Profit falls 7% YoY to Rs 2,032 crore, BFSI News, ET BFSI

[ad_1]

Read More/Less

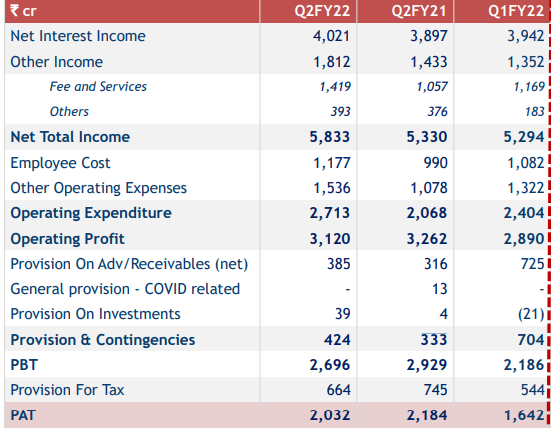

Net interest income (NII) for the bank rose 3 per cent YoY to Rs 4,021 crore from Rs 3,897 crore in the same quarter last year. Net interest margin (NIM) for the quarter came in at 4.45 per cent, the private lender said in a BSE filing.

Gross non-performing assets (GNPA) ratio stood at 3.19 per cent in the September quarter, which was better than 3.56 per cent in the June quarter, but higher than 2.70 per cent (pro-forma) in the year-ago quarter.

Provisions and contingencies for the quarter fell sequentially to Rs 424 crore from Rs 704 crore in the preceding quarter but was higher than Rs 333 crore in the year-ago quarter.

The bank said total provisions, including specific, standard, COVID-19 related ones, stood at Rs 7,637 crore, nearly 100 per cent of gross NPAs. It included Rs 1,279 crore in Covid-19 provisions, which were not utilised during the first half of the financial year.

Provision coverage ratio stood at 67 per cent as on September 30, the bank said in an exchange filing.

Current account deposits grew 32 per cent to Rs 53,280 crore in the September 2021 quarter from Rs 40,454 crore in the year-ago quarter. Savings deposits grew 13 per cent to Rs 1,23,479 crore from Rs 1,08,990 crore YoY.

In accordance with the resolution framework for Covid-19 related stress of individuals and small businesses, announced by RBI, the bank implemented a total restructuring of Rs 495 crore (0.21 per cent of Advances) as at September 30.

Similarly, the bank implemented total MSMEs restructuring of Rs 767 crore (0.33 per cent of advances) as at September 30, the bank said.

[ad_2]