Five world market themes for the week ahead, BFSI News, ET BFSI

[ad_1]

Read More/Less

US inflation numbers may test the Federal Reserve’s view of price pressures as transitory, while trade data and more Q3 company earnings will show whether supply-chain glitches are waning.

PARTY TIME

A gathering of China‘s Communist Party in Beijing is expected to pass a historical resolution laying the foundation for President Xi to serve an unprecedented third term.

The first such resolution, in 1945, set the stage for Mao Zedong to become paramount leader while the second, in 1981, laid the groundwork for Deng Xioaping’s reform era.

This one may signal that Xi’s path is the one ahead, leading to “common prosperity” and away from growth at all costs. Unlikely to be mentioned is the precarity of the moment, with China’s growth engines sputtering and credit markets crumbling just as global monetary policy is in flux — caveat emptor.

PRICE GAUGING

The US consumer price index out on Wednesday, is forecast to have climbed 0.5 per cent in October after a 0.4 per cent rise in September as Americans paid more for food, rent and other goods.

Whether the current rise in prices is fleeting, stemming from temporary effects as the economy emerges from the pandemic, or signals the start a new upward trend, remains to be seen.

The Federal Reserve’s latest meeting held to the belief that high inflation would prove “transitory” though it acknowledged that global supply difficulties add to inflation risks.

It has managed to unveil a tapering of monthly bond buys without triggering a market “tantrum.” A strong inflation print that renews rate-hike talk could change that.

TRADE CROSSROADS

Accommodative policies in the developed world have fuelled huge demand for consumer goods, driving this year’s trade rebound. Exports from emerging economies, from raw materials to semiconductors, have surged. Shortages and price rises have ensued.

But trade may now be at a crossroads. Economists predict post-COVID normality will allow Western consumers to spend less on goods and more on travel and dining out. That could allow inventories to rise and cool the goods trade in early-2022.

Data on Sunday will show whether Chinese power shortages slowed exports and if a cooling economy is hurting imports.

A US export slump has blown its trade deficit to record highs, so Tuesday’s German data will be watched after August export volumes fell for the first time in 15 months. Finally, Monday may show semiconductor powerhouse Taiwan posting a 16th month of export growth.

BEAT GOES ON

European blue-chips reporting next week include financials Allianz, Aviva and Zurich Insurance, drugmakers Merck and AstraZeneca and steelmaker Arcelor Mittal.

European stocks have never been higher and the latest slew of earnings could prove a catalyst for fresh peaks. Expectations for Q3 profit growth have surged to 57.2 per cent year-on-year from 47.6 per cent two weeks ago; so far almost 66 per cent of companies have beaten expectations.

The fear of missing out on the post COVID-19 recovery and negative “real” bond yields help explain stock markets’ resilience. But how long can the party last? After all, the pent-up profit recovery from the COVID-19 2020 recession is expected to slow in 2022.

HIKES ON OR OFF?

World markets are often shaken up by investors switching between risk-on or risk-off. To mix things up, sentiment these days is being driven by a hikes on/hikes off mindset.

One day, it’s about major central banks hiking rates soon (sell bonds, buy bank stocks) and the next, it’s about them putting off tightening for as long as possible (buy bonds, send stocks to new record highs).

The latter view currently dominates after the biggest central banks pushed back by keeping policy unchanged.

But uncertainty over the rates outlook remains high. And that means the swing between ‘hikes on’ and ‘hikes off’ days could become the norm. Brace for more volatility.

