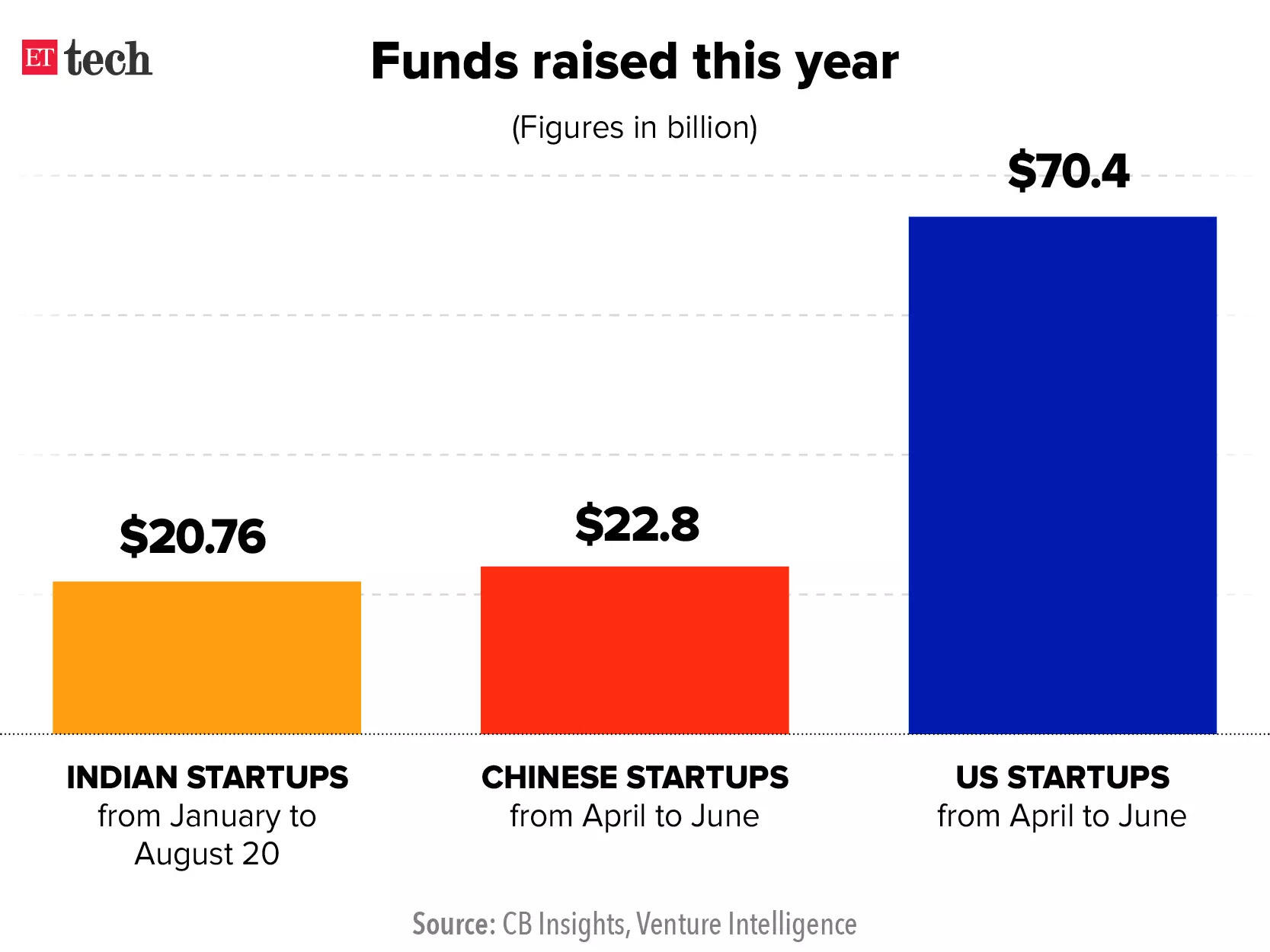

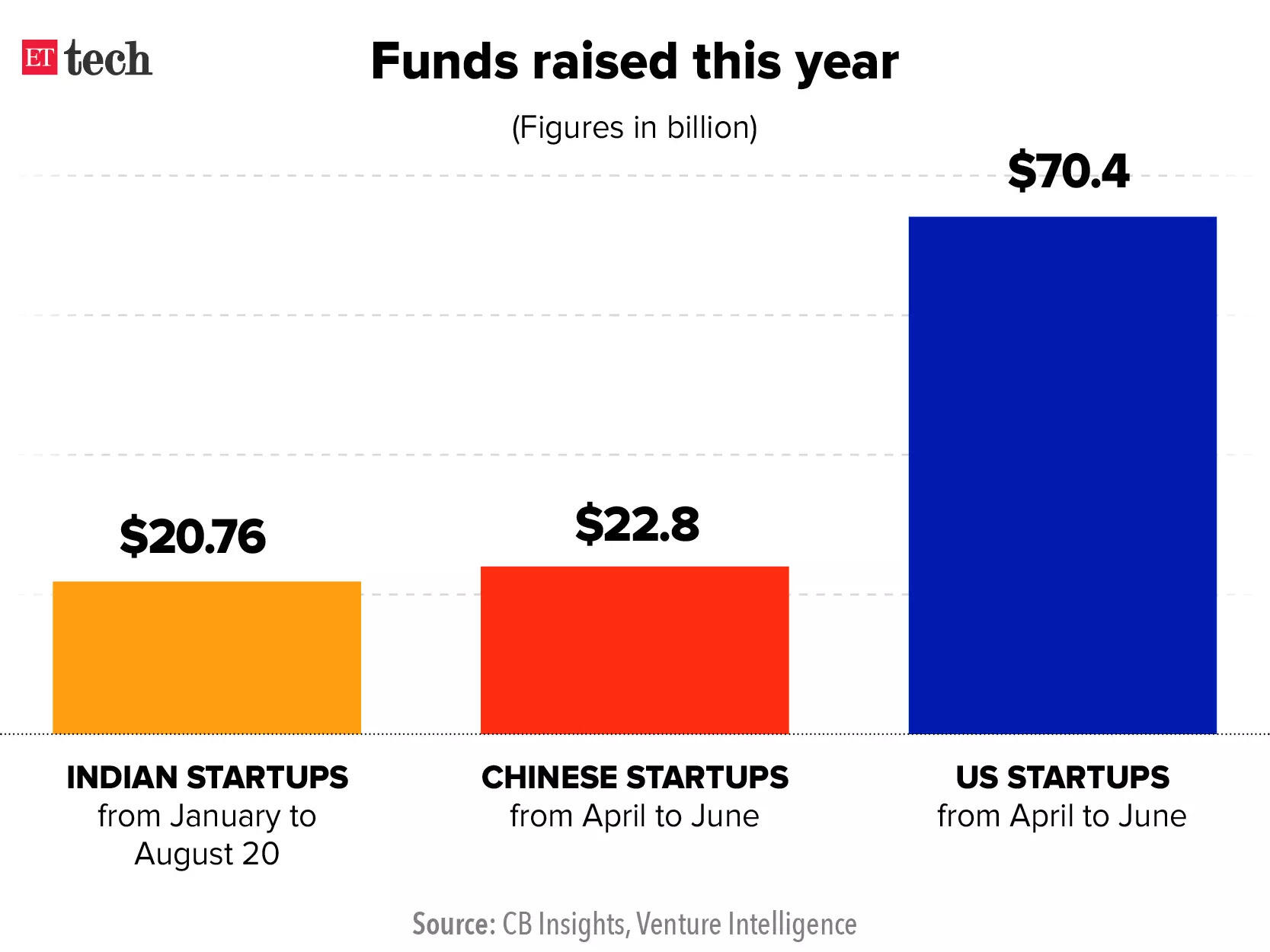

It’s been a landmark year for Indian tech startups, which have already raised a record $20.76 billion from investors since January. Now, with China’s crackdown on its technology sector forcing risk investors to look elsewhere, it seems the funding tap isn’t going to run dry anytime soon.

