The Monetary Policy Committee (MPC) met on 2nd, 3rd and 4th, June 2021 and took stock of the evolving macroeconomic and financial conditions as well as the impact of the second wave of the pandemic. Based on its assessment, the MPC voted unanimously to maintain status quo, keeping the policy repo rate unchanged at 4 per cent. The MPC also decided unanimously to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. The marginal standing facility (MSF) rate and the bank rate remain unchanged at 4.25 per cent. The reverse repo rate also remains unchanged at 3.35 per cent.

2. Since the MPC’s April meeting, the second wave of COVID-19 has surged across several states and spread into smaller towns and villages, leaving a trail of human misery and tragedy in its wake. Yet in these days of trials and travails, it is vital to remain focused on vanquishing the virus. Tough times call for tough choices and tough decisions to emerge triumphant. It is said that storms make trees take deeper roots. I am convinced that as we stretch our endurance to eradicate the virus, it will bring out the finest aspects of human character and capability. I am reminded here of a quote attributed to the Greek philosopher Epictetus: “The greater the difficulty, the more glory in surmounting it…”1.

3. Let me begin by setting out the underlying rationale of the MPC’s decision. Provisional estimates of national income released by the National Statistical Office (NSO) on May 31, 2021 placed India’s real gross domestic product (GDP) contraction at 7.3 per cent for 2020-21, with GDP growth in Q4 at 1.6 per cent (y-o-y). The forecast of a normal south-west monsoon, the resilience of agriculture and the farm economy, the adoption of COVID compatible operational models by businesses, and the gathering momentum of global recovery are forces that can provide tailwinds to revival of domestic economic activity when the second wave abates. On the other hand, the spread of COVID-19 infections in rural areas and the dent on urban demand pose downside risks. Ramping up the vaccination drive and bridging the gaps in healthcare infrastructure and vital medical supplies can mitigate the pandemic’s devastation.

4. The inflation print for April at 4.3 per cent has brought with it some relief and policy elbow room. A normal south-west monsoon along with comfortable buffer stocks should help to keep cereal price pressures in check. On the other hand, the rising trajectory of international crude prices within a broad-based surge in international commodity prices and logistics costs is worsening cost conditions. These developments could keep core price pressures elevated, although weak demand conditions may temper the pass-through to consumer inflation.

5. On balance, the MPC was of the view that at this juncture, policy support from all sides is required to regain the momentum of growth that was evident in H2:2020-21 and to nurture the recovery after it has taken root. Accordingly, the MPC decided to keep the policy rate at its current level of 4 per cent and to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

Assessment of Growth and Inflation

Growth

6. The second wave of COVID-19 is associated with unexpectedly higher rates of morbidity and mortality relative to the first wave. The break out of mutant strains that render the virus highly transmissible across both urban and rural areas has led to fresh restrictions on activity being imposed across a large swath of the country. Yet unlike in the first wave, when the economy came to an abrupt standstill under a nation-wide lockdown, the impact on economic activity is expected to be relatively contained in the second wave, with restrictions on mobility being regionalised and nuanced. Moreover, people and businesses are adapting to pandemic working conditions.

7. Urban demand, as reflected in some high frequency indicators – electricity consumption; railway freight traffic; port cargo; steel consumption; cement production; e-way bills; and toll collections – recorded sequential moderation during April-May 2021 as manufacturing and services activity weakened due to restrictions/lockdowns imposed by most states. Mobility indicators have declined during April-May, but they remain above the levels seen during the first wave last year. Domestic monetary and financial conditions remain highly accommodative and supportive of economic activity. Moreover, the vaccination process is expected to gather steam in the coming months and that should help to normalise economic activity.

8. With external demand strengthening, a rebound in global trade is taking hold, which should support India’s export sector. Global demand conditions are expected to improve further buoyed by fiscal stimulus packages and the fast progress of vaccination in advanced economies. India’s exports in March, April and May 2021 have launched into an upswing. Conducive external conditions are forming for a durable recovery beyond pre-pandemic levels. The need of the hour is for enhanced and targeted policy support for exports. It is opportune now to give further policy push by focusing on quality and scalability.