[ad_2]

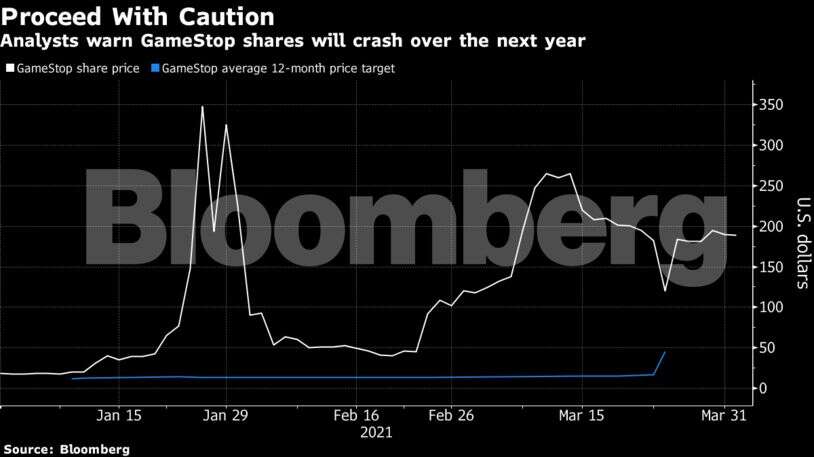

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.”

“People are going to be doing other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big reckoning” at some point, he said. “There’s no question in my mind.” But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen.

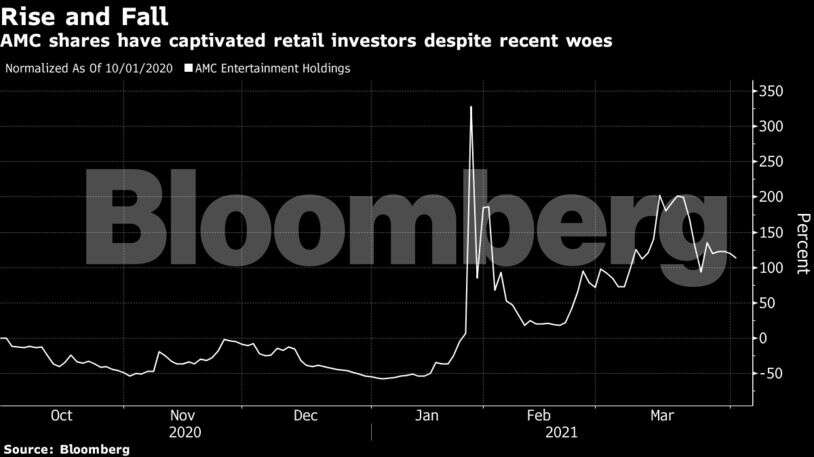

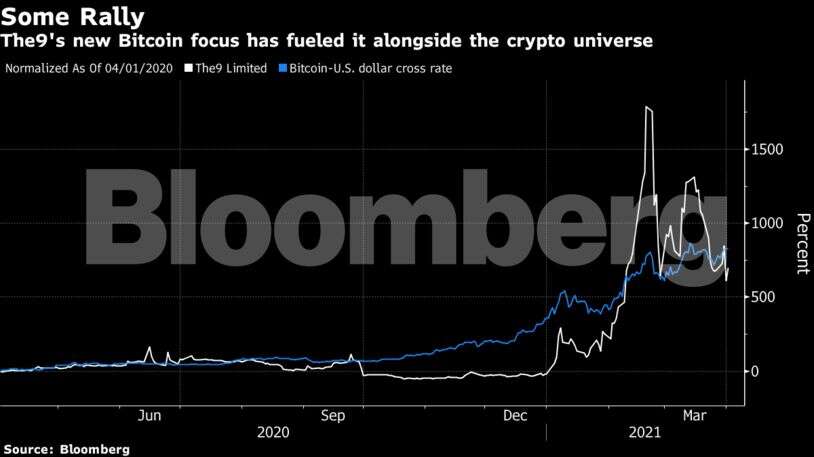

But any sense of GameStop trading on fundamentals has been ignored since it first captivated Wall Street and Reddit users in the back half of January. Bulls are more than happy to tout their bets on forums as a move to stick it to short sellers as they buy into a company rebirth delivered by activist investor Ryan Cohen. Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.

Retail euphoria leaked over to a broader range of securities from cult-favorites like Bitcoin, Tesla Inc., and the ARK Innovation ETF to smaller companies like the clothing retailer Express Inc. Chinese tech company The9 Limited is among the group’s best performers this year with an 860% surge.