Also in this letter:

- Milkbasket cofounder resigns, RIL execs join board

- Infosys fixes I-T portal after CEO is summoned

- Cognizant Technology faces US visa trial

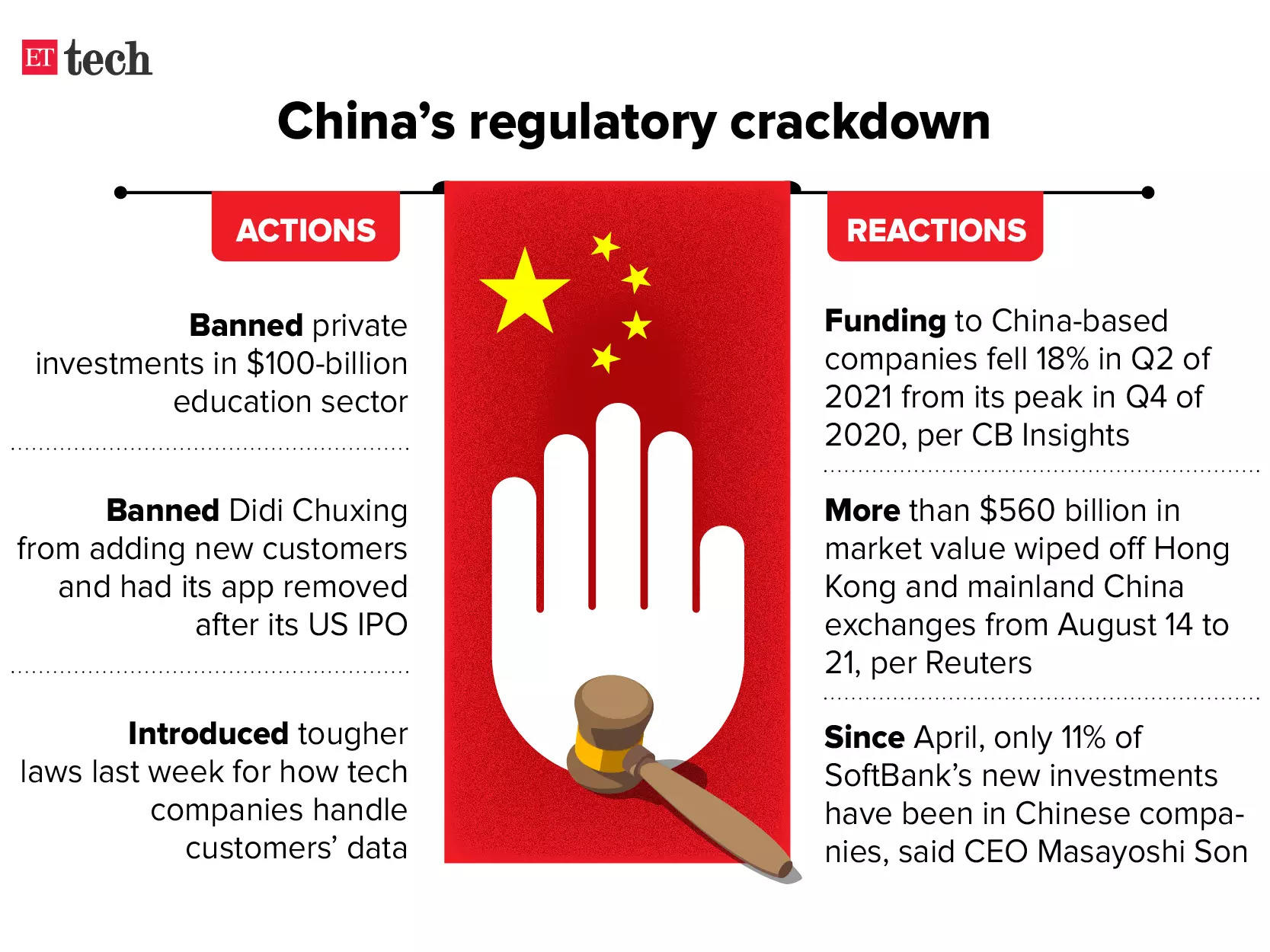

Indian startups will benefit from China’s tech crackdown

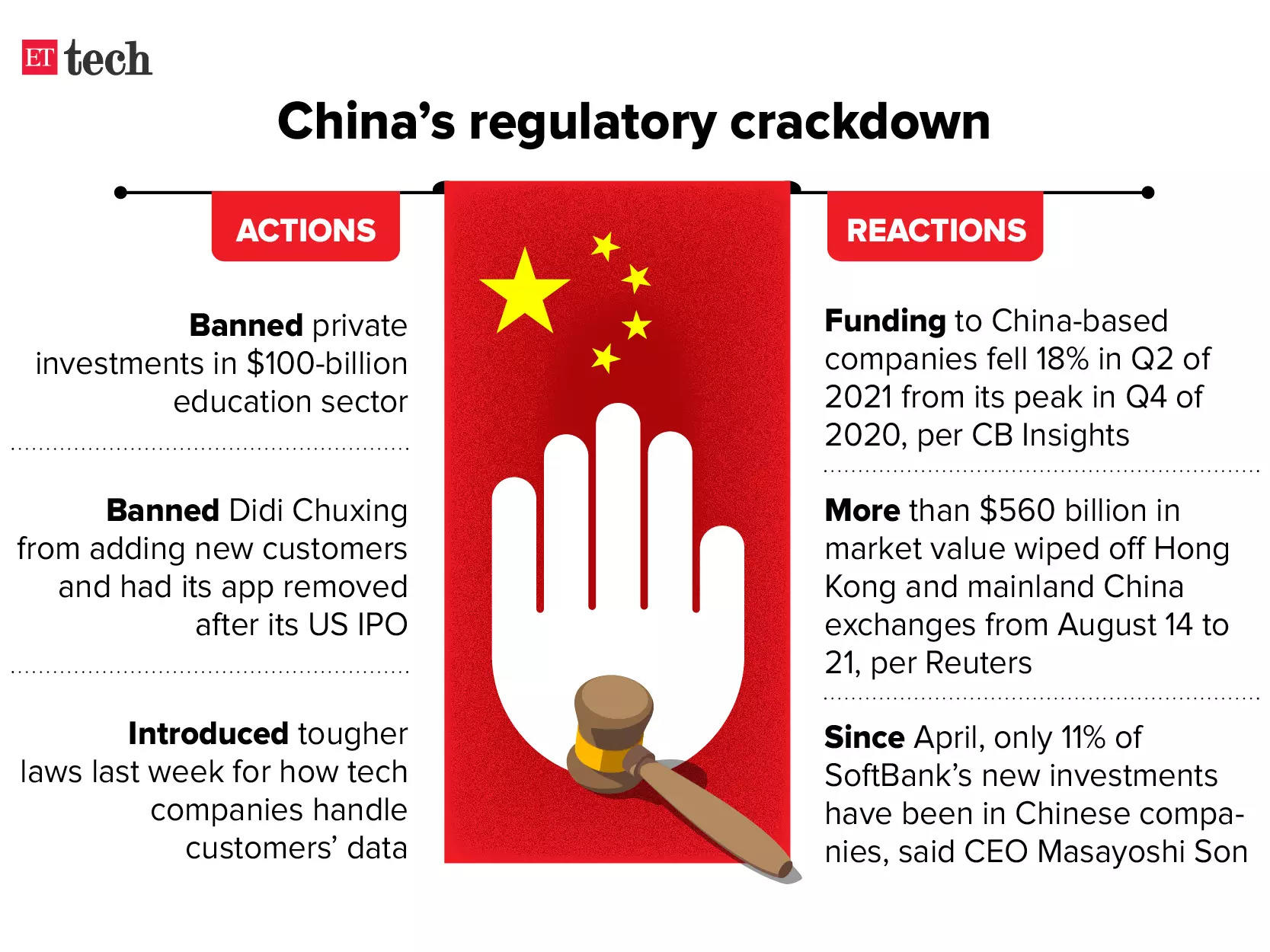

China’s crackdown on its tech sector is expected to further boost investments in India’s tech startups, which have already been raking in record sums from private equity and venture capital firms this year. That’s according to several founders and investors we spoke with.They also said China’s continued crackdown on Big Tech firms could also trigger long-term changes in the way large internet companies are regulated globally.

