– By Tarika Sethia

They are not just young but their choices are too unusual. While the traditional investors are still confused over cryptocurrency, millennials have already found solace in it.

Millennials investing in crypto

Vartika, a 28-year-old girl living in Mayur Vihar, Delhi, has seen hundreds of videos on YouTube which are related to cryptocurrency investments. She has invested in bitcoin and also made some money.

“I understood what cryptocurrency is by watching videos and decided to invest in it,” she said.

Around one crore investors are holding over $ 1 billion of cryptocurrency investments in India and the majority of them are millennials.

About 62% of users at WazirX, India’s biggest cryptocurrency exchange, are below 34 years of age. According to CoinDCX’s report titled ‘Mood of the Nation- 2020’, 71% of respondents below the age of 35 had invested in crypto at least once.

According to the CNBC Millionaire survey, more than 33% of millionaire investors belonging to the millennial generation have over half their wealth in cryptocurrencies. As mainstream and quotidian as it gets, it becomes essential to ask why some Indian millennials are throwing all their savings into a volatile virtual currency that they cannot afford to lose or is it just an alternate investment.

Cryptocurrency and Millennials

All these numbers shed light on the curious eyes of the millennial demography. The notion of crypto being a young person’s asset choice isn’t a farce. However, the question remains, why? While the equity markets were touching fresh lows each day during the Covid lockdown in 2020, cryptocurrencies kept rallying. It was 2020 when many began surfing the crypto wave. Work from home expanded the opportunity to do more than just work and allowed some free time to people leading to huge clamour for ‘meme’ stocks on social media. Fear Of Missing Out (FOMO) has made millennials dash for a chunk of the crypto pie.

Two things are attracting millennials towards cryptocurrencies. First, everything is digital and can be processed seamlessly on the smartphone. Second, it fetches high returns which no other asset class seems to offer.

“I have done my calculations. There are high chances that I will earn far more than what I invest,” said Syed, a 25-year-old intern in a private company.

Living in a digital world, convenience leaves millennials drooling. With copious platforms emerging for crypto trading and each one of them innovating to provide a better user experience, investing and trading has become easier. Brisk KYC to instant crypto purchases, investing in digital currency has become swift and seamless. It is the gift of having everything at your fingertip.

Millennials are not risk-averse

With skyrocketing growth and hard-hitting falls, cryptocurrencies are not for the risk-averse. Millennials are still young enough to afford risking a part of their investment into highly oscillating asset classes, as advised by financial advisors and influencers on Instagram and YouTube. This isn’t very fresh advice but has always lingered in the investment world. However, now it has welcomed a new asset class. This ideology served with the appeal of building wealth faster encourages this bracket to run towards crypto.

Cryptocurrency and regulations

Neither the government nor the regulator has taken any firm stand on cryptocurrencies yet. The crypto exchanges are trying their best to convince the regulator. While India’s central bank has clearly stated that they have issues against cryptocurrency, the Finance Ministry has a different view.

“We want to make sure there is a window available for all kinds of experiments which will have to take place in the crypto world. The world is moving fast with technology. We cannot pretend we don’t want it,” said, Nirmala Sitharaman, Finance Minister.

Cryptocurrency and Global Push

The virtual currency has been dancing over tweets and has even attracted eyeballs of governments from El Salvador to India.

The curiosity about crypto is all over the world. It reached a new high when Tesla founder Elon Musk joined the race. In fact, after a drastic fall, Bitcoin soared this week after Musk’s tweets again favour the crypto.

Moreover, the European Investment Bank (EIB) issued its first digital bond on the Ethereum blockchain, in April this year. Richard Teichmeister, the head of funding at the EIB called the blockchain technology “revolutionary”. Dogecoin that started as a meme currency shot up in value when the tech billionaire Elon Musk tweeted about it.

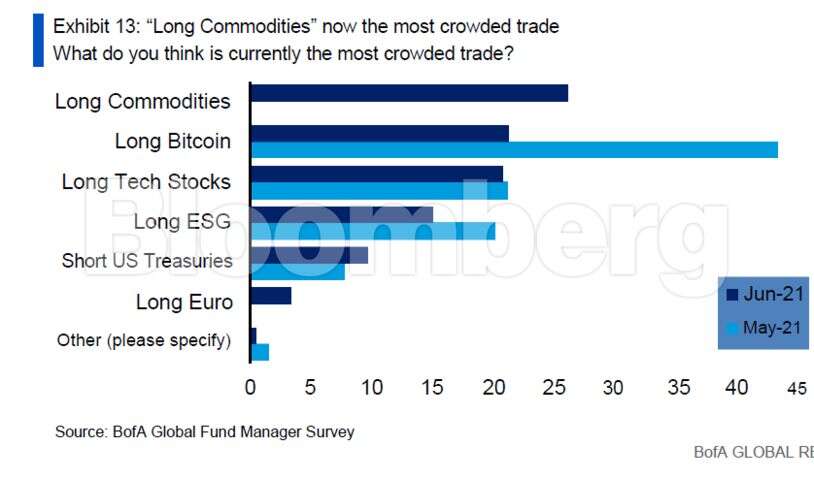

Other highlights from survey, which was conducted June 4 to 10, include:

Other highlights from survey, which was conducted June 4 to 10, include: