised GMV run rate of $1 billion in the next three quarters, the company said. Gross merchandise value, or GMV, is a key online retailing metric for the total value of merchandise sold through a marketplace.

There is, however, no set time frame for the deployment of the cash as it is an overall commitment to the category, Majety told us.

- “It is not a dated commitment where we are going to deploy this in the next 12 months or 18 months. We think that is the size of ammunition that we need to deploy to be able to do justice to this category,” he said.

Tell me more: Swiggy’s large capital commitment for Instamart comes on the back of the Bengaluru-based company holding talks to close a $600-700 million funding round led by US asset manager Invesco, we reported first on Sept. 28. The fundraising, which is likely to ascribe the firm a valuation of over $10 billion, is part of a re-rating exercise that will double the company’s valuation post rival Zomato’s bumper IPO.

Quote: “It is an exciting category and our commitment to invest is also a function of that. Every time there is a new category that is starting to explode or open up—whether globally or locally— there’s always going to be interest and there will be some funding happening along the way,” Majety said about the flood of investments in the ultra-fast delivery space.

The competition: The delivery platform, which competes with Zomato-backed Grofers, Mumbai-based Zepto and Tata’s BigBasket in the quick commerce category, is clocking more than one million grocery orders per week and runs 150 dark stores across 18 cities. It will add 100 more of these so-called dark stores, over the next few months.

Grofers, which is likely to receive $500 million capital from Zomato, operates a network of 200 dark stores to which it plans to add another 100, the company had announced in a blog post in November. Zepto, a pure-play quick commerce platform that recently raised $60 million, is targeting 100 dark stores by the year-end.

Quick delivery push: Zomato’s move to double down on the fast-growing quick delivery segment comes on the back of rival Swiggy prioritising Instamart.

Food delivery remains the focus: Even as Swiggy pushed ahead aggressively on the grocery delivery front, the company’s food-delivery business hit a $3 billion annualised GMV run rate, a lifetime high for the category, Majety told us. The company’s food delivery volumes have surpassed pre-pandemic level, he said, without getting into the specifics.

Flipkart merges its customer and marketing departments

Walmart owned online retail giant Flipkart is merging its customer and marketing departments with growth and monetisation, all of which will be headed by senior Flipkart executive Prakash Sikaria, according to an internal company email sent by CEO Kalyan Krishnamurthy.

The changes are effective from January 1, 2022, according to the email, reviewed by ET.

Sikaria is also scaling Flipkart’s social commerce business Shopsy which is taking on SoftBank-backed Meesho.

Flipkart launched Shopsy in July and has seen a four times revenue growth during this festive period, compared to non-festive period, the company had said in a statement last week. Flipkart’s travel business Cleartip, which appointed a new CEO in former Myntra executive Ayyappan R, will also report to Sikaria.

