Bhupender Yadav, BFSI News, ET BFSI

[ad_1]

Read More/Less

In an interaction with the media ahead of the international climate conference to be held from October 31 to November 12 in Glasgow, the minister said it is yet to be determined which country will get how much financial support to combat the global climate challenge.

There are many issues which will be on the table but the most vital will be to remind the developed nations to deliver on their promise of USD 100 billion per year to the developing countries, he said.

Yadav said Modi will attend the conference, but did not confirm the date of his visit.

At the United Nations Climate Summit in Copenhagen in 2009, the developed nations had pledged to provide USD 100 billion a year to the developing nations to help mitigate climate change. It is yet to be delivered. The amount has now accumulated to over USD one trillion since 2009.

Elaborating on the issue, Environment Secretary R P Gupta said that the amount to be received by India is yet to be ascertained.

He also said that besides fulfilment of climate funding, India expects the developed nations to compensate for the loss and damage expenditure borne by the country due to climate change and global warming as the developed world is responsible for it.

“The severity and the frequency of floods and cyclones have increased and it is because of climate change. The 1.5-degree Celsius temperature rise globally has happened because of the developed nations and their historical emissions. There should be compensation for us.

“The developed nations must bear the expenditure of the damage because they are somewhere responsible for it,” Gupta said, adding that India is hopeful of a good outcome at the COP 26.

India’s per capita carbon emissions per year is 1.96 tons which is way below China and USA which account for 8.4 tons and 18.6 tons emissions respectively, Gupta said, adding that “we are suffering because of developed nations.”

The world’s average per capita emission per year is 6.64 tons.

Under the Paris Agreement, India has three quantifiable nationally determined contributions (NDCs), which include lowering the emissions intensity of its GDP by 33-35 per cent compared to 2005 levels by 2030; increase total cumulative electricity generation from fossil free energy sources to 40 per cent by 2030 and create additional carbon sink of 2.5 to 3 billion tons through additional forest and tree cover. PTI AG SMN SMN

[ad_2]

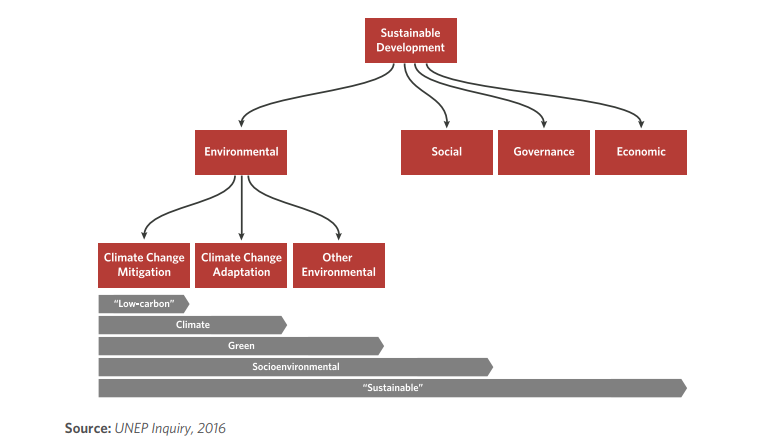

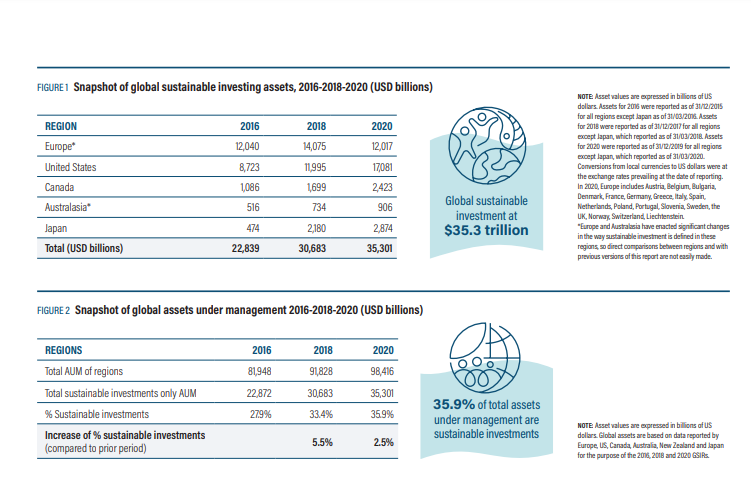

Source: Global Sustainable Investment Alliance

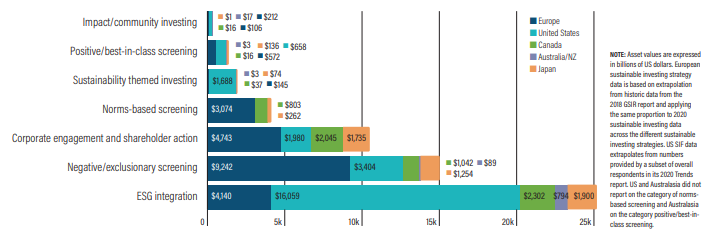

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

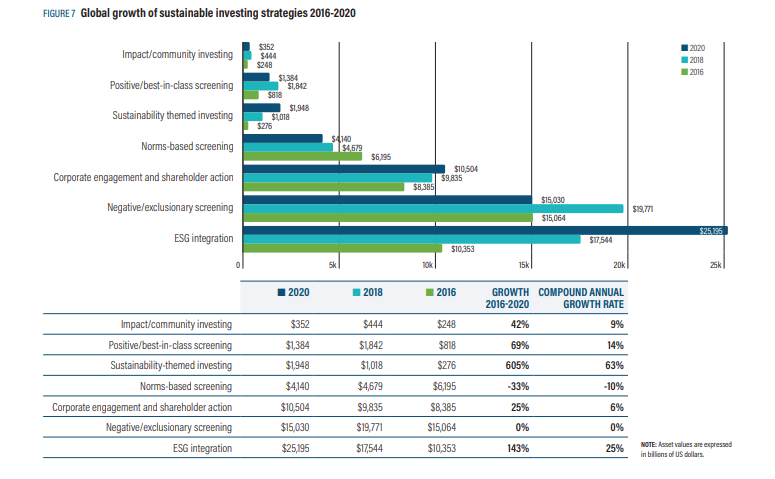

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)