Barclays’ Bajoria says a lot of inflation risks priced in now, BFSI News, ET BFSI

[ad_1]

Read More/Less

In the backdrop of the RBI’s recent reiteration of policy support for economic growth and signs of improvement in high frequency indicators, what is your outlook on the growth-inflation mix?

The August policy meeting was in a way a mirror reflection of what happened in April, except that the growth and inflation risks were sort of interchanged.

In this particular meeting, it was evident that you are going to have lesser risks to your growth outlook because the economy was opening up.

Inflation out-turns have been greater than what the Reserve Bank of India (RBI) had been forecasting. so the natural bias was to say that inflation risks are tilted to the upside.

In terms of the broad policy stance, there is uncertainty going forward about whether we will have a third wave, and what kind of impact a possible third wave can have on our growth momentum. There are many questions – what does that mean for inflation, for supply dynamics, potential return of supply shocks to the inflation trajectory?

The fact that there is some improvement in the macro data has been well acknowledged by the RBI, I think the bias was clearly towards that.

But they are still grappling with the lingering uncertainty and that’s why it is very difficult for the RBI to really commit itself in the direction of normalisation.

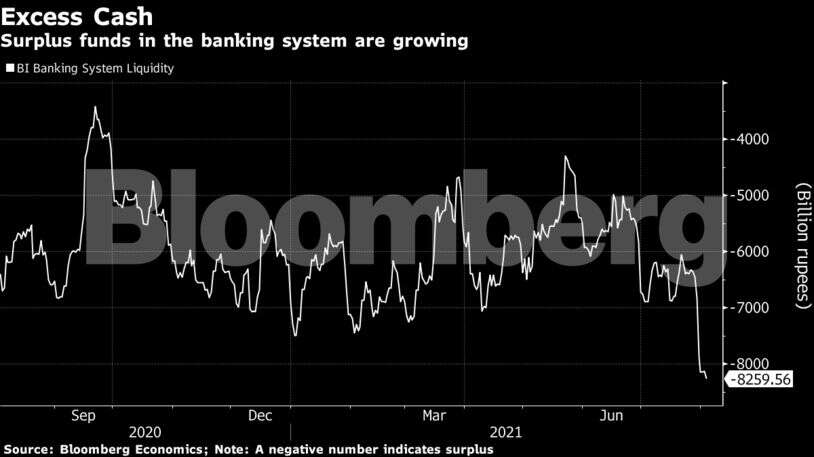

We look at the new variable reverse repo rate (VRRR) as a step towards probably more balanced liquidity. It is not a new instrument. We have had VRRR in the system since January this year and there has not really been any commensurate material tightening of liquidity.

There have been periods when liquidity has shrunk, excess liquidity has come down but it is not really necessarily a step towards normalising. You could say it is a step, but it is a very gradual step. Our sense is that by the time we reach the October policy meeting, a lot of these variables will probably clear up and we will have a better sense of the direction.

But the broad message we took away from this meeting was that unless and until there is absolute clarity on the growth outlook, it is difficult to see how RBI will move towards a confident approach to normalising monetary conditions.

The preference for supporting growth over managing inflation is very clear and that comes across both in terms of the guidance from the MPC and from the RBI governor himself.

There has been much talk of the extent to which the liquidity surplus in the banking system has expanded over the last couple of months. It is true that the traditional channel of strong demand for credit is not really functioning at the present juncture. Are there any risks of overheating which are emanating from liquidity?

Not really. I would say the general sense of overheating is not there. I could possibly talk about the equity valuations and the governor has spoken on this issue but equity valuations are a function of flows and the flow dynamic in India has remained pretty strong.

Obviously there has been some excitement around the IPO cycle but that comes and goes. It is more of a seasonal thing. But when you look at say credit growth, you look at credit demand in the system, you look at capacity utilisation, a lot of these numbers are looking tepid and that is one of the reasons why I think the RBI may take some comfort in the fact that there are no real incipient signs of demand side pressures in the system.

Maybe they will emerge in six months as the economy normalises further but then there is no reason for the RBI to be really worried about major trouble spots being formed right away.

