SC refuses to entertain bail plea of Rakesh Wadhawan, asks him to approach HC, BFSI News, ET BFSI

[ad_1]

Read More/Less

Rohatgi referred to the medical condition of the accused and said that he has been in jail for quite some time.

“I see, he has been in hospital more than in jail. Go to the high court,” the bench said prompting Rohatgi to say that it was the high court which refused the bail.

“File after some time. Not now. Alright permitted to withdraw to approach the high court,” the bench said.

The Bombay High Court on October 14 had refused to grant bail to Wadhawan.

Wadhawan, founder of Housing Development Infrastructure Limited (HDIL), was arrested by the Enforcement Directorate in 2019 in the case.

The high court had said that Wadhawan’s submission that he was immediately required to be released on temporary bail on medical grounds, was “not justified”.

It had said that denial of medical bail was in no way a breach of Wadhawan’s fundamental right to life since he had been provided adequate medical treatment by the state prison authorities whenever required.

Wadhawan, who had undergone a surgery for pacemaker implantation, had sought that he be released on bail so that he can seek discharge from the civic-run KEM Hospital in the city, where he is recuperating while in judicial custody, and shift to a private hospital while out on bail.

He had said in his plea that he suffered from severe comorbidities, that his immune system had been compromised after having contracted COVID-19 recently, and that he was susceptible to contracting infections and ailments while at the civic hospital due to the heavy footfall the hospital received.

He had also said that the KEM Hospital did not have an ICU facility specifically meant for those suffering from cardiac issues.

The fraud at PMC Bank came to light in September 2019 after the Reserve Bank of India discovered that the bank had allegedly created fictitious accounts to hide over Rs 4,355 crore of loans extended to almost-bankrupt Housing Development and Infrastructure Limited (HDIL).

According to RBI, the PMC bank masked 44 problematic loan accounts, including those of HDIL, by tampering with its core banking system, and the accounts were accessible only to limited staff members.

Mumbai Police’s Economic Offences Wing and the ED had registered offences against senior bank officials and HDIL promoters.

[ad_2]

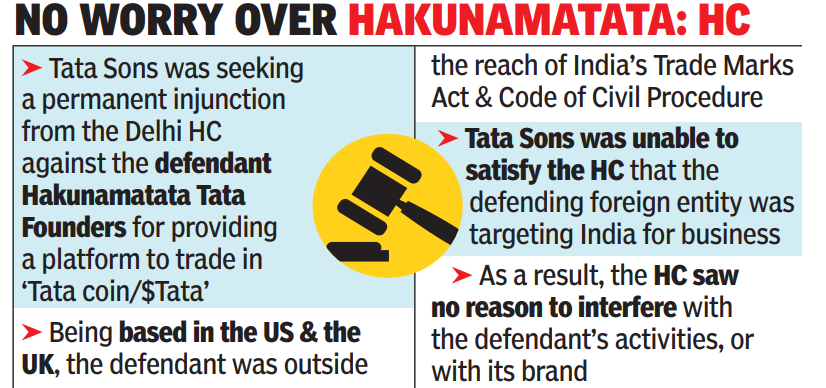

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.