By Bailey Lipschultz

The day-trading

Reddit crowd turned the first quarter of 2021 into one of the wildest periods of stock market mania in modern history. Books — plural — will undoubtedly be dedicated to the topic in years to come.

But after these small-time speculators banded together to drive up dozens of obscure stocks by hundreds or even thousands of percent — and in the process burned a few hedge-fund barons betting on declines — the movement appears to be petering out. An index that tracks 37 of the most popular meme stocks — 37 of the 50 that Robinhood Markets banned clients from trading during the height of the frenzy — is essentially unchanged over the past two months after soaring nearly 150% in January.

Talk to Wall Street veterans and they’ll tell you that this flat-lining is the beginning of what will be an inexorable move downward in these stocks.

It’s not so much about the poor fundamentals of the companies. At least not in the short term. The day-trading zealots have shown a surprising ability to ignore those facts. It’s more that as the pandemic slowly winds down and the economy starts to open up, many of them will leave their homes and start going back into offices and out to restaurants and embarking on trips near and far. And as they do, they may stop obsessing about their Robinhood accounts.

Their collective sway on the meme-stock universe, in other words, will wane.

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.”

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.”

Of course, the Wall Street set has, broadly speaking, misread the Reddit crowd for weeks earlier this quarter, and it’s possible their analysis is wrong again now. Preliminary data, though, suggests they’re right.

Recent reports suggest vaccinated Americans are planning long-awaited vacations with searches for “Google flights” reaching a peak popularity score of 100 this week, according to a Google Trends tracker. The opposite is being seen for terms like “stock trading” and “investing” which have plunged, Google Trends shows.

“The stimulus check impact on retail trading is waning,” said Edward Moya, senior market analyst at Oanda. “Many Americans are looking to go big on attending sporting events, traveling across the country, vacationing, visiting family and friends, and revamping wardrobes before going out to restaurants, pubs and returning to the office.”

Gamestop Juggernaut

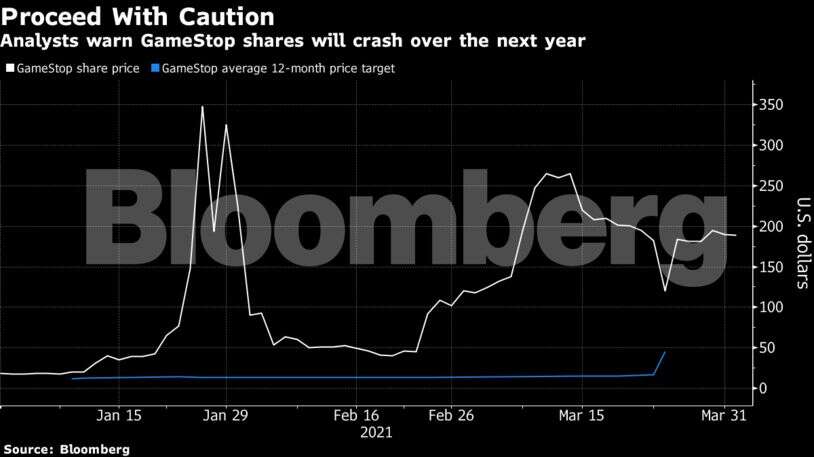

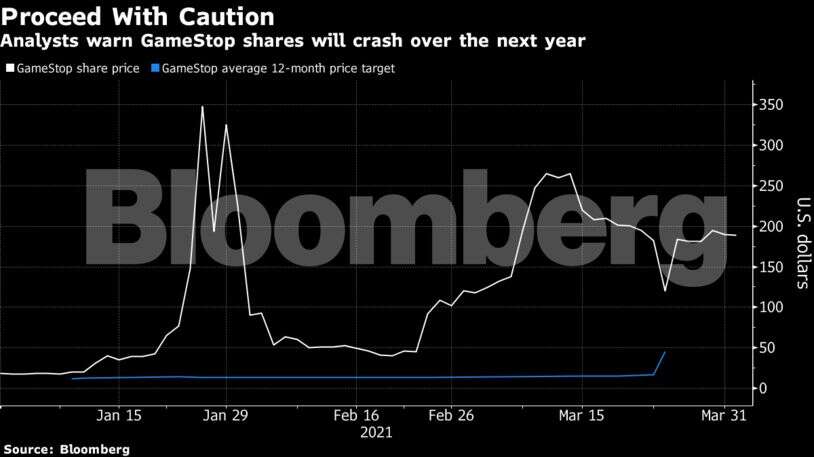

Video-game retailer GameStop Corp. became the poster child for retail traders looking to rage against the hedge fund elite. However, the stock’s 2,460% roller coaster alongside other favorites touted on Reddit’s WallStreetBets thread caused as much pain as it did joy.

The stock’s more than 900% surge this year has drawn a wary eye from the Wall Street analysts that follow it. The average 12-month price target implies the stock will lose more than three-quarters of its value from current levels. Only Jefferies holds a price target near Thursday’s $191.45 close and that call came with the warning that shares are “subject to volatility beyond fundamentals.”

But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen.

But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen.