Also Read: Flipkart’s Nandita Sinha appointed as new Myntra CEO

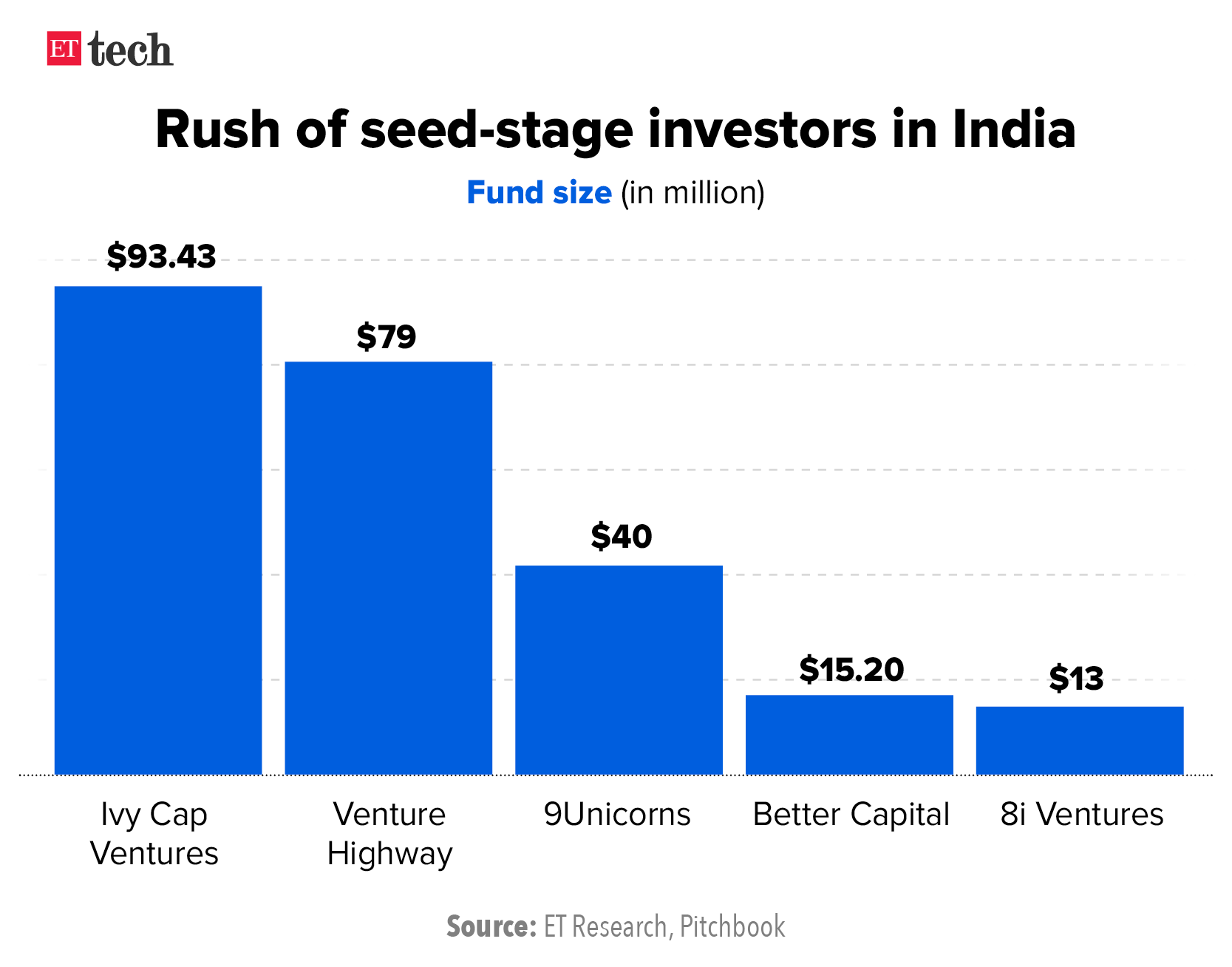

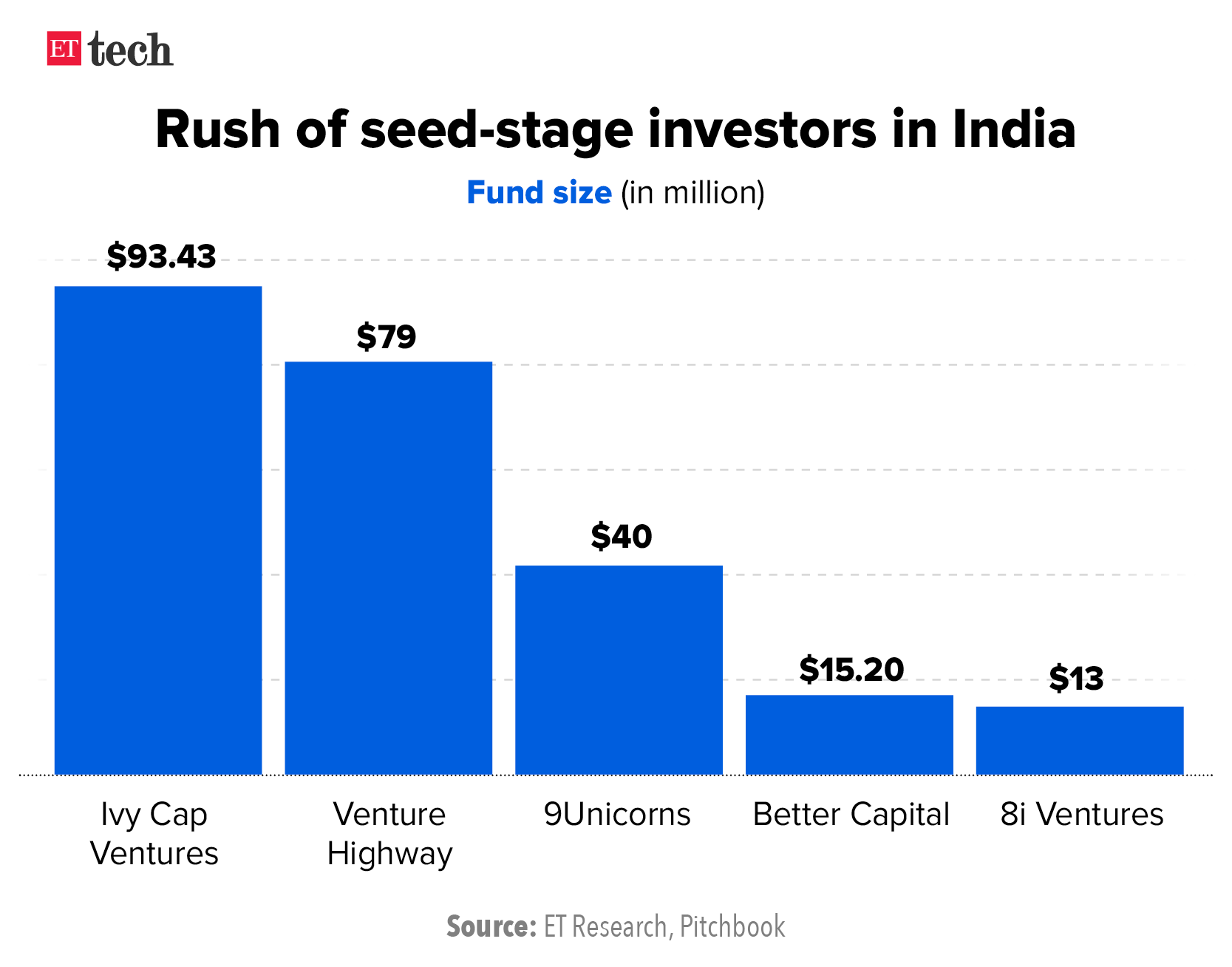

8i Ventures aims to raise larger second fund at $50 million

8i Ventures partners

8i Ventures partners

Mumbai-based 8i Ventures is looking to raise a $50-million Fund-II, almost four times larger than its previous corpus, as the seed-stage investor looks to double down on its investments across commerce and fintech.

Portfolio: Founded in 2019 by entrepreneur and angel investor Vikram Chachra along with Vishwanath V, 8i Ventures has backed seven early-stage startups from its maiden $13-million Fund-I.

The firm’s fintech bets like Slice, a credit-card issuing startup; M2P, a card-issuing platform; and Difenz, a digital risk and fraud management firm, have performed well. In fact, last week, Slice said it had raised $220 million from Tiger Global and Insight Partners, among others, as its valuation topped $1 billion. 8i Ventures first invested in Slice earlier this year, when it was valued at $200 million and is sitting on a 7.4X paper gain clocked in less than six months of its investment.

The firm has also backed consumer brands like Blue Tokai Coffee and Bbetter, an Indian supplements brand.

Quote: “8i’s Fund-I is clocking a multiple of 4.2 times on the capital we have drawn down, and 5.6 times on the investments we have made from the fund, over the last two years…We raised our fund in 2020-21 and expect to return around 25% of the fund assets under management by the end of FY22. We should be able to return the entire fund by FY23,” Chachra told us