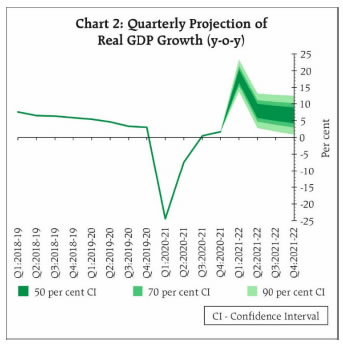

9. Notwithstanding the sequential decline of the indicators of rural demand in April, rural demand is expected to remain strong as forecast of a normal monsoon bodes well for sustaining its buoyancy going forward. The increased spread of COVID-19 infections in rural areas, however, poses downside risks. Taking all these factors into consideration, real GDP growth is now projected at 9.5 per cent in 2021-22 consisting of 18.5 per cent in Q1; 7.9 per cent in Q2; 7.2 per cent in Q3; and 6.6 per cent in Q4 of 2021-22.

Inflation

10. Turning to the outlook for inflation, the favourable base effects that brought about the moderation in headline inflation by 1.2 percentage points in April, may persist through the first half of the year, conditioned by the progress of the monsoon and effective supply side interventions by the Government. Upside risks to inflation emanate from persistence of the second wave and consequent restrictions on activity on a virtually pan-India basis. In such a scenario, insulating prices of essential food items from supply side disruptions will necessitate active monitoring and preparedness for coordinated, calibrated and timely measures by both Centre and states to prevent emergence of supply chain bottlenecks and increase in retail margins.

11. Taking into consideration all these factors, CPI inflation is projected at 5.1 per cent during 2021-22: 5.2 per cent in Q1; 5.4 per cent in Q2; 4.7 per cent in Q3; and 5.3 per cent in Q4 of 2021-22, with risks broadly balanced.

Liquidity and Financial Market Guidance

12. The foremost endeavour of the Reserve Bank throughout the pandemic has been to create conducive financial conditions so that financial markets and institutions keep functioning normally. Accordingly, adequate system level liquidity has been ensured and targeted liquidity to stressed institutions and sectors has been provided. As a result, borrowing costs and spreads have been reduced to historic lows. This has incentivised a record amount of private borrowing through corporate bonds and debentures in FY2020-21. Reserve money rose by 12.4 per cent (y-o-y)2 as on May 28, 2021, while money supply (M3) grew by 9.9 per cent (y-o-y) (as on May 21), and bank credit by 6.0 per cent (y-o-y) (as on May 21). G-SAP operations and some instances of cancellations, devolvement and exercise of greenshoe options in G-Sec auctions have conveyed the Reserve Bank’s views to the market. With the second wave intensifying this financial year, the focus of the Reserve Bank is increasingly turning from systemic liquidity to its equitable distribution. In fact, the enduring lesson from the experience of the pandemic in the Indian context has been the deployment of unconventional monetary policy measures that distribute liquidity among all stakeholders. We shall continue with our proactive and pre-emptive approach, relying on market-based channels of transmission as we strive to mitigate the toll of the pandemic and return the economy to a path of high and durable growth.

13. The auctions under G-SAP 1.0 have evoked keen interest from market participants, with bid cover ratios of 4.1 and 3.5, respectively, in the two auctions undertaken so far. The timing of the second auction was aimed towards replenishing the drainage of liquidity due to the restoration of the cash reserve ratio (CRR) to its pre-pandemic level of 4 per cent of net demand and time liabilities (NDTL), effective May 22, 2021. In addition, the redemption of government securities worth around ₹52,000 crore during the last week of May fully neutralised the CRR restoration. The positive externalities associated with G-SAP 1.0 operations are reflected in other financial market segments, notably corporate bonds and debentures. Interest rates on commercial paper (CP), 91-day treasury bills, and certificates of deposit (CDs) also remained low and range bound.

14. In my statement of April 7, 2021, I had indicated that in addition to G-SAP, the Reserve Bank will continue to deploy regular operations under the LAF, longer-term repo/reverse repo auctions, forex operations and open market operations, including special OMOs, to ensure that liquidity conditions evolve in consonance with the stance of monetary policy and financial conditions remain supportive for all stakeholders. During the current year so far, the Reserve Bank has undertaken regular OMOs and injected additional liquidity to the tune of ₹36,545 crore (up to May 31) in addition to ₹60,000 crore under G-SAP 1.0. A purchase and sale auction under operation twist has also been conducted on May 6, 2021 to facilitate the smooth evolution of the yield curve. Going forward, the Reserve Bank will continue to conduct regular operations for liquidity management.

