HDFC Bank, plots path to double retail loans, BFSI News, ET BFSI

[ad_1]

Read More/Less

Uncertainty is declining and demand is improving as businesses seek to bolster growth after Covid-19, Arvind Kapil, the bank’s country head for retail assets, said in an interview. It’s an opportunity to reverse the declining share of loans to this segment of the market that was needed to preserve asset quality, he said.

“We are planning to double our retail assets book in a focused manner,” Kapil said. “I can sense a robust demand at ground level. I run businesses and I am giving you a feel of what I see.”

Of the bank’s total Rs 11.5 trillion ($156 billion) loan book, Kapil is in charge of retail borrowing worth 3.7 trillion rupees, which is expected to reach almost 8 trillion rupees within the next two years.

If successful, that would mark a sharp turnaround from its strategy a year ago when the bank slowed down its retail lending to protect its asset quality as the pandemic led to millions of job losses and businesses closures.

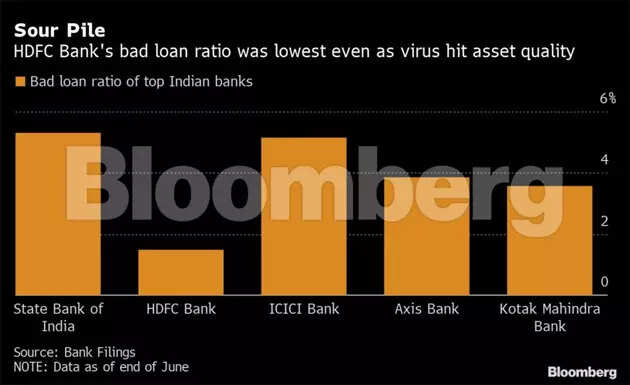

HDFC Bank’s retail lending share as portion of its total fell to 47 per cent in March, the lowest in at least five years from an average of 54 per cent to 55 per cent previously. The bank, which is also the nation’s most valuable, has the lowest bad-loan ratio among peers, and now wants to focus on unsecured loans for salaried workers, vehicle loans and government business.

“We are taking a pretty aggressive positioning to grow our retail loan book,” Kapil said. “We want to accelerate on segments where we can maintain the asset quality and offer the best return on assets.”

The Mumbai-based lender’s retail loans grew around 9.3 per cent slower than its overall book’s 14.4 per cent in the June quarter. That’s sharply lower than its peers like State Bank of India’s 16.5 per cent and ICICI Bank’s 20 per cent growth in that portfolio. Still, the lenders also saw a spike in bad loans in retail lending in the June quarter after an unexpected and more deadly new wave of the virus ripped through India. Since then, loan collections have improved and, for HDFC Bank, are back to pre-pandemic levels, Kapil said.

“The results of doubling our business will be more visible early next financial year,” he said. “We will balance our top-line growth with our return on assets objective.”

[ad_2]