Which sectors may lead and which ones may lag now, BFSI News, ET BFSI

[ad_1]

Read More/Less

The index consolidated in a broad but defined range, as it dragged the resistance points lower. Following a stable but corrective week, the headline index closed with a net loss of 321 points (-1.80 per cent).

From a technical perspective, Nifty has marked the 17,900-17,950 zone as an intermediate top. This also gets reflected in the Options data, which shows highest Call Open Interest at strike price 18,000 after heavy Call writing activities. The previous five days saw the formation of a broad trading range in the 17,400-17,950 area. Unless the market violates either of these two points, the index should continue to oscillate in this broad range. Any major slippage below the 17,400 level will be damaging for the market.

Following heavy Put writing at 17,400 and 17,500 levels, strike price 17,500 showed highest Put OI. The coming week is likely to see Nifty attempt to stabilise with a positive bias. The 17,650 and 17,750 levels will act as potential resistance points, while support will come in at 17,400 and 17,310 levels.

The weekly RSI stood mildly overbought at the 73.30 level. The RSI was neutral and did not show any divergence against the price. The weekly MACD continued to be bullish and traded above the Signal Line. A large Black Body emerged on the candles; it reflected the directional consensus among the market participants that prevailed during the week.

Pattern analysis showed Nifty was well above the upper rising trend line support. In the event of continued corrective activity, if Nifty tests this trend line support, the next support may emerge in the 17,350-17,400 area. This trend line is drawn from the low point of March 2020 and joins the subsequent higher bottoms.

All in all, it is largely expected that while defending the 17,350-17,400 zone, Nifty may stay in a defined range and continue to consolidate. The most recent price action saw Nifty’s supports being dragged lower to 17,800 from 17,950 level. So, the 17,800 level will be the most immediate resistance if Nifty attempts to gain some stability and pulls itself back.

Over the coming days, we expect a selective sectoral outperformance in the market. There are higher chances that select banks, auto, pharma and PSE stocks will continue to do well. Shorts should be avoided and purchases must be kept highly stock-specific in the coming week.

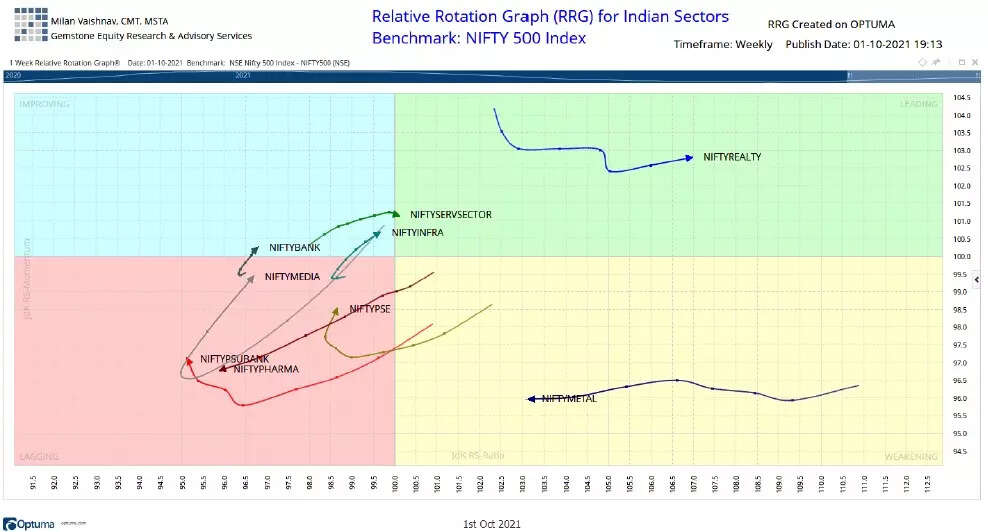

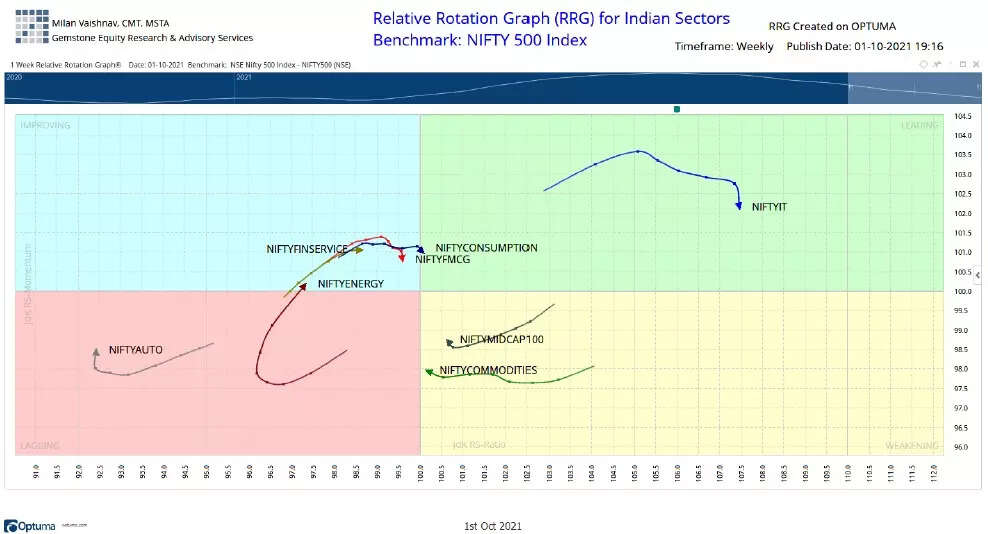

In our look at Relative Rotation Graphs®, we compared various sectoral indices against CNX500 (Nifty500 Index), which represents over 95 per cent of the free float market cap of all the listed stocks. The analysis showed a lot of inherent strength in the market. The IT and Realty Indices are placed inside the leading quadrant. Apart from this, Nifty Energy Index and the Bank Nifty have rolled inside the improving quadrant. This showed their likely relative underperformance against the broader market.

Along with this, Media, Private Banks, PSE, PSU Bank and Auto Indices are all trading inside the lagging quadrant. However, all these indices are showing a very distinct improvement in their relative momentum against the broader Nifty500 Index. All these groups are likely to put up a resilient show over the coming days. The Nifty Services Sector Index has rolled inside the improving quadrant, while Nifty Commodities and the Metal indices are inside the weakening quadrant. They show no sign of any improvement in their relative momentum. Some stock-specific isolated performances may be seen, but the indices are likely to relatively underperform the broader market.

Important Note: The RRG™ charts show the relative strength and momentum in a group of stocks. In the above chart, they show relative performance against the Nifty500 Index (broader market) and should not be used directly as buy or sell signals.

(Milan Vaishnav, CMT, MSTA, is a Consulting Technical Analyst and founder of EquityResearch.asia and ChartWizard.ae and is based at Vadodara. He can be reached at milan.vaishnav@equityresearch.asia)

[ad_2]