How does RBI’s staff accountability framework on NPAs work?, BFSI News, ET BFSI

[ad_1]

Read More/Less

Ahead of a big credit push, the government has moved to remove the bankers’ fears of vigilance in extending small loans with a staff accountability framework.

Bankers fear investigation, hurt to career prospects and retirement if a loan sanctioned by them turns sour. This has made them averse to giving loans, which has led to obstacles in the flow of credit to deserving individuals and firms. The banking system is flush with liquidity but one of the reasons for credit not percolating is the risk-averseness which the new staff accountability norms seek to remove.

Loans up to Rs 10 lakh

Staff accountability need not be examined in NPA accounts with outstanding up to Rs 10 lakh. Most loans up to Rs 10 lakh are “template-based” and do not constitute a major percentage of the NPA portfolio by amount. Such accounts can turn into NPA even due to a slight change in circumstances including a family health crisis or a shutdown, leading to disruption in cash flows.

The credit risk assessment in these kinds of loans is driven by digital algorithms/templates and pre-designed schemes with low human intervention. The borrower community under this tier neither has financial literacy nor credit history.

Loans between Rs 10 lakh and Rs 1 crore

For examining staff accountability, banks may decide on a threshold of Rs 10 lakh or Rs 20 lakh, depending on their business size. These loans are processed at centralised back offices and not specifically at branches. They use lending automation templates, built-in digital algorithms and information drawn from aggregators with low use of discretion.

They have support of empanelled advocates and valuers. The staff accountability is to be examined by a committee formed at regional/controlling offices. For preliminary examination, the controller will submit to the committee a brief report, covering details of the loan and observations in inspection/audit reports for the previous four years.

If the committee finds a case of staff accountability exists, this will be examined by a fact-finding officer. But inspection and audit department staff will not be involved in conducting staff accountability. While conducting staff accountability examination, they should follow RBI guidance/norms. Standard operating procedure is to be followed in carrying out the task. This process will reduce the number of NPAs needing staff accountability examination to a large extent.

Loans between Rs 1 crore and Rs 50 crore

Accounts in this range are mostly credit facilities sanctioned to business units warranting examination by a specialised unit within the banks. NPA accounts in this range should undergo a preliminary examination by a committee constituted at one level higher than the sanction level — an account sanctioned at the regional office will be taken up at the zonal level, those at the zonal level by the circle office or head office, and so on.

The committee should be headed by an official senior to the sanctioning authority. For preliminary examination by the committee, a detailed report should be submitted through the controller. If the committee finds material lapses in any of the processes, the account may be referred at the discretion of the committee to the controlling audit office for a detailed examination of staff accountability.

A detailed report on the account will be submitted to the committee covering the borrower profile with reasons leading to the account turning into NPA. The comments of the internal and external auditors of the last four years and compliance thereof will also be submitted to the committee. Preliminary examination by the committee will be based on all monitoring, follow up, compliance of observations of the auditors.

If the committee finds material lapses in the stages of sanction, disbursement, monitoring and follow up, the committee may at its discretion refer the NPA account to the controlling audit office/audit vertical for detailed staff accountability examination. The audit vertical will rely upon the observations/remarks of the external/internal auditors of the last four years and after the conclusion of analysis shall submit a report to the committee for taking a final view.

For loans above Rs 50 crore

In the large accounts, after examining staff accountability, the vigilance and non-vigilance angle is to be identified by the Internal Advisory Committee (IAC).

Recommendations of IAC, where staff accountability is established, will be referred to the chief vigilance officer (CVO) for vetting. For banks with business of up to Rs 10 lakh crore, the cases of Rs 10 crore and above are to be sent to CVO. Banks with business of between Rs 10 lakh crore and Rs 25 lakh crore can refer cases of Rs 30 crore and above. Banks with business of over Rs 25 lakh crore may refer cases of Rs 50 crore and above.

Banks will have to complete an accountability exercise within six months from the date an account is classified as NPA. Depending on the banks’ business size, the guidelines suggest threshold limits for scrutiny of the accountability by the chief vigilance officer. If NPA is caused by external factors — such as change in government policy, natural calamities, non-release of government subsidy/grant — it should not attract a staff accountability examination, according to the framework.