15. Taking these developments into account, it has now been decided that another operation under G-SAP 1.0 for purchase of G-Secs of ₹40,000 crore will be conducted on June 17, 2021. Of this, ₹10,000 crore would constitute purchase of state development loans (SDLs). It has also been decided to undertake G-SAP 2.0 in Q2:2021-22 and conduct secondary market purchase operations of ₹1.20 lakh crore to support the market. The specific dates and securities under G-SAP 2.0 operations will be indicated separately. We do expect the market to respond appropriately to this announcement of G-SAP 2.0.

16. After a risk-off period of retrenchment in April-May, the prospects for capital flows to India are improving again. While these flows ease external financing constraints, they also impart volatility to financial markets and asset prices, while producing undesirable and unintended fluctuations in liquidity that can vitiate the monetary policy stance. This has necessitated countervailing two sided interventions by the Reserve Bank in spot, forward and futures markets to stabilise financial market and liquidity conditions so that monetary policy retains its domestic orientation and the independence to pursue national objectives. Thus, the Reserve Bank actively engages in both purchases and sales in the foreign exchange market and its various segments. The success of these efforts is reflected in the stability and orderliness in market conditions and in the exchange rate in spite of large global spillovers. In the process, strength is imparted to the country’s balance sheet by the accumulation of reserves.

17. Yet another issue that has generated wide-ranging interest and discussion among economists, market participants and analysts is the role and nature of our forward guidance. As you would recall, in April the MPC had decided on state-based rather than time-based forward guidance, recognising that it is difficult in the context of the pandemic to perfectly foresee how the economy evolves and when the economic recovery gets firmly entrenched. Amidst such all-pervasive uncertainty, the Reserve Bank will continue to use all instruments at its command and work to revive and sustain growth on a durable basis. Needless to add, the consistency and credibility of our communications are reinforced by our visible actions.

18. I would like to emphasise that in the whole process of fighting against the pandemic, the strength of the financial system is very crucial. Building adequate provisioning and capital buffers, together with sound corporate governance in financial entities, have become much more important than ever before, more so in the context of banks and NBFCs being at the forefront of our efforts to mitigate the economic impact of COVID-19. The Reserve Bank remains fully committed to creating an enabling environment in which a sound and efficient financial sector flourishes while preserving financial stability.

Additional Measures

19. Against this backdrop and based on our continuing assessment of the macroeconomic situation and financial market conditions, certain additional measures are being announced. The details of these measures are set out in the statement on developmental and regulatory policies (Part-B) of the Monetary Policy Statement. The additional measures are as follows.

On-tap Liquidity Window for Contact-intensive Sectors

20. In order to mitigate the adverse impact of the second wave of the pandemic on certain contact-intensive sectors, a separate liquidity window of ₹15,000 crores is being opened till March 31, 2022 with tenors of up to three years at the repo rate. Under the scheme, banks can provide fresh lending support to hotels and restaurants; tourism – travel agents, tour operators and adventure/heritage facilities; aviation ancillary services – ground handling and supply chain; and other services that include private bus operators, car repair services, rent-a-car service providers, event/conference organizers, spa clinics, and beauty parlours/saloons. By way of an incentive, banks will be permitted to park their surplus liquidity up to the size of the loan book created under this scheme with the Reserve Bank under the reverse repo window at a rate which is 25 bps lower than the repo rate or, termed in a different way, 40 bps higher than the reverse repo rate.

Special Liquidity Facility to SIDBI

21. To nurture the still nascent growth impulses and ensure continued flow of credit to the real economy, the Reserve Bank had extended fresh support of ₹50,000 crore on April 7, 2021 to All India Financial Institutions (AIFIs) for new lending in 2021-22. This included ₹15,000 crore to the Small Industries Development Bank of India (SIDBI). To further support the funding requirements of micro, small and medium enterprises (MSMEs), particularly smaller MSMEs and other businesses including those in credit deficient and aspirational districts, it has been decided to extend a special liquidity facility of ₹16,000 crore to SIDBI for on-lending/ refinancing through novel models and structures. This facility will be available at the prevailing policy repo rate for a period of up to one year, which may be further extended depending on its usage.