Case in point: Earlier this month, education platform Eruditus saw its valuation jump 4x to $3.2 billion after it raised $650 million from SoftBank, Accel US and others.

Ashwin Damera, its cofounder and CEO, said, “China gets more venture capital than India. Now, if the Chinese funnel is getting choked, it will [have to] go somewhere. Emerging markets such as India will get that allocation.”

SoftBank leads the way: Chinese startups account for 23% of SoftBank’s portfolios in terms of fair value. But CEO Masayoshi Son said that since April, only 11% of new investments have been in Chinese companies.

Earlier this month, Son said he was being ‘cautious’ on China investments and that it may take up to two years for the situation there to stabilise.

SoftBank has a sizable India portfolio and has invested large sums in Meesho, Swiggy, Mindtickle, OfBusiness and others this year.

Third-largest market: India is the third-largest startup market for investors. So far this year, 25 new unicorns—startups valued over $ 1 billion—have been minted here.

India’s startups have raised $20.76 billion in 583 deals this year (as of August 20), according to data from Venture Intelligence. In comparison, they raised $11.1 billion in all of 2020, with 12 turning unicorns.

Fallout goes beyond money: China’s crackdown on its tech sector wiped more than half a trillion dollars off Chinese tech stocks in a week, including those of Alibaba Group, Kuaishou Technology and Tencent Holdings.

But the impact of the country’s new rules will be felt in other ways, too.

Varun Dua, founder of Acko, an insurance tech startup, said China’s clampdown may have long-term, global impact, “especially on labour rules for gig workers, data privacy and usage, corporate structures, and more regulations for fintech”.

India and other countries may adopt portions or versions of these rules as internet companies become larger and more powerful, he added. “While the underlying reasons [for framing rules] might be different, it’s a sign of things to come across the globe. These changes could take businesses years to adjust to,” he said.

RIL execs join Milkbasket board, cofounder resigns

Milkbasket cofounder Anant Goel

Milkbasket cofounder Anant Goel

Milkbasket cofounder Anant Goel resigned as of July 19, and two senior Reliance Industries executives—Nikhil K Chakrapani and Rajendra Kamath—joined the startup’s board the same day, according to the latest regulatory filings.

We had reported in May that RIL was in the final stages of acquiring Milkbasket, which offers subscription-based grocery deliveries, to bolster its ecommerce play.

The development is an indication that RIL now controls the firm, though neither company has made an official announcement.

- “The deal was done in May itself. The recent filings reflect that. All investors have exited and Goel is out too,” a source said.

RIL’s JioMart has been testing subscription-based deliveries of essentials in select markets such as Chennai and Bengaluru.

New faces: Kamath is chief financial officer (CFO) of Reliance Retail Value and has been associated with Reliance for the past 29 years.

Chakrapani is CFO of Reliance Content Management and also director at Jio Infrastructure Management. Sources said he is also part of the mergers and acquisitions team at RIL.

Other exits: Besides Goel, Vani Kola, managing partner of Kalaari Capital, has also quit the board, as have Nikhil Khattau Nirvan, managing director of Mayfield Ventures, and Pawan Chaturvedi, partner at Unilever Ventures.

Also Read: How Kalaari’s exit led to the fall of Milkbasket

Both Mayfield and Unilever Ventures were among Milkbasket’s main investors, while Kalaari sold its stake in Milkbasket to MN Televentures in July-August last year.

Related Coverage:

Tweet of the day

Infosys fixes I-T portal after CEO is summoned

Infosys CEO Salil Parekh

Infosys CEO Salil Parekh

Infosys CEO Salil Parekh will meet Finance Minister Nirmala Sitharaman today to explain why glitches in the tax filing website built by the company persist. The snags haven’t been resolved, two-and-a-half-months since its launch, and it hasn’t been available at all since Saturday, the Income Tax department said in a Twitter post on Sunday afternoon.

