GN Bajpai-led panel wants IBBI to set up dashboard for insolvency data, BFSI News, ET BFSI

[ad_1]

Read More/Less

Former Sebi chairman G N Bajpai-led working group has suggested designing a national dashboard for insolvency data, saying ”reliable real-time data” is essential to assess the performance of the insolvency process under the IBC.

The panel also said the IBBI has made commendable efforts in publishing quarterly data on the insolvency resolution process in detail. The data published by the Insolvency and Bankruptcy Board of India (IBBI), a key institution in implementing the Code, include those on insolvency filings, recovery amount and duration of the insolvency process across corporate debtors for all creditors. In its report, the group said that cross-validation of data sourced from multiple data banks is a challenge in making credible assessments.

The Insolvency and Bankruptcy Code (IBC), which provides for a time-bound and market-linked resolution of stressed assets, has been in force for more than five years now.

The objectives

The six-member group said in a report that resolution of the distressed asset remains the first objective of the Insolvency and Bankruptcy Code (IBC), followed by promotion of entrepreneurship, availability of credit and balancing the interests of stakeholders. “This order of objectives is sacrosanct,”

it said.

The working group on tracking outcomes under the Code has suggested a framework based on ‘Effectiveness, Efficiency and Efficacy’ with respect to Corporate Insolvency Resolution Process (CIRP).

Another suggestion is for the IBBI to look at including quantitative data on cost indicators such as court/bankruptcy authority fees, resolution professional’s fees and asset storage and preservation costs in its quarterly updates.

The report noted that data on time, cost and recovery rates will allow a reliable evaluation of the insolvency process with respect to parameters of effectiveness and efficiency.

The indicators

Further, the report said it was important to track the performance of related economic indicators to assess the performance of the insolvency process for other objectives such as ‘promoting entrepreneurship’ or ‘enhancing credit availability.

Such an assessment would measure the performance of the system with respect to the ‘efficacy’ parameter.

”The WG (Working Group) recommends a range of indicators such as the number of new companies registered, credit supply to stressed sectors like real estate, construction, metals etc, change in the cost of capital (particularly for stressed sectors), the status of non-performing loans, employment trends, size of the corporate bond market and investment ratio for the related sectors,” it added.

This is the second report in recent months after a parliamentary standing committee had suggested changes to the code in August.

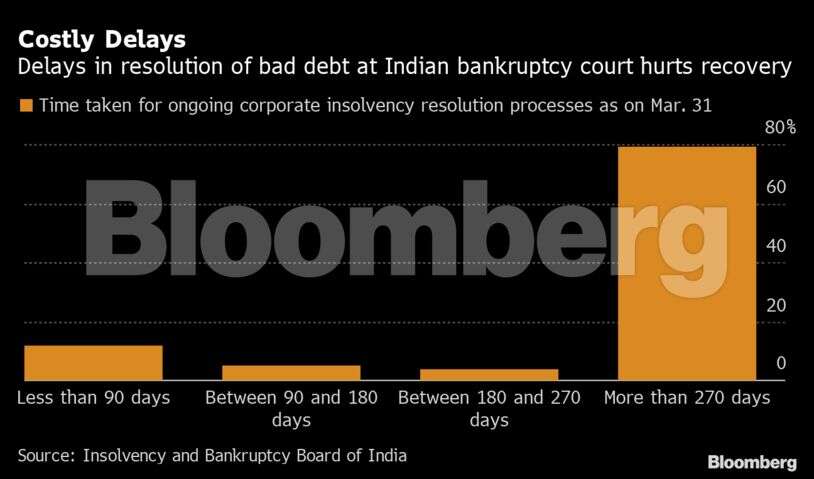

In August, a 29-member standing committee headed by former minister of state for finance Jayant Sinha, and including former prime minister Manmohan Singh, said that low recovery rates with haircuts as much as 95% and 71% of the cases pending beyond the 180-day time frame envisaged by the law pointed towards a deviation from the original objective of the code.

The key recommendations of the committee include setting up specialised National Company Law Tribunal benches to hear only IBC matters, establishing professional code of conduct for committee of creditors, strengthening the role of resolution professionals and digitalising IBC.

[ad_2]