Enhancement of the Exposure Thresholds under Resolution Framework 2.0

22. The Resolution Framework 2.0 announced by the Reserve Bank on May 5, 2021 provides for resolution of COVID-19 related stress of MSMEs as well as non-MSME small businesses, and loans to individuals for business purposes. With a view to enabling a larger set of borrowers to avail of the benefits under Resolution Framework 2.0, it has been decided to expand the coverage of borrowers under the scheme by enhancing the maximum aggregate exposure threshold from ₹25 crore to ₹50 crore for MSMEs, non-MSME small businesses and loans to individuals for business purposes.

Placement of Margins for Government Securities Transactions on behalf of FPIs

23. The Reserve Bank has been taking several measures to encourage investments by Foreign Portfolio Investors (FPIs) in the Indian debt market. With a view to easing operational constraints faced by FPIs and promoting ease of doing business, it has been decided to permit Authorized Dealer banks to place margins on behalf of their FPI clients for their transactions in Government securities (including State Development Loans and Treasury Bills), within the credit risk management framework of banks.

Facilitating Flexibility in Liquidity Management by Issuers of Certificates of Deposit

24. In December 2020, Regional Rural Banks (RRBs) were permitted to access the liquidity windows of the Reserve Bank as well as the call/notice money market in order to facilitate more efficient liquidity management by the RRBs at competitive rates. To provide greater flexibility in raising short term funds by RRBs, it has now been decided to permit RRBs to issue Certificates of Deposit (CDs). It has also been decided that all issuers of CDs will be permitted to buy back their CDs before maturity, subject to certain conditions. This will facilitate greater flexibility in liquidity management.

Availability of National Automated Clearing House (NACH) on all days of the week

25. NACH, a bulk payment system operated by the NPCI, facilitates one-to-many credit transfers such as payment of dividend, interest, salary, pension, etc., as also collection of payments pertaining to electricity, gas, telephone, water, periodic instalments towards loans, investments in mutual funds, insurance premium, etc. NACH has emerged as a popular and prominent mode of direct benefit transfer (DBT) to large number of beneficiaries. This has helped transfer of government subsidies during the present COVID-19 in a timely and transparent manner. In order to further enhance customer convenience, and to leverage the 24×7 availability of RTGS, NACH which is currently available on bank working days, is proposed to be made available on all days of the week effective from August 1, 2021.

26. The relevant instructions /circulars for all these measures will be issued separately.

Concluding Remarks

27. In the year gone by, the Reserve Bank has engaged in safeguarding the economy and the financial system from the ravages of the pandemic. We have been on continuous vigil – through the first wave; the lull between the waves; and now the second wave. Maintaining financial stability and congenial financing conditions for all stakeholders is a commitment that we have adhered to assiduously. The sudden rise in COVID-19 infections and fatalities has impaired the nascent recovery that was underway, but has not snuffed it out. The impulses of growth are still alive. Aggregate supply conditions have shown resilience in the face of the second wave.

28. We will continue to think and act out of the box, planning for the worst and hoping for the best. The measures announced today, in conjunction with other steps taken so far, are expected to reclaim the growth trajectory from which we have slid. Looking ahead, a policy package to consolidate India’s position as vaccine capital of the world with leadership in production of pharma products can change the COVID narrative.

29. The need of the hour is not to be overwhelmed by the current situation, but to collectively overcome it. Amidst the uncertainty and the lingering gloom, there have been many instances of rare courage and indomitable spirit, entrenching a strong faith in the future of our nation. Our resilience, conviction and hope can be best summed up in the words of Mahatma Gandhi: “I have never lost my optimism. In seemingly darkest hours hope has burnt bright within me.…..”3.

Thank you. Stay safe. Stay well. Namaskar.

(Yogesh Dayal)

Chief General Manager

Press Release: 2021-2022/317