Citigroup Inc.’s new Chief Executive

Jane Fraser is facing an

Asia question handed down to her from predecessor Mike Corbat’s time: What to do about the consumer banks?

Out of the 19 that Citi operates globally, 12 are in the Asia-Pacific region. When Corbat took over as CEO in 2012, the unit — which now also includes five smaller consumer banks in Europe, the Middle East and Africa — was pulling in half the firm’s Asia net income. Over the next seven years, the institutional clients group, which houses the corporate and investment banks, powered ahead and became twice as profitable as the stagnant consumer franchise. Some investors began to ask if it was time to exit.

My view then was, “Don’t do it.” It was too early to give up on the Asian consumer. But the pandemic has changed the math. Consumer banking in South Korea, the Philippines, Thailand and Australia is under review. Even in India, where Citi is the largest foreign bank, the retail business might be spun off, according to local media reports.

Covid-19 hit Citi with $17.5 billion in credit losses and allowances, two-thirds of which were in global consumer banking. A $900 million payment erroneously sent to Revlon Inc.’s lenders shaved off 0.3 percentage point from last year’s 6.9% overall return on tangible common equity, leaving it woefully short of the 14% return at JPMorgan Chase & Co.

Fraser wants to unlock value by simplifying the firm like “any true Scot,” she says. It’s about time. After a subprime crisis, a pandemic, and years of repair work in between, Citi shares are 55% lower than in September 2008. In the same period, Jamie Dimon at JPMorgan has quadrupled the stock price.

Still, if Citi goes under the knife, it will be more facelift than amputation. The well-heeled among Asian consumers will still remain important to a Citi shorn of consumer banking.

The first woman to lead a major Wall Street institution is planning a big push into wealth management. Asia is Fraser’s best bet. Even HSBC Holdings Plc, which is scaling down its ambitions in North America and continental Europe, is pivoting to the region to grab the same opportunity.

Among “glocals,” or global banks servicing local Asian economies, Citi has a better chance of making it in the post-pandemic landscape than HSBC. (With return on tangible equity down in the dumps at 3%, Standard Chartered Plc isn’t even in the race.) That’s because its access to Asia’s wealthy isn’t restricted to Hong Kong, HSBC’s traditional stronghold and the source of much of its current grief because of China’s incursions into the city’s autonomy.

Citi has pan-Asian heft, garnering about 30% of its revenue in the region from ASEANnations. Rapid digitization in Southeast Asia was shaking the economics of physical branch networks for all lenders. And that was before Covid-19 sparked a work-from-home megatrend. An asset-light banking model could work, as long as affluent customers don’t fall through the cracks.

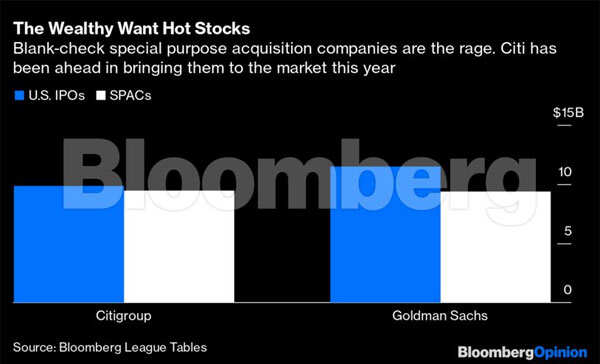

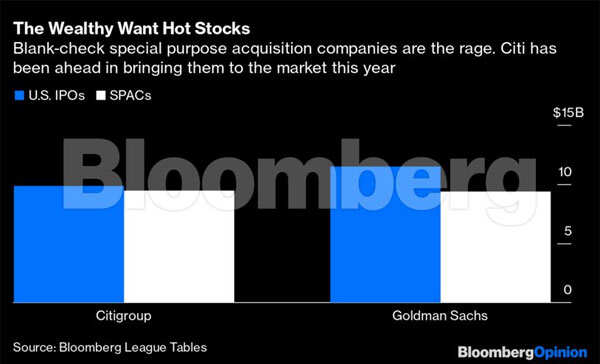

Rich people do business everywhere. Citi taps them via the plumbing of commerce: by supporting their firms in everything from cash management to fund-raising across 96 countries where it has boots on the ground. The quarter of the world’s billionaires who are its private-banking clients won’t exactly fret if some ATMs in Manila or Mumbai disappear. They want access to hot initial public offers — Citi and Goldman Sachs Group Inc. are running neck and neck in underwriting U.S. IPOs this year. With almost $9.5 billion of deals so far in 2021, Citi is also leading the global craze for blank-check special purpose acquisition companies, or SPACs.

Unlike JPMorgan, Morgan Stanley or HSBC, Citi doesn’t have a large asset management arm. So it offers a wider menu of funds from many firms even to the customer with $100,000 to invest. Its broader wealth operation is being merged with the private bank. To put millionaires and billionaires under one roof is a much required simplification, especially in a region where a new affluent class is climbing the ladder rapidly as their businesses become multinationals. This is something that the pandemic hasn’t slowed.

Citi’s wealth unit added net new client assets of $20 billion in Asia last year, taking its total to $310 billion, which puts it behind only the Swiss heavyweights, UBS AG and Credit Suisse Group AG.

As long as Citi retains the consumer banks in the marquee financial centers of Singapore and Hong Kong, it can redeploy capital from other Asian markets to improve returns. On her first day as CEO this month, Fraser made the commitment to achieving net-zero greenhouse-gas emissions in financing by 2050, which should get the stock some new love from environmentally conscious funds. Share buybacks, through which the lender has returned $65 billion to investors since 2015, have resumed.

Before the financial crisis, Morgan Stanley worried if its Dean Witter brokerage would get crushed by Citi making a play for UBS. After the 2008 turmoil, Citi’s prized Smith Barney unit fell into Morgan Stanley’s lap. There’s no such pressure now. The balance sheet has weathered the pandemic and dodged the Revlon blow. Overhauling controls to satisfy regulators is the priority. While attending to it, Fraser has to bulk up in wealth — even if that means trimming branches in Asia, and issuing fewer credit cards and mortgages. For the world’s last surviving global bank to remain standing, the Scot in the corner office has to unsheathe the claymore. With luck, she’ll only need to prune the hedges.