Quick fix: Late on Sunday night, Infosys tweeted that emergency maintenance on the website had concluded and it was now live.

Background: The union cabinet approved a new income tax e-filing portal at a cost of Rs 4,242 crore in 2019, and the government has paid Infosys Rs 165 crore through June this year, minister of state for finance Pankaj Chaudhary told Parliament last month. Taxpayers and professionals have reported defects in the portal and Infosys has acknowledged technical issues, Chaudhary said.

Infosys had in June said that it would resolve all issues in a few weeks, and again reiterated its commitment to fixing issues in a timely manner during its 40th annual general meeting on June 19.

But on Saturday, Infosys tweeted that the income tax website was inaccessible due to “planned maintenance”. The following day, the company again tweeted that the portal continues to be under “emergency maintenance” and it would post an update when the portal would be available for use again.

Cognizant faces US visa trial as court refuses to dismiss case

A US court has refused to dismiss a lawsuit against Cognizant Technology Solutions Corp. for allegedly sending workers to the country using business or intra-company visas, instead of the more expensive H-1B work permits.

What’s the matter? The lawsuit, filed by the Teaneck, New Jersey-based company’s former assistant vice president Jean-Claude Franchitti under the False Claims Act (FCA), alleges that Cognizant may have underpaid for visa costs for its foreign employees.

- A US judge said that Cognizant had an obligation to pay an appropriate fee for the privileges associated with the desired visa.

- The company had argued that the FCA does not apply to records and statements made under the US Internal Revenue Code.

Quote: “By paying for L-1 and B-1 visas but directing its staff to perform work that required a more expensive H-1B visa, Cognizant decreased its obligation to pay money to the United States government.” — Peter G. Sheridan, United States District Judge for the District of New Jersey.

Where India stands on the global AI landscape

Artificial Intelligence, or AI, holds great potential as a key driving force for the next phase of economic growth led by technological innovation, and no nation wants to be left behind.

More than 50 countries have announced national strategies on AI and many others are rushing to do so. Which are the countries that are early movers in the global AI sweepstakes and where does India stand in the race for global AI leadership? (read more)

Also Read: Conversational AI is set to become ubiquitous

Femtech startups want to change women’s healthcare in India

It took Dhivya Arumugam about 15 years to find her people. For the former software engineer, who had grappled with irregular periods since puberty and was taunted about her weight, it had been a long and lonely battle with polycystic ovarian syndrome (PCOS), a chronic condition involving hormones.

It was about a year ago that she came across an online platform called My Ava, focusing on PCOS, which had a community section.

- “It was the first time in my life that I was seeing women talking openly about it. I had never got that kind of affirmation before,” says the 31-year-old, who now runs a homestay in Manali. In February, helped by a 21-day free trial of My Ava’s PCOS programme, she got her period after a 28-day cycle for the first time in her life. “I couldn’t believe it.”

That Arumugam had to struggle for years with a medical condition that is hardly rare is emblematic of the silence, stigma and lack of resources that have historically plagued much of women’s health, unless it is concerned with maternity or infertility. A clutch of women-led startups now wants to change that. (read more)

Other Top Stories We Are Covering

Volunteers needed: The people behind www.covid19india.org are hopeful others will take over the task of updating the website once they stop doing so at the end of October.

Sustained momentum: Indian IT services providers are expected to perform well going forward, despite challenges in sourcing talent, a new report by HDFC Securities showed.

The rise of greentech: The technology from Sentient Labs uses microbes to break down paddy and wheat straw to produce pure hydrogen, and methane, which can be further processed to produce hydrogen.

Global Picks We Are Reading

- How Amazon won shopping (NYT)

- One man’s quest to get an AI machine gathers momentum (Bloomberg)

- The biggest gift of remote work is not commuting (Axios)

Today’s ETtech Morning Dispatch was curated by Tushar Deep Singh and edited by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Milkbasket cofounder Anant Goel

Milkbasket cofounder Anant Goel Infosys CEO

Infosys CEO