Investment trend: Majority of the investments made by the fund is in the range of $1-$1.5 million in the seed stages, as well as through follow-on investments in Series A and B rounds.

With the new fund, the VC expects the cheque sizes to go up to $5 million, depending on the growth stage and maturity of the companies.

Other Top Stories By Our Reporters

Parliamentary panel suggests selectively banning WhatsApp, Facebook: The government should explore selectively blocking Facebook, WhatsApp, and Telegram instead of a blanket shutdown of the internet, a parliamentary panel studying internet bans in India has suggested. The Standing Committee on Communications and IT, headed by senior Congress leader Shashi Tharoor, tabled a report on the Temporary Suspension of Telecom Services (Public Emergency or Public Service) Rules, 2017 on Wednesday.

Freshworks loses $5.45 billion in market cap in one month: Nasdaq-listed Freshworks Inc, which briefly toppled Zendesk Inc in terms of market capitalisation about a month ago, has since slipped by nearly 30%. The poster child of Indian software-as-a-service (SaaS) companies hit an intraday high of $53.35 per share on November 2, valuing it at $13.56 billion, about $1.4 billion more than Zendesk’s $12.1 billion.

Global Picks We Are Reading

- Who is Parag Agrawal, Twitter’s new CEO? (NYT)

- Uber adds ride booking via WhatsApp in India (Bloomberg)

- Donald Trump’s social media venture seeks to raise $1 billion (Reuters)

Paytm founder Vijay Shekhar Sharma

Paytm founder Vijay Shekhar Sharma Sriharsha Majety, cofounder and CEO, Swiggy

Sriharsha Majety, cofounder and CEO, Swiggy

8i Ventures partners

8i Ventures partners