Housing and realty sector heading into the best of times, says Deepak Parekh

[ad_1]

Read More/Less

The country’s housing and real estate sector is heading into the best of times, said Deepak Parekh, Chairman, Housing Development Finance Corporation.

“Right now, there is a lot of optimism in the air on the potential of the housing and real estate sector. This isn’t just feel good talk, it is real. The Indian real estate market is on the cusp of a new growth cycle and it is important that we make the best of it,” Parekh said at the CREDAI Financial Conclave 2021 on Friday.

Parekh said that in his over 50 years of work life, he has not seen better housing affordability in the country, such easy liquidity conditions and record low interest rates and such “burning desire” to be a homeowner than in these current times.

Parekh said India is fortunate not to have a housing bubble and said the inherent demand for housing remains immense and concerted efforts have been made to ensure supply at the right price points to meet the needs of various income groups.

Apart from sales, new projects have also been launched, which he termed as “the greatest mark of confidence for the future”.

Noting that a developer’s reputation is of the foremost importance in the real estate business, Parekh said they must focus on reputation and resolution.

“Both these go hand in hand. Choose a resolution path that bails you out the fastest, not necessarily the path that maximises your returns,” he advised them.

Defaulter tag

Parekh also stressed that a defaulter tag is hard to shake-off. “Financial regulators are not willing to look at real estate non-performing loans through a different lens,” he said, adding that financiers have no choice and have to respect the views of the regulators.

While adequate provisioning can be made against NPAs, incremental funding for these projects to be completed becomes difficult, he said, adding that then it triggers a vicious cycle of no other lender wanting to step in either.

He also stressed on the need for a Credit Linked Subsidy Scheme version 2.0, stating that “it has been amongst the best executed and impactful government schemes”.

Parekh stated that both, financiers and developers should continue to work on affordable homes, as the segment has the greatest demand.

He also called on banks and NBFCs to continue to support the credit needs of the real estate sector.

“We need more homes, more commercial premises, more construction and for the Indian economy to grow at its true potential, credit growth cannot stay tepid at a mere six to seven per cent,” he said.

[ad_2]

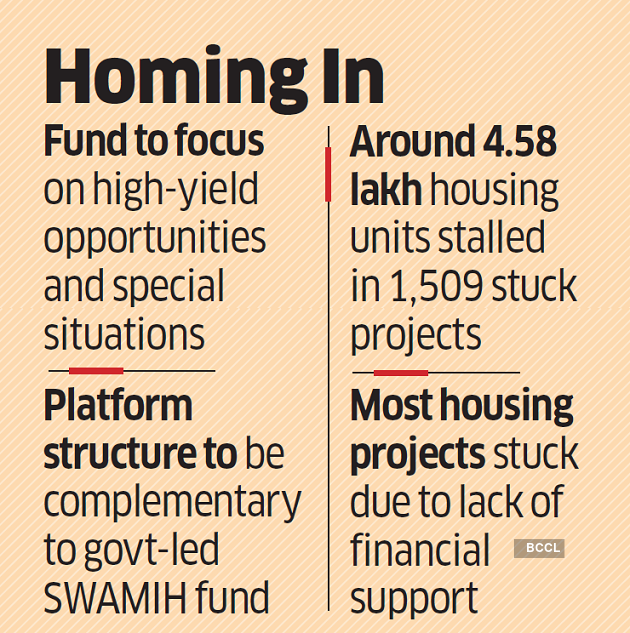

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.

While HDFC and other financial institutions have invested in SWAMIH fund, the HDFC-Cerberus fund will be the only private sector initiative with an objective of resolving the issue of stuck and distressed housing projects.