Biggest U.S. banks smash profit estimates as economy revives, BFSI News, ET BFSI

[ad_1]

Read More/Less

WASHINGTON – The four largest U.S. consumer banks posted blockbuster second-quarter results this week, after pandemic loan losses failed to materialize and the U.S. economy began roaring back to life.

Wells Fargo & Co, Bank of America Corp, Citigroup Inc and JPMorgan Chase & Co posted a combined $33 billion in profits, buoyed by the release of $9 billion in reserves they had put aside last year to absorb feared pandemic losses.

That was beyond analyst estimates of about $24 billion combined, compared with $6 billion in the year-ago quarter.

Consumer spending has climbed, sometimes beyond pre-pandemic levels, while credit quality has improved and savings and investments have risen, the banks said.

Thanks to extraordinary government stimulus and loan repayment holidays, feared pandemic losses have not materialized. A national vaccination roll-out has allowed also Americans get back to work and to start spending again.

Sizzling capital markets activity has also helped the largest U.S. banks, with Goldman Sachs Group Inc reporting a $5.35 billion profit, more than double its adjusted earnings a year ago.

“The pace of the global recovery is exceeding earlier expectations and with it, consumer and corporate confidence is rising,” Citigroup Chief Executive Officer Jane Fraser said.

That was reflected in a pick-up in consumer lending.

For example, JPMorgan said combined spending on its debit and credit cards rose 22% compared with the same quarter in 2019, when spending patterns were more normal.

Spending on Citi-branded credit cards in the United States jumped 40% from a year earlier, but with so many customers paying off balances its card loans fell 4%.

Citigroup Chief Financial Officer Mark Mason said the bank expects more customers to go back to their pre-pandemic pattern of carrying revolving balances as government stimulus programs wind down later this year.

Wells Fargo posted a 14% gain in credit-card revenue compared with the second quarter of 2020, due to higher point-of-sale volume. Revenue was up slightly on the first quarter, the bank said.

“What we’re seeing is people starting to spend and act more in a way that seems more like it was before the pandemic started and, certainly on the consumer side, spending is up quite a bit, even when you compare it to 2018,” Wells Fargo chief financial officer Mike Santomassimo told reporters.

While loan growth is still tepid, which is usually bad for bank profits, there were signs that demand is creeping back.

Excluding loans related to the U.S. government’s pandemic aid program, loan balances at Bank of America, for example, grew $5.1 billion from the first quarter.

“Deposit growth is strong, and loan levels have begun to grow,” Bank of America CEO Brian Moynihan said in a statement.

JPMorgan, the country’s largest lender, on Tuesday reported profits of $11.9 billion compared with $4.7 billion last year.

Citigroup’s second-quarter profit rose to $6.19 billion, up from $1.06 billion last year, while Bank of America’s profit jumped to $8.96 billion from $3.28 billion.

Wells Fargo posted a profit of $6 billion compared with a loss of $3.85 billion last year, which was largely related to special items.

While the results indicate good news for consumers and businesses, low interest rates, weak loan demand and a slowdown in trading will probably weigh on results going forward, analysts said.

The U.S. Federal Reserve is staying the course, with an inflation target of 2% and no plans to tighten monetary policy by, for instance, raising interest rates, Fed Chair Jerome Powell said in prepared remarks for a congressional appearance on Wednesday.

That suggests banks will have to deal with low rates for an extended period of time.

(Reporting by Michelle Price; additional reporting by Noor Zainab Hussain, David Henry and Matt Scuffham; Editing by Lauren Tara LaCapra and Nick Zieminski)

[ad_2]

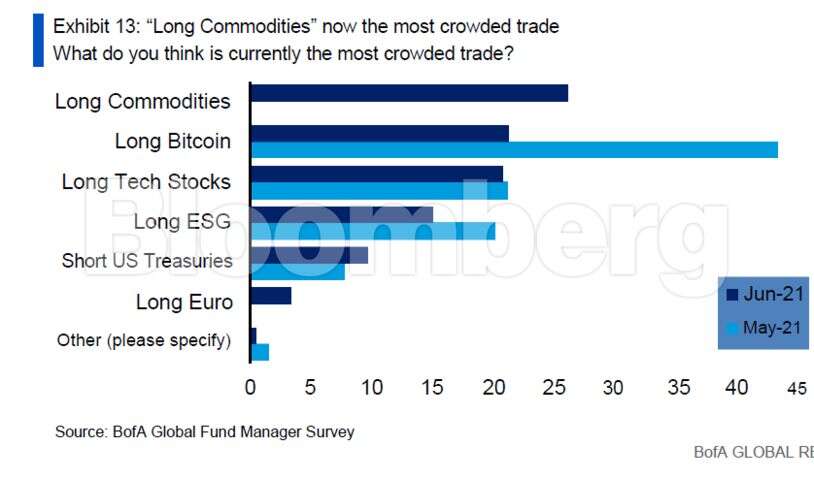

Other highlights from survey, which was conducted June 4 to 10, include:

Other highlights from survey, which was conducted June 4 to 10, include: