HDFC Capital and global alternative investment major

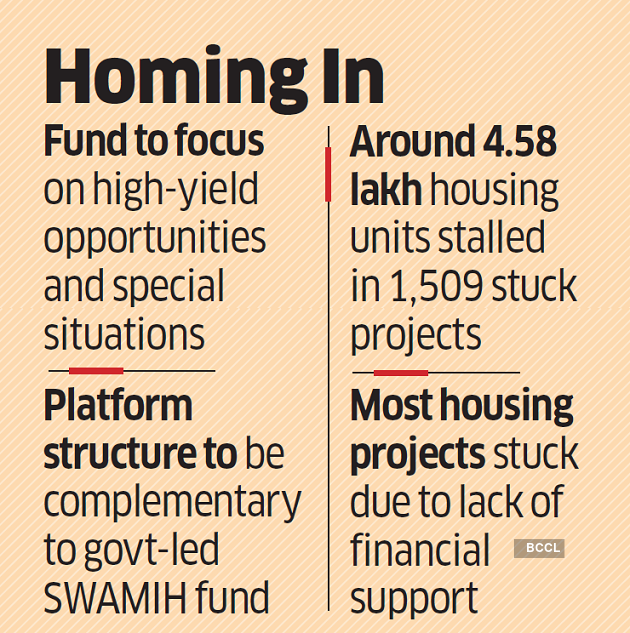

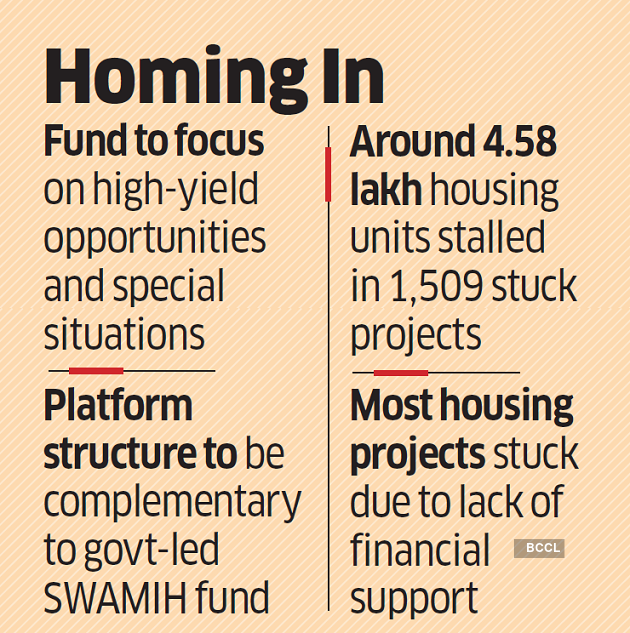

Cerberus Capital Management LP have formed a partnership to create a fund that will focus on high-yield opportunities in Indian residential real estate. The size of the proposed fund will be upwards of $1 billion, said people familiar with the development.

The fund, to be set up through an affiliate of New York-headquartered Cerberus Capital, will target stressed projects, purchase inventory and provide last-mile funding for under-construction residential projects.

“Housing is an integral part of our economy and because of its linkages to other industries and to the labour market, it is a critical sector for ensuring economic growth,” Deepak Parekh, chairman of Housing Development Finance Corporation (HDFC), of which HDFC Capital is a subsidiary, told ET.

The deal is another sign of foreign investment firms’ growing interest in India. “Despite the massive need for housing in the country, a large number of launched projects are in distress, leading to a complete standstill in execution,” said Parekh. “This platform will provide much-needed financing for housing projects and help in delivery of finished units to home buyers.” HDFC and Cerberus declined to comment on the size of the proposed fund.

Currently, the government-backed Special Window for Completion of Construction of Affordable and Mid-Income Housing (SWAMIH) projects is the only large dedicated federal financing pipeline for such projects.

Allow partial exit to lenders

“The structure of the HDFC-Cerberus fund will make it complementary to the government-led SWAMIH fund, as it will also allow partial exit for existing lenders of the project, thereby increasing the scope of projects that can be covered for resolution,” said Vipul Roongta, managing director, HDFC Capital.

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.

“Cerberus has a long track record of partnering with businesses and properties around the world,” said Frank Bruno, co-chief executive, Cerberus. “We are able to provide tailored solutions in sectors with dislocated funding channels in various forms, such as the purchase of assets, creation of operating and lending platforms, and provision of structured capital to best-in-class operators.”

Cerberus has been active in India since 2019 across verticals including acquisition of non-performing assets, provision of capital to corporates and creation of financial services and real estate platforms.

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.