HDFC Q4 net profit surges 42 per cent

[ad_1]

Read More/Less

Housing Development Finance Corporation (HDFC) Ltd reported a 42.4 per cent jump in its standalone net profit at ₹3,179.83 crore for the fourth quarter of 2020-21.

Its standalone net profit was ₹2,232.53 crore in the fourth quarter of 2019-20.

For the full fiscal 2020-21, HDFC’s net profit however, declined 32.3 per cent to ₹12,027.3 crore versus ₹17,769.65 crore in 2019-20.

Also read: HDFC Bank unveils organisational changes to power future growth

“The profit numbers for the year ended March 31, 2021 are not comparable with that of the previous year. In the previous year, the corporation had recorded a fair value gain consequent to the merger of GRUH Finance with Bandhan Bank amounting to ₹9,020 crore,” HDFC said in a statement on Friday.

For the quarter ended March 31, 2021, HDFC reported a net interest income of ₹4,065 crore, which was 14 per cent higher compared to ₹3,564 crore in the previous year.

Net interest margin for the year ended March 31, 2021 stood at 3.5 per cent.

As at March 31, 2021, ₹4,479 crore is being restructured under the RBI’s Resolution Framework for Covid-19 related stress, amounting to 0.8 per cent of the assets under management.

Of the loans being restructured, 27 per cent are individual loans and 73 per cent non-individual loans.

Gross non-performing loans as at March 31, 2021 stood at ₹ 9,759 crore or 1.98 per cent of the loan portfolio.

During the quarter ended March 31, 2021, individual loan disbursements grew by 60 per cent over a year ago.

“The month of March 2021 witnessed the highest levels in terms individual receipts, approvals and disbursements. Growth in home loans was seen in both, the affordable housing segment as well as high-end properties,” HDFC said.

The board recommended a dividend of ₹23 per equity share of face value of ₹2 each for the financial year 2020-21.

It also approved the re-appointment of Keki Mistry as the Managing Director (designated as Vice Chairman and Chief Executive Officer) of HDFC for a period of three years with effect from May 7, 2021, subject to approval of the members at the ensuing AGM.

Further, the board approved issuance of Redeemable Non-Convertible Debentures (secured or unsecured) and any other hybrid instruments (not in nature of equity shares) up to ₹1.25 lakh crore during a one year period.

[ad_2]

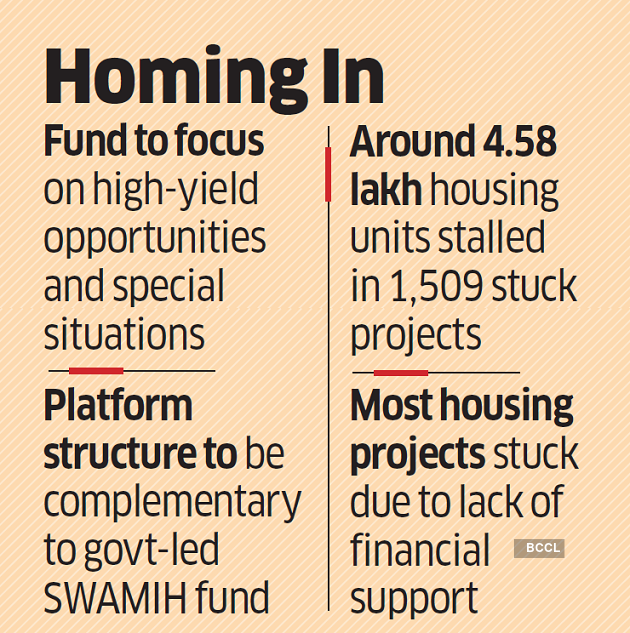

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.