ESG, Green bond issues rise sharply in 2021 as Indian firms promote sustainable business

[ad_1]

Read More/Less

By Manish M Suvarna

Issuances of Green and ESG (Environmental, Social, and Governance) bonds have risen sharply in calendar year 2021 as Indian companies are engaging in more sustainable business practices. Indian companies raised nearly $7 billion through ESG and Green bonds in 2021, compared to $1.4 billion and $4 billion in 2020 and 2019, respectively.

Dealers said companies get better rates on their ESG instruments rather than the normal fundraising instruments. Bank of America has made a global $1.5 billion sustainable finance commitment by 2030, which will focus on environment transition and development aligned to the United Nations sustainable development goal.

In 2021, JSW Hydro, Greenko, ReNew Power, and Adani Green have been large issuers of Green bonds. Similarly, Axis Bank AT1, Shriram Transport Finance, Adani Electricity Mumbai, and Ultratech Cement are among the larger fundraisers through ESG bonds.

“Over the last few years, Indian companies have become increasingly conscious of their carbon footprint and the impact of their businesses on all stakeholders and are keen to explore ESG-linked products as they engage in more sustainable business practices,” said Subhrajit Roy, India head, global capital markets, Bank of America.

Most companies are accessing the route of ESG or Green bonds due to multiple factors as they are becoming more conscious of the environmental impact and social responsibilities. Secondly, the focus of the investors has increased on these instruments that led to stronger bids, larger order books, increased pricing leverage and a higher quality investors base. As per data, $1.3 trillion has been raised through green loans or credit supply since 2006, of which $1 trillion has come since 2016 as companies practice green businesses.

Market participants expect issuances of ESG and Green bonds to increase in the coming years as India has started working towards the five-point vision stated by Prime Minister Narendra Modi at the COP26 summit. Bank of America expects fundraising through these instruments by Indian firms to touch $25 billion between 2022 and 2024.

“Investor thinking has evolved from seeing ESG metrics as a tertiary dataset to considering them as an important part of a company’s business model. So actively managing a portfolio’s footprint may help lenders or investors decrease exposure to companies that may face legal and reputational risks arising from environmental or social or governance concerns,” Roy said.

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

[ad_2]

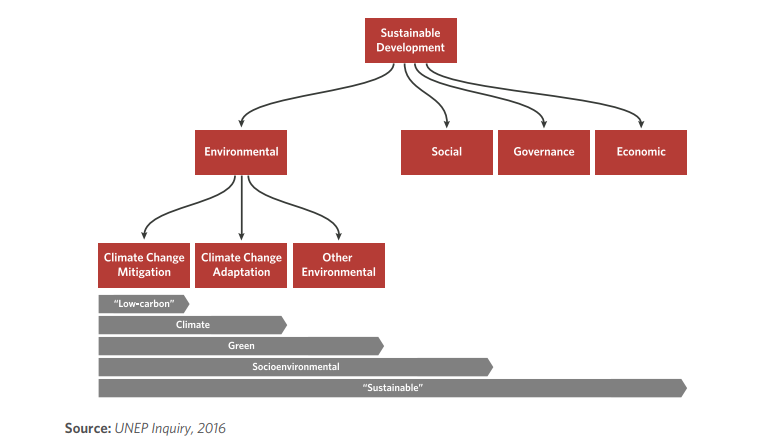

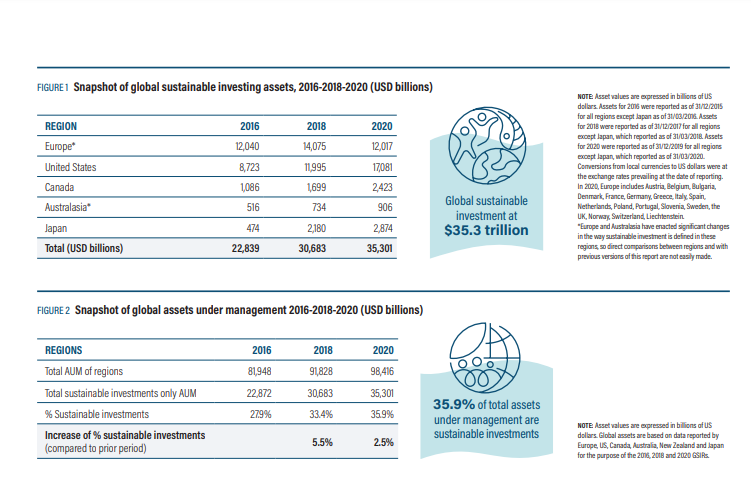

Source: Global Sustainable Investment Alliance

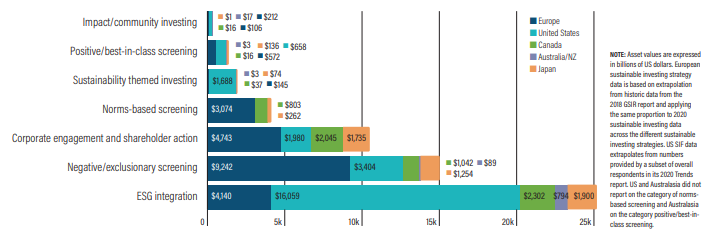

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

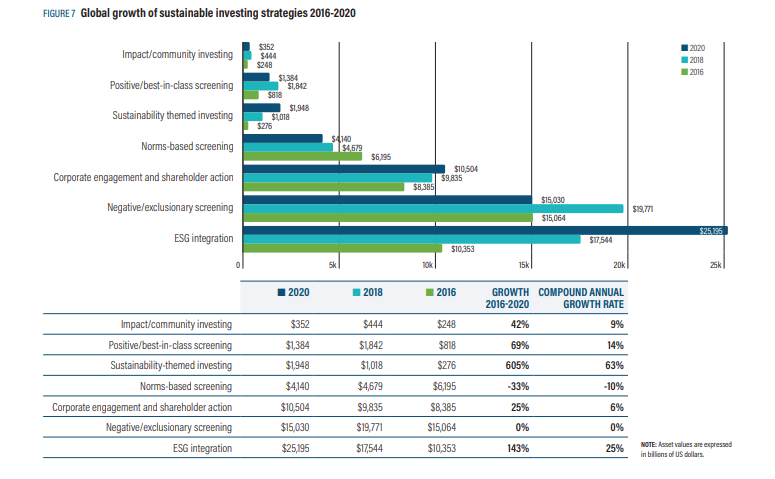

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)