If you’re merely dipping your toe in

cryptocurrency, it can be hard to imagine your

crypto as something worth talking to an estate attorney about. But that fun money could grow to a significant percentage of your total investments, sometimes overnight. Sorry to be a downer, but

YOLO – so make a plan for your crypto in the event you pass away.

Crypto accounts aren’t like traditional investment accounts. They can be more vulnerable to security issues, and you generally can’t name a beneficiary. For example, if you store your crypto on a physical device at home and a few friends know your key – a password of sorts that grants access to a crypto wallet – one of those so-called friends could wander into your house and steal your crypto as easily as they could walk off with your great-grandmother’s diamond earrings. Or, if you shared the keys with no one, your crypto is lost forever.

It’s important to understand how to safely store your crypto and communicate your wishes with your loved ones, just like you would with any other valuable asset.

KNOW HOW YOUR CRYPTO IS STORED

You trade and store crypto in wallets, but not the leather kind. Crypto wallets can either be digital and managed on an app or website, or physical like a thumb drive. The kind you choose depends on what you intend to do with your crypto.

HOT WALLETS:

These are used for trading and purchasing crypto. The upside is they’re typically free and convenient, but the downside is they’re less secure because they’re always connected to the internet.

COLD WALLETS:

These are used to store crypto for a longer period of time. Think of it like putting your crypto in a freezer.

The hot wallet is like a checking account – with money moving in and out – while the cold wallet is more like a savings account, where you park money for a longer time. You can have both at the same time.

Whoever holds the keys – that is, who maintains custody over a password of randomly generated numbers and letters – has access to your crypto. It could be you, a third-party crypto exchange or a hybrid of both.

“Don’t keep more than you’re willing to lose on a third-party exchange as a long-term solution,” says Alex Mejias, founder and managing attorney at James River Law in Richmond, Virginia. “You don’t control the keys. They could freeze your funds or get attacked.” Mejias recommends a self-custody or hybrid option as the value of your crypto grows.

KEEP YOUR CRYPTO SECURE, YET ACCESSIBLE

A cold wallet can be a small physical storage device that’s easy to misplace. Your cold wallet requires a PIN code for access, plus you set up a recovery phrase as a backup in case you lose your key. According to Mejias, a fireproof safe at home or a safety deposit box at a bank is a must, but don’t store your cold wallet in the same place as the note containing your key, PIN and recovery phrase. If someone finds all of those items together, it’s bye-bye Bitcoin.

Above all, design a storage method that makes sense. “Don’t get so cute that you make some complicated system that you can’t remember,” Mejias says. He’s heard of people writing down their keys and cutting the paper into three pieces, hiding each piece in a separate location. “It sounds like a good idea, but it’s a horrible idea. If you lose one of those three, it’s gone forever. You’ve tripled your risk.”

MAKE A DETAILED PLAN FOR LOVED ONES

Name a beneficiary in your will and add a document to your estate plan that lists your crypto assets and any passwords, PINs, keys and instructions to find your cold wallet. If you have an account at a cryptocurrency exchange, your beneficiary can contact customer support to notify them of your death.

According to a Coinbase representative, there is a process in place to guide next of kin, including one-on-one assistance from a Coinbase analyst. Gemini requires a death certificate and power of attorney to initiate a transfer out of a deceased person’s account.

“We hope to simplify this process in the future, so we are working to add account beneficiaries functionality to our platform,” a Gemini representative said in an email.

UPDATE YOUR PLAN AND YOUR WALLET

Ensure that your assets will go to the right people by keeping your estate plan updated, especially after a life change like marriage or divorce. Provide up-to-date instructions so beneficiaries can access your assets. Cold wallets need maintenance, too, in the form of periodic firmware updates. This can help lessen the burden on your loved ones and hopefully prevent fights as they settle your estate after your death.

“Crypto has the potential to be a very explosive thing because the value can be so huge so quickly,” Mejias says. “When you think about five, 10 years from now, we’re potentially talking about a whole lot of money.”

This article provides information for educational purposes. NerdWallet does not offer advisory or brokerage services, nor does it recommend specific investments, including stocks, securities or cryptocurrencies.

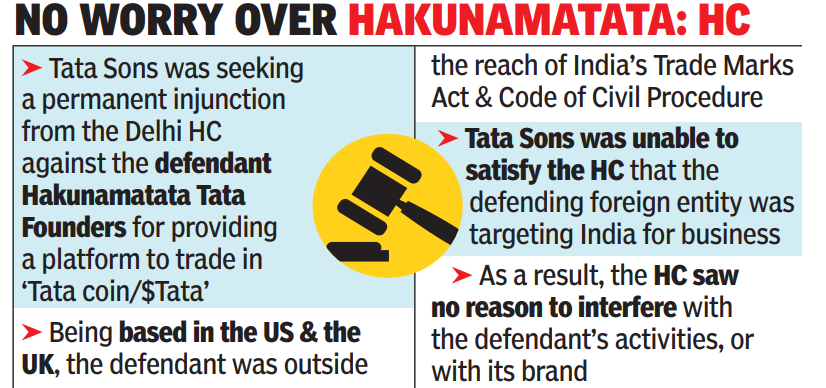

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.