NEW DELHI: Economists at India’s largest bank have cut the FY22

GDP growth projection for the economy by 60 basis points, and said India could have done better to tackle the second wave of the Covid-19 pandemic.

The downgrading of growth projections was triggered largely due to restrictions being imposed by different states.

“India managed the first wave of pandemic well. However, the country is now facing an unprecedented second wave. There is no doubt India could have done better,” said economists at SBI.

The second wave of Covid-19 pandemic has shattered all records. The number of active cases crossed the 30 lakh mark for the first time since the beginning of the pandemic. In the past 24 hours, 3.79 lakh fresh cases and 3,596 deaths were reported in the country, highest for a single day.

With rising cases, the recovery rate of Covid-19 patients has also plummeted sharply from 97 per cent at the beginning of the second wave to 82.5 per cent now. This 14.5 per cent drop in recovery rate has happened over the past 69 days.

However, SBI is sensing “good news amidst all the gloom” and believes the peak of the pandemic is near.

“Given that every 1 per cent reduction in recovery rate takes around 4.5 days, it translates into around 20 days from now. Also, our estimate shows every 1 per cent reduction in recovery rate increases active cases by 1.85 lakhs. Thus we believe the peak of the second wave would come around mid-May with active cases reaching around 36 lakh at that point,” the economists wrote.

The economists say they have started noticing some deeper impact of the second wave on economic activity in the country. Its business activity index in April dipped to a new low level of 75.7, a level last attained in August 2020.

This indicates the disruption caused by increased restrictions imposed in various states. All the indicators, except for labour participation and electricity consumption have declined significantly during April.

“Given the current circumstances of partial/local/weekend lockdowns in almost all states, our growth forecast is now revised downwards. SBI’ revised FY22 growth projection now stands at 10.4 per cent for real GDP and 14.2 per cent for nominal GDP,” the economists said.

Earlier, SBI had projected real GDP growth for FY22 at 11 per cent (RBI:10.5 per cent) and nominal GDP at 15 per cent (Union Budget: 14.4 per cent) on the back of a low base effect and renewed economic momentum.

Total loss due to the second wave lockdowns is estimated at Rs 1.86 lakh crore, of which Maharashtra, Madhya Pradesh, Karnataka and Rajasthan account for 75 per cent. Maharashtra’s loss alone stands at 43 per cent.

Vaccine as public good

SBI advocated declaring Covid-19 vaccine as a public good, which it believes is the only way to fight this dreadful pandemic. In economic parlance, ‘public goods’ are defined as non-excludable and nonrival in nature.

“The primary idea of a public good is that agents must cooperate and not be combative, and then only all the players will have the opportunity to get a better payoff…When both Centre and state government cooperate with each other, both will receive benefit in the form of more vaccination, better medical facilities, and less number of cases. When both [are non-cooperative], the payoffs will be zero for both,” said SBI economists.

In the last couple of months, there have been instances when some states and central government have tussled over managing the pandemic, with each blaming the other for any mishaps.

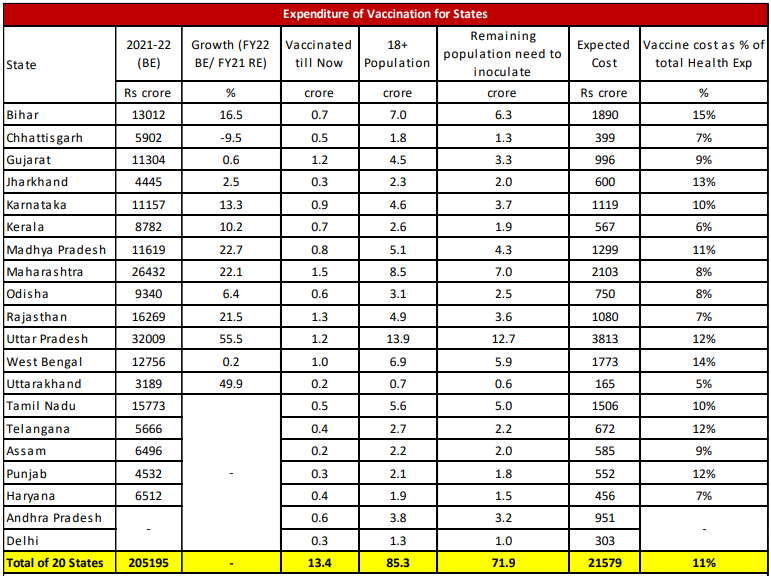

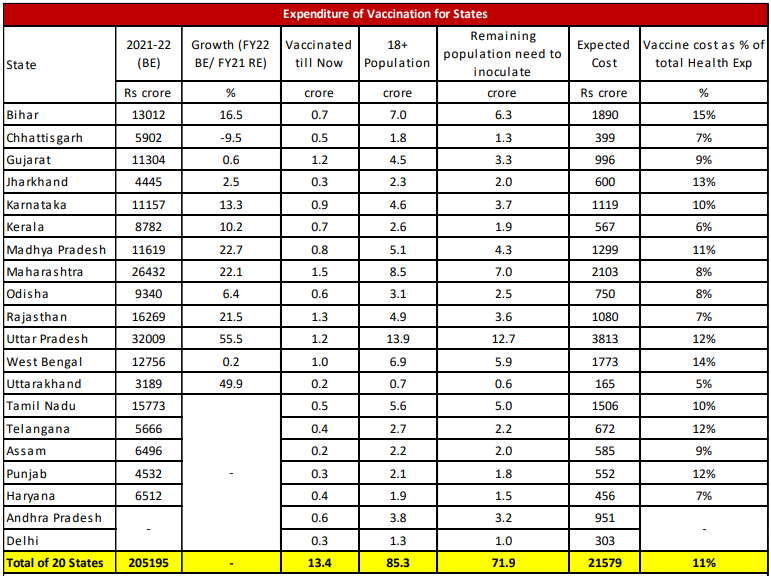

The bank said for the 20 states it analysed, the cost of vaccines is almost 10-15 per cent of their health expenditure budget, assuming half of the population in these states will get vaccinated by the central government.

This cost is, however, only 0.1 per cent of GDP and much lower than the economic loss if restrictions occur to control the spread of pandemic which is already around 0.8 per cent of GDP.

SBI also cast doubt on the criticism that elections were responsible for faster spread of the virus. Many analysts and epidemiologists believe that the elections were one of the major factors behind the record cases in election states.

SBI also cast doubt on the criticism that elections were responsible for faster spread of the virus. Many analysts and epidemiologists believe that the elections were one of the major factors behind the record cases in election states.

“In some states like Maharashtra, Delhi and Chhattisgarh, even as mobility has declined significantly, cases increased and they have shown some stabilization only recently, indicating the transmission may not be possible only through humans, but it is airborne. This makes a strong case mass sanitisation of public places for disinfection,” said SBI.

SBI also cast doubt on the criticism that elections were responsible for faster spread of the virus. Many analysts and epidemiologists believe that the elections were one of the major factors behind the record cases in election states.

SBI also cast doubt on the criticism that elections were responsible for faster spread of the virus. Many analysts and epidemiologists believe that the elections were one of the major factors behind the record cases in election states.