With the exception of equities, there is no other asset market in India which is doing outstandingly well, whether you look at the property sector, you look at say demand for gold, etc, that is not really showing any signs of major shift away from financial assets into fiscal assets and that I think will be taken as a sign as well by the RBI that maybe this excess liquidity in the system is not really causing dislocations that cannot be managed in the future through policy actions whether it is through rates or through macro prudential steps.

What, in your view, are the factors contributing to inflation expectations in India?

I would say that quite a few of the indicators which would typically drive inflation expectations in India — food prices, milk prices, vegetable prices, fuel prices, school fees — typically tend to increase at this time.

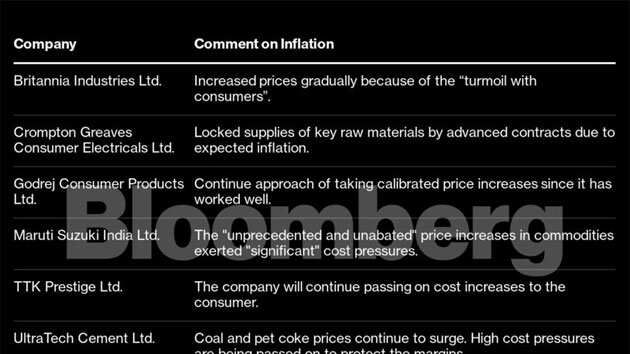

But, the sustainability of elevated inflation expectation has to be driven by some sustained improvement in demand because the flip side of this issue of inflation expectation is that when we look at the producer prices and what is happening with retail inflation, especially when we look at the PMI data — these input prices have been elevated for a long time as commodity prices globally have been rising.

We have seen input cost increase but output prices actually have remained very tepid.

There is a big gap between the imported price pressures and what the domestic price pressure story is telling.

This can be interpreted in two ways. One is that these increases in input costs are not going to materialise into higher output prices because pricing power is weak and demand is weak. If you do have a big demand revival, three-six months down the line, these price pressures can be translated into output prices.

Given the spirit of the K-shaped recovery, it will be very difficult to say that these are generalised price pressures. There will be a combination of some sectors seeing higher prices but certain sectors might not really see any major spillovers coming through. It will be difficult to navigate that kind of an environment which makes forecasting inflation a tad more difficult than what you would think of in a normal cycle.

The recent inflation print was less than 6%. Could this trend persist with more and more supply constraints loosening?

I think so. A lot of inflation risks are now already priced in, so basically it is within the forecast that the RBI has. What is very interesting is that we have always maintained that the current bout of inflation has been imported in nature. It is because of higher commodity prices whether food or whether it is fuel prices and a lot of imported food commodities.

Cooking oil is a primary example; meat prices have been elevated. We have to think of it from the perspective of levels versus rate of inflation and what we are seeing is that sequentially quite a few of these pressure points particularly are starting to dissipate. They are not falling aggressively month on month, but they are also no longer increasing 3-4%. There will be some level of comfort being derived from that front.

We think we are likely to see an undershooting of the inflation forecast. In our tracker we had come out with a number of 5.5% for the month of August, obviously it is still a bit early but price trends are indicating that it is not going to be closer to 6%.

Taking this forward, do you have any sort of internal estimate as to by when the RBI would start normalising policy?

We have been saying very consistently that the RBI will not have any kind of a front loaded normalisation cycle.

There is no real room for pre-emptive behaviour on their part because the growth picture does not clear up until very late in the fiscal year. We think that once the RBI has clarity on growth and that could mean they are looking at certain level of vaccinations, the global growth picture and signs of investment revival, or it could be a combination of these data points. The earliest we think the RBI could start hiking the reverse repo is in December.

It could be as early as December but in all likelihood, we do not think repo rate hikes will come into the picture anytime before the first quarter of the next fiscal year. It could either be the April or the June meeting depending on what the growth assessment is but it is not going to be a frontloaded action. Our sense is that the market also may be overpricing the extent of normalisation because unlike previous instances, we do not think the RBI is going to undertake a big normalisation.

We think that 2022 is probably the year when more signs of organic growth might start to return in the system and it will probably make the RBI a little bit more confident when they think about the normalisation cycle.Rahul Bajoria

RBI will probably have two repo rate hikes in 2022 and that is it! We are not going to see any further hikes from them because by that time the rate of inflation should also be slowing down and so the gap between the nominal policy rates and inflation is going to close as well. It is not like they are going to be aggressively hiking once they start normalising.