[ad_2]

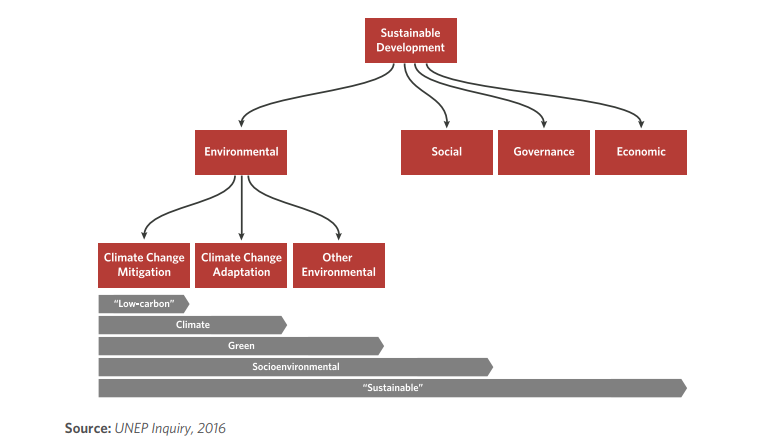

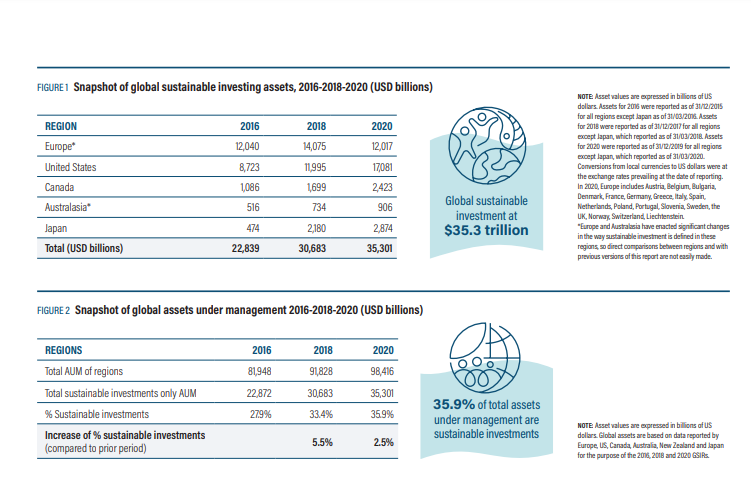

Source: Global Sustainable Investment Alliance

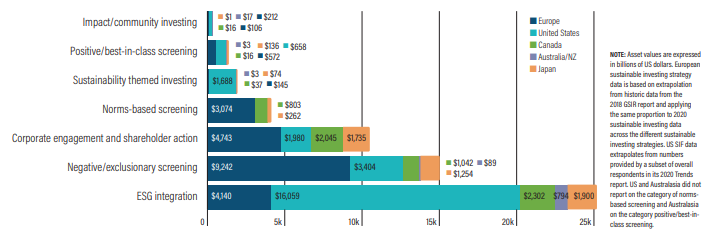

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

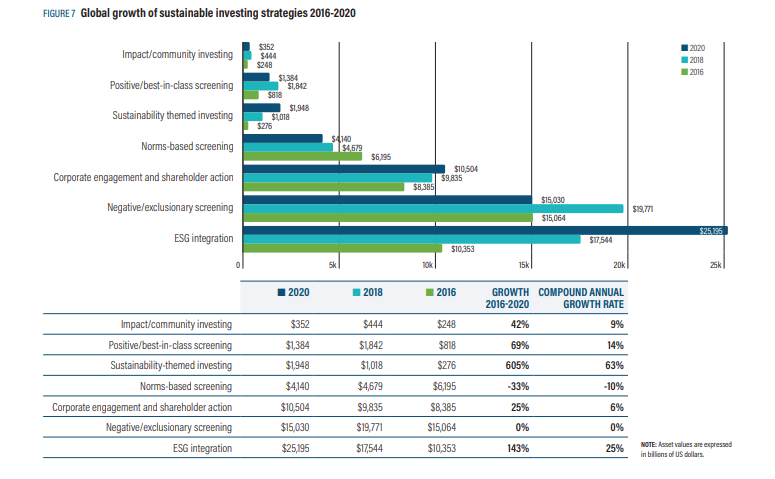

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)