How you can make your home climate-proof

[ad_1]

Read More/Less

The effects of climate change are strongly and clearly upon us — severe rains, landslides, hurricanes to scorching heat.

The recent report by the Intergovernmental Panel on Climate Change (IPCC) notes that South Asia is very vulnerable and India may suffer more frequent and intense heat waves, extreme rainfall events,erratic monsoons and cyclonic activity in the coming decades.

As homes offer protection against the elements, there is also a need to have a shift in how we approach residential property. Home sales and prices are not yet impacted by climate change considerations, except in a few coastal regions.

Rising risks

Data from the IPCC show three scenarios of mean temperature rise in South Asia – 1.9º C, 2.9º C and 5.1º C. Besides higher average, there will also be more days of extreme heat — over 40º C temperature. The best-case scenario projected is a 50 per cent increase, from about 40 days in a year now, and the worst case is up to three months of extreme heat.

This change will push up cooling costs for homes. In fact, analysis by the International Energy Agency shows that the share of electricity demand by homes, mainly for cooling, will nearly triple by 2030 globally.

The other hazard is cyclonic storms. Analysis shows that the Arabian Sea is likely to be most affected and in the past decade the cyclonic systems in the region already increased from two to three. The storm intensity, too, is expected to increase.

Floods are an existing danger and data from the Geological Survey of India show that 12.5 per cent of the country are major flood-prone areas. Coastal regions – nearly 7,000 km long – face the risk of water inundation from cyclonic storms. Rising sea levels also pose a threat, though the immediate effect may be limited to a few low-lying places.

Flash floods from glacier run-offs will be a peril for those in the Himalayan region.

Unpredictable monsoon, leading to not just high precipitation, but also water-shortage is also another factor to consider for some regions.

How to manage

While the prediction is dire, there are at least three ways in which you can tackle these risks from a housing perspective. The first line of defence is to consider locations that are relatively safer.

For example, you can refer to the vulnerability atlas of India (https://vai.bmtpc.org/) published by the Building Materials and Technology Promotion Council . However, it is likely that you may have limited options in picking a location, due to career or other considerations.

You can still find places in the city that are not low-lying, have better water drainage systems and choose homes that are built on an elevation. Be sure to inspect the area during the monsoon to see how it fares.

Even with that, you must buy insurance to cover for any damages.

Your losses can run high — the 2015 Chennai floods led to total claims of about ₹4,800-5,000 crore and the Uttarakhand flash floods saw insurance companies paying out claims amounting to ₹1,500 crore.

Flood insurance is a subpart of regular home insurance, and if there is potential for flood, you must opt for it. Make sure the insurance cover is comprehensive and includes multiple calamities. In general, there are two types of cover – structural and content.

While content plan typically covers damages to possessions due to fire and flood, structural coverage also includes damage to structure due to storm, lightning and others.

Given that the losses may be high, do not skimp on the insured amount.

Also, make it a point to check the amount during renewal, as it may alter over the years, based on the policy. For instance, the plan may be based either on the reinstatement value or on the market value of the property to be insured.

The former considers the cost of re-constructing the structure after damage while the later deducts depreciation, based on the usage of the building.

Four, pay attention to the thermal comfort of the home. This includes analysing the layout of the house, green cover and choice of building materials used.

These factors can together make it cooler by a few degrees. You can also look at solar and wind power solutions, to reduce your power bill.

The author is an independent financial consultant

[ad_2]

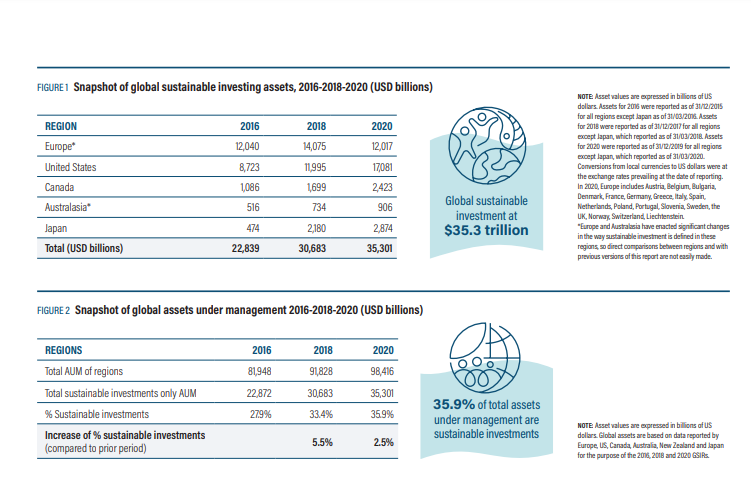

Source: Global Sustainable Investment Alliance

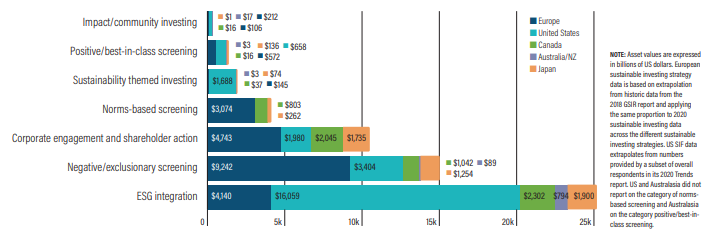

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

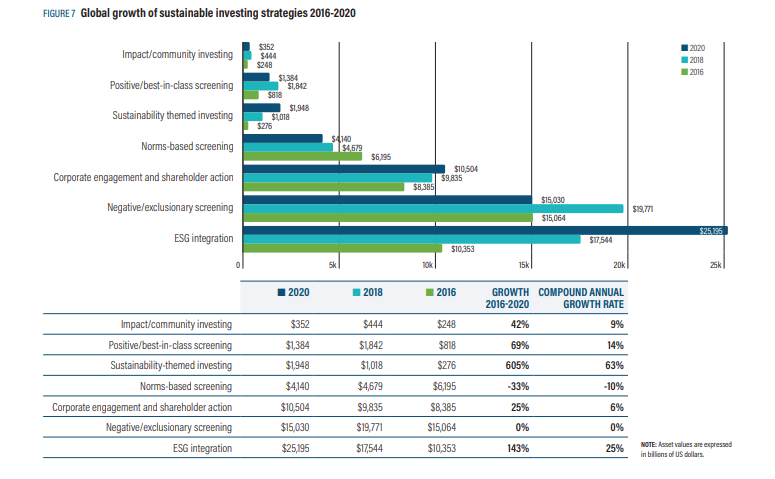

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)