How will the next few months play out for the sovereign bond market? The RBI has permitted some degree of a rise in yields. What is your takeaway?

I think so in the sense that obviously there are two parts of the liquidity management strategy which is directly in control of the RBI; it involves domestic balance sheet growth, which is them buying bonds or calibrating currency in circulation requirements in the system.

The second is the FX reserves story which is not completely in control of the RBI but they tend to have some say in the way flows are being sterilised and whether we have sterilised or unsterilised FX intervention or the RBI can choose the level and the quantity of dollars they buy.

Here the general bias of RBI has been to go for growth and liquidity at a reasonably robust pace. Maybe at a later stage, that preference starts to tweak. But I do not think we are looking at any major inorganic steps on their part to draw down the liquidity.

Ideally what you want to see is that growth picks up, demand for currency, demand for credit picks up in the system and there is a bit of a runway for RBI to start normalising its liquidity in the system. We do not really see them aggressively stepping into take out liquidity right because that in itself could be in a 65 bps rate hike.

I would say the operating rate goes from the reverse repo to the repo and if they do that, it means that they are very confident about the growth outlook.

What do you think is going to be the general trend for the rupee this financial year?

Broadly speaking, the current account has seen the big delta swing between 2019 and 2020 and now in 2021 relative to 2020. The current account has gone from small deficit to a small surplus to a small deficit and this obviously has some implications for our reserve accretion strategy but what is reasonably evident is that our balance of payments is going to remain in a pretty decent size surplus right.

The size of monthly surpluses are coming down without doubt, but it is still going to be in a surplus and over the next six to 12 months, the flows are probably going to be a lot more evenly matched then what they were say in the last 12 months. From that perspective, it could mean that RBI’s reserve accretion strategy is going to carry on.

We also think the central bank has clearly been running down its forward book in order to build more reserves. So, there has been this trade off between forward reserves being traded off for current spot reserves and there is quite a bit of signalling effect from when we think about the global monetary policy cycle.

RBI clearly is going to lag any normalisation that is already underway. Within the emerging market, central banks of countries like Brazil has been hiking rates; Mexico has hiked rates, South Africa is talking about hiking rates. India is not doing that.

We will do that next year but we are not going to do that now but then the external pressure points are very limited for us because there is no imminent risk of large scale depreciation happening in the rupee because we are not keeping pace with the real rates kind of a framework.

Now within the domestic policy, both in the context of say the Aatmanirbhar Bharat programme and the PLI scheme, general interventionary trends that we have seen shows a bias for a stable to a slightly weaker rupee.

India’s fuel prices are not high only because of weaker currency or higher commodity prices. There is a taxation component to it which shows that there is a preference not to use the FX in order to lean into the inflation pressures. Our sense is that the rupee should generally find conditions to be stable with such a backdrop.

What are your estimates for GDP growth? When can we see a sustainable recovery?

We are sitting at about 9.2% for the current fiscal year and at the moment, we are picking up two clear messages from the data. First of all, the extent of growth loss or activity loss that was being estimated by us and generally by the markets as well appears to be much less. I do not think we really are in a position to predict whether a third wave happens or not.

We are not building any major impact of the third wave beyond the usual cyclical weaknesses. That sort of evens out the realised better activity levels with future risks of some loss coming. If we do not have the third wave, I would think there are very clear upside biases to our growth and we could even be again looking at maybe double digit GDP growth numbers in the current fiscal and it will be one recovery which is pretty much driven by the base effect and you are seeing normalisation of activity.

What would be very interesting to see is what happens with the 2022 growth story because right at the beginning of this year, a lot of analysts and a lot of people on the policy making side as well were getting pretty excited about maybe a new capex cycle emerging. Demand conditions were looking quite good and obviously the Budget added to that positivity. That optimism may start to have some effect on the 2020 story.

I would not say we are very bullish but we certainly think that India’s growth momentum can sustain into 2022 which will have a one leg of support coming from the investment cycle as well.

We think that 2022 is probably the year when more signs of organic growth might start to return in the system and it will probably make the RBI a little bit more confident when they think about the normalisation cycle. But then given that there are several risk factors around it, we are not exactly thumping the table but can see that happening as a pretty realistic likelihood. The probability of that turning out to be true appears reasonably high to us.

[ad_2]