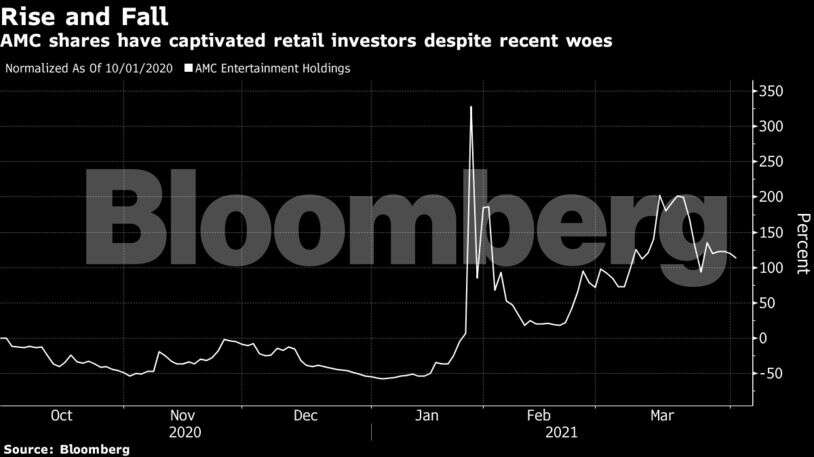

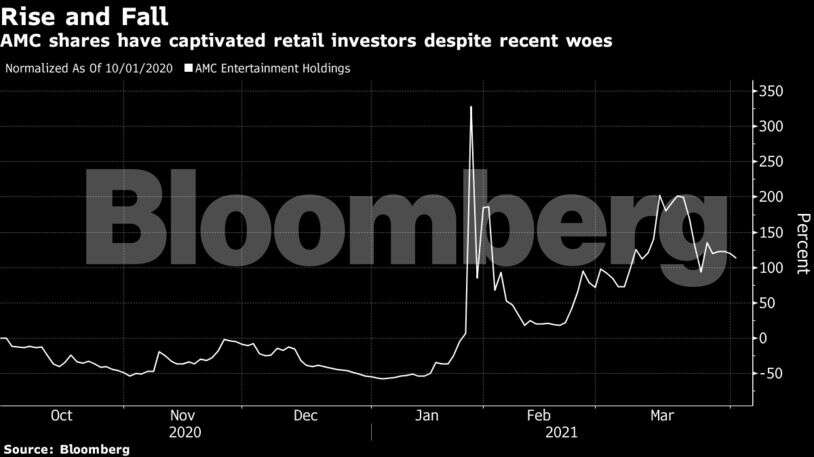

Given AMC Entertainment Holdings Inc.’s position as a movie theater many Americans went to at some point, it’s not a complete surprise as to why Reddit users rushed to the company’s aide. #SaveAMC trended on Twitter and amateur investors appeared more than happy to fight against Wall Street’s skeptics despite most movie theaters being closed due to the ongoing pandemic.

The chain’s latest rally came amid plans to continue reopening cinemas, however, Wall Street is skeptical. None of the nine analysts tracking the company rate it a buy and the average price target implies the stock will lose 63% of its value in the coming year.

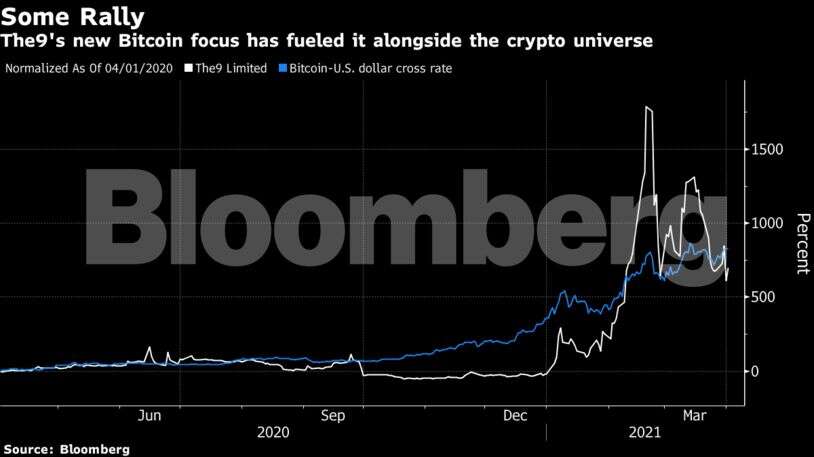

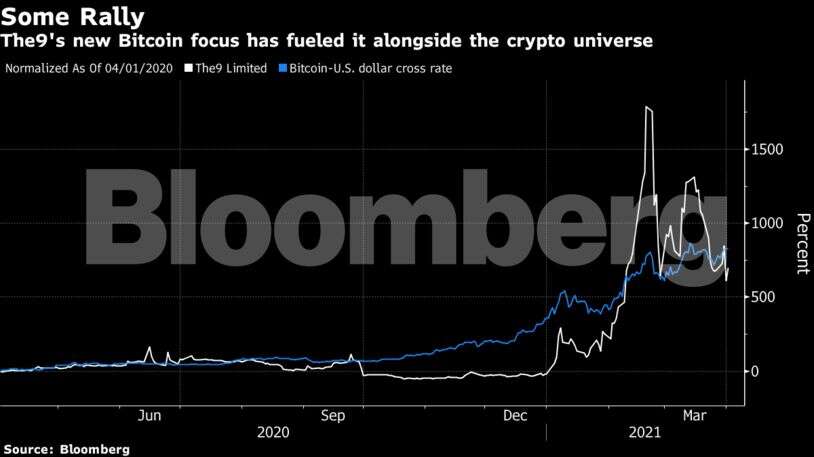

Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.

Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.

The company’s rally has been fueled by recent moves to ride the Bitcoin wave alongside peers like Future FinTech Group Inc. and Ault Global Holdings Inc.

Zomedica Corp., a small-cap animal health company, has become a cult favorite among retail investors chasing stocks with low share prices. The Ann Arbor, Michigan-based company started the year worth less than a quarter, but had soared as high as $2.91.

Trading volume of the company has accelerated this year with an average of 174 million shares changing hands per session, more than four times the average over the course of 2020. A mention from Tiger King’s Carole Baskin helped it go viral in mid-January.

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.”

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.” But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen.

But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen. Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.

Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.