Not one PSU bank in the top 5 lenders with lowest NPAs, BFSI News, ET BFSI

[ad_1]

Read More/Less

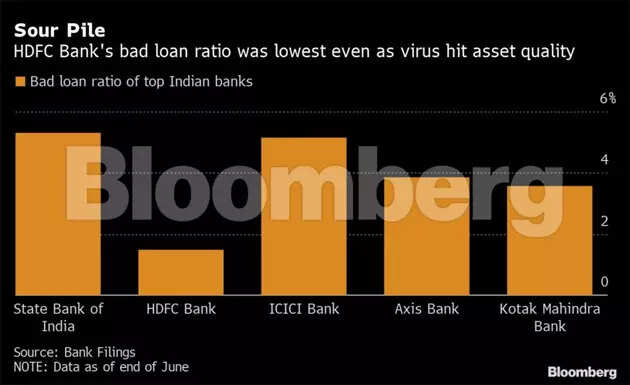

Among Indian banks, HDFC Bank has stayed on top of the list of lenders with the lowest non-performing assets.

However, there is not a single public sector bank in the top five banks with the lowest NPAs.

HDFC Bank, which has reported more than 20 per cent YoY profit growth every quarter for over 40 quarters, has never crossed 0.5 per cent of loans in net non-performing assets. In its latest quarterly results, the bank’s net NPA ratio stood at 0.48%.

For retail loans, the bank relies on the model of wide franchise and low-cost deposit base, which ensures good pricing power and sustainability of above average net interest margins.

The second number is held by IndusInd Bank. In its latest quarterly results, the bank’s gross non-performing assets (GNPAs) stood at 2.88 per cent as it was impacted by the second wave of Covid-19 while the net NPA ratio rose 15 basis points sequentially to 0.84 per cent.

The bank leads in certain retail asset classes with a pan India franchise which gives it strength to manage the asset quality in those segments.

The third bank on the list is ICICI Bank, which despite a rise in slippages, saw the net NPAs staying lower at 1.14 per cent as on March 31, 2021, against 1.54 per cent as on March 31, 2020. In its latest quarterly results, the bank reported a net NPA ratio of 1.16 per cent.

The next on the list is Federal Bank that saw gross NPAs rise to 3.5 per cent and net NPAs increase marginally to 1.23 per cent largely due to the Covid-19 related challenges faced by borrowers in the latest quarterly results.

In fiscal 2021, Federal Bank exhibited a decline in NPAs due to diligent selection of borrowers, while its slippage ratio fell to 1.6%, lower than 1.7% in 2020.

Kotak Mahindra Bank, the third largest Indian private sector bank by market capitalisation, has seen net NPAs consistently below 1.5 per cent. In its latest quarterly results, the bank’s asset quality weakened as gross NPAs stood at 3.56 per cent. However, net NPAs still came in below 1.5 per cent. The bank’s loan book has grown at a CAGR of over 25% over the past decade, which has been supported by a healthy contribution of low-cost deposits.

[ad_2]