How green is the green finance promise of global banks?, BFSI News, ET BFSI

[ad_1]

Read More/Less

Most global banks have signed Gfanz (the Glasgow Financial Alliance for Net Zero) at COP26 UN Climate Change Conference pledging to report annually on the carbon emissions linked to the projects they lend to.

Major signatories to the initiative, which aims to provide trillions of dollars in green finance, include Citi, Morgan Stanley and Bank of America. However, earlier efforts to promote green financing have not met with a serious response.

Principles of responsible banking

In 2019, the UN General Assembly exuberantly launched its principles of responsible banking (PRBs) where signatory banks agreed to work with their clients to encourage sustainable practices and to align their business strategy to the UN sustainable development goals and the Paris climate agreement.

Also, many of the biggest banks have not signed the PRBs, even though the principles have been the gold standard until now for committing to decarbonising lending.

Of the top ten banks (by market capitalisation), only Citi, Commercial Bank of China (ICBC), Bank of China and Agricultural Bank of China are signatories to PRBs. JPMorgan Chase, Bank of America, China Construction Bank, Wells Fargo, Morgan Stanley and China Merchants Bank are not on the list.

This is despite it being a limited commitment. Signatories have four years to comply with the principles, and signatories are not penalised or even named and shamed for failing to live up to the principles.

How banks fare

Among the major signatories to PRBs, Citi was the third-biggest fossil fuel lender in 2016-19 after the Paris Agreement and reached second place in 2020.

MUFG and ICBC, who are also signatories to the PRBs, both grew their fossil-fuel lending over the period. MUFG is also a Gfanz member, though neither ICBC nor any of the other Chinese banks are part of the new initiative.

Meanwhile, Wells Fargo and JP Morgan, which were not signatories to PRBs, reduced their total fossil fuels lending each year from 2018 to 2020, by 57% and 23% respectively.

Signatories to the PRBs are also supposed to carry out environmental-impact assessments and to measure the greenhouse gas emissions of projects. They are also supposed to ensure that loans go to projects that are carbon neutral. However, very little of this is happening on the ground at present.

While there is a need for a scheme that makes PRBs compulsory and binding, Gfanz does not tick the boxes. Under it, annual reporting requirements on carbon emissions are not mandatory either.

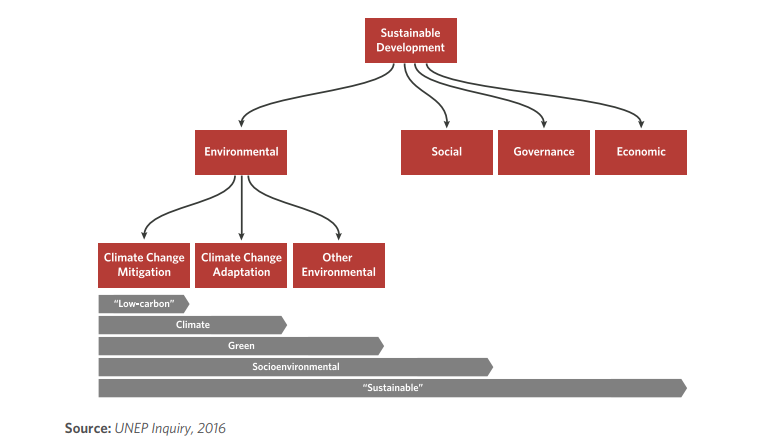

Experts say instead of forbidding lending to non-green projects now, loan books need to be treated as a portfolio of projects in different hues of green, with a defined trajectory towards greener – but it needs to be mandatory for signatories.

[ad_2]

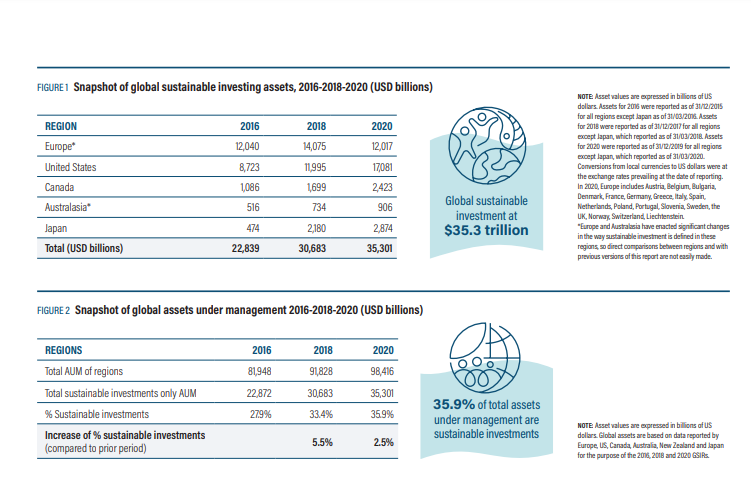

Source: Global Sustainable Investment Alliance

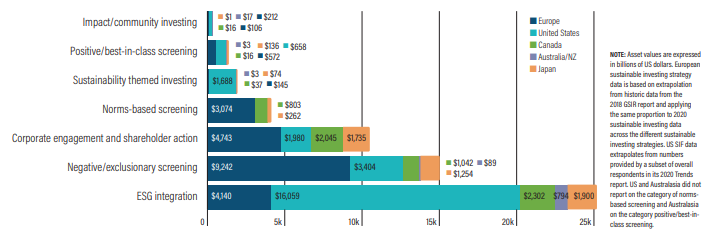

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

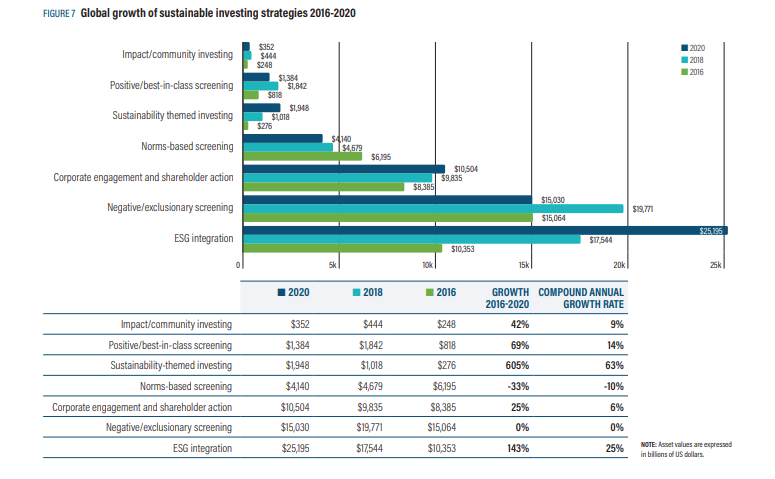

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)