Payment channels show pick-up in Oct driven by festive spends

[ad_1]

Read More/Less

Most digital payment channels recorded an increase in the value of transactions on a month-on-month basis in October as festive-season spending gave a boost to consumption.

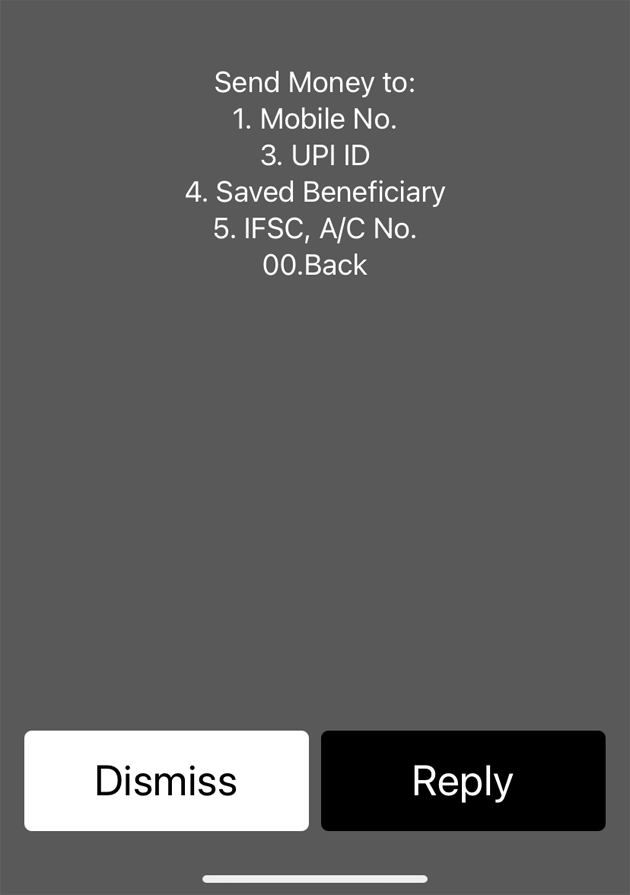

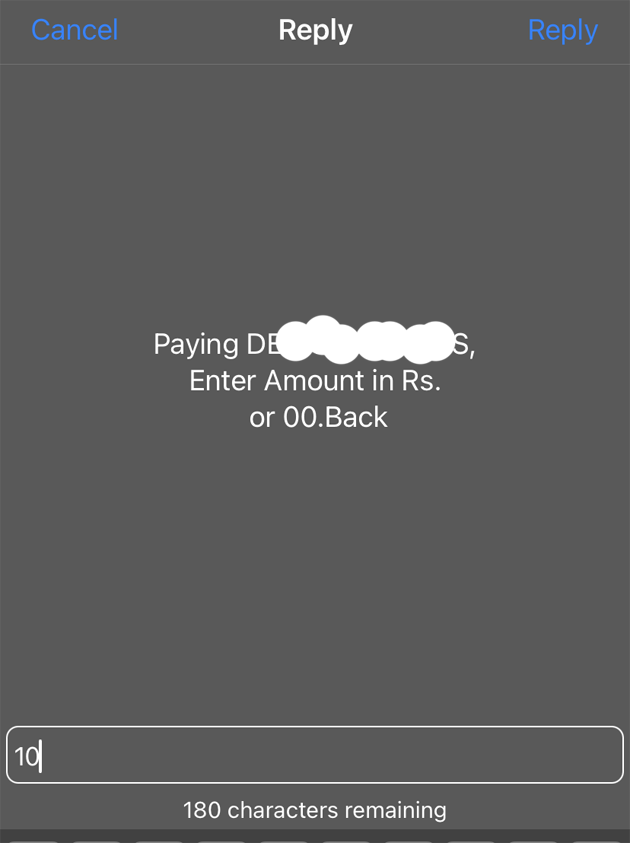

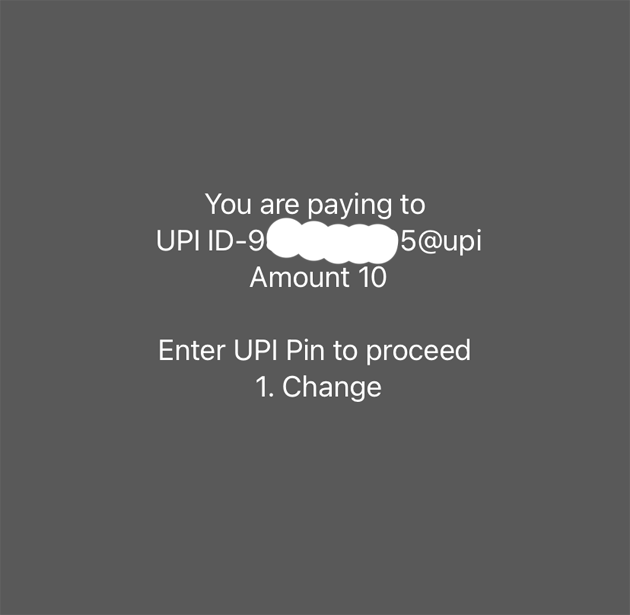

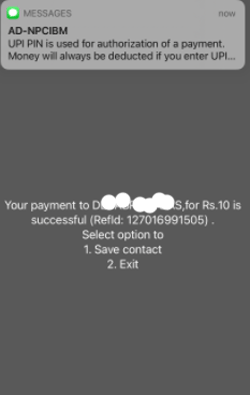

According to data available on the Reserve Bank of India’s website, spends through the National Electronic Funds Transfer (NEFT) rose 2% MoM to Rs 24.76 lakh crore, Immediate Payment Service (IMPS) spends were up 14% to Rs 3.7 lakh crore, Unified Payments Interface (UPI) spends grew 18% to Rs 7.71 lakh crore, credit card spends rose 21% to Rs 76,274 crore and debit card spends grew 19% to Rs 61,416 crore. Electronic toll payments also recorded an increase. The value of transactions through prepaid payment instrument (PPI) cards, however, fell 16% MoM to Rs 2,498 crore.

Several indicators suggest a pick-up in consumption during October. The RBI said in its State of the Economy report for November that the outcome of improved mobility – both passenger and goods – was reflected in a surge in fuel consumption in October. The consumption of petrol touched pre-pandemic levels, while aviation turbine fuel (ATF) and diesel consumption exhibited sequential improvement.

Players in the payments ecosystem witnessed strong traction in volumes during the month. On Wednesday, PhonePe said it processed over two billion transactions on its platform in October on the back of rapid traction across tier II, tier III cities and beyond, which accounted for 80% of transactions. Banks, too, have reported an uptick in consumption. HDFC Bank said in an investor call that early results for the first 10 days of October showed a 42% growth in card spends over a similar time period in September, driven by festive spends.

However, the recovery in the economy is yet to become entrenched and broad-based, many believe. RBI governor Shaktikanta Das on Tuesday said that the Q1FY22 GDP data revealed that there still exists a significant gap in both private consumption and investment, relative to their pre-pandemic levels in FY20.

“Contributing the largest share of aggregate demand, around 56% of GDP, private consumption is critical for inclusive, durable and balanced growth of our country. Daily wage earners and workers at the lower rungs of the society have incurred significant losses of income and employment during the pandemic that will take time to repair,” Das said.

At the same time, he expressed confidence that consumption demand triggered by the festive season and the recent cut in levies on fuel by the central and state governments will augment purchasing power of people and create space for additional consumption.

Get live Stock Prices from BSE, NSE, US Market and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, calculate your tax by Income Tax Calculator, know market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and follow us on Twitter.

![]() Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates.

[ad_2]