SJVN

The Satluj Jal Vidyut Nigam, or SJVN, is an Indian government-owned company that generates and transmits hydroelectric power.

Only 0.71 percent of trading sessions in the last 11 years had intraday gains of more than 5%. The stock returned 5.47 percent over three years, compared to 96.44 percent for the Nifty Midcap 100. Over a three-year period, the stock returned 5.47 percent, whereas the S&P BSE Power provided investors a 75.42 percent gain. SJVN Ltd., founded in 1988, is a Mid Cap business in the Power sector with a market capitalization of Rs 11,082.02 crore.

SJVN Ltd. has declared an equity dividend of Rs 2.20 per share in the last 12 months. Since September 1, 2010, SJVN Ltd. has issued 19 dividends. This equates to a dividend yield of 7.8 percent at the current share price of Rs 28.20.

Steel City Securities

Steel City Securities Limited is a stockbroking firm that deals with regular investors. The company offers a wide range of financial goods and services, including mutual fund distribution, fixed income, initial public offerings (IPOs), and corporate debt, as well as securities and commodity trading.

Steel City Securities Ltd., founded in 1995, is a Small Cap business in the Financial Services industry with a market cap of Rs 90.11 crore. Stock returned -15.05 percent during a three-year period, compared to 96.41 percent for the Nifty Smallcap 100. Since March 21, 2017, Steel City Securities Ltd. has declared 13 dividends.

Steel City Securities Ltd. has issued an equity dividend of Rs 3.00 per share in the last 12 months. This equals a dividend yield of 5.03 percent at the current share price of Rs 59.65.

Choksi Imaging

Choksi Imaging Ltd., founded in 1992, is a Small Cap company in the Miscellaneous category with a market capitalization of Rs 19.60 crore. Since the last five years, the company has had no debt. Photographic items are offered by Choksi Imaging Limited. X-ray films, chemicals, and accessories, as well as ultrasound and colour doppler, are all available from the company.

Choksi Imaging Ltd., founded in 1992, is a Small Cap company in the Miscellaneous category with a market capitalization of Rs 19.60 crore. Since the last five years, the company has had no debt. Photographic items are offered by Choksi Imaging Limited. X-ray films, chemicals, and accessories, as well as ultrasound and colour doppler, are all available from the company.

Gothi Plascon

Sales have decreased by 6.41 percent. For the first time in three years, the company’s revenue has decreased. Gothi Plascon (India) Ltd., founded in 1994, is a Small Cap company in the Plastics industry with a market capitalization of Rs 25.30 crore. Since March 26, 2020, Gothi Plascon (India) Ltd. has declared two dividends. It has issued an equity dividend of Rs 1.00 per share in the last 12 months.

This equates to a dividend yield of 4.03 percent at the current share price of Rs 24.80.

Rail Vikas

Since September 6, 2019, Rail Vikas Nigam Ltd. has issued three dividends. Rail Vikas Nigam Ltd. has declared an equity dividend of Rs 2.28 per share in the last 12 months. This equates to a dividend yield of 7.52 percent at the current share price of Rs 30.30. Rail Vikas Nigam Limited is a subsidiary of Indian Railways, Ministry of Railways, Government of India, which is responsible for developing rail infrastructure for the railways.

TCFC Finance

TCFC Finance Ltd., founded in 1990, is a Small Cap business in the Financial Services industry with a market capitalization of Rs 43.82 crore. Since the last five years, the company has had no debt. The company’s annual sales increase of 772.13% surpassed its three-year compound annual growth rate of -43.79 percent. Since July 15, 2004, TCFC Finance Ltd. has declared 13 dividends.

TCFC Finance Ltd. has issued an equity dividend of Rs 1.50 per share in the last 12 months. This equates to a dividend yield of 3.65% at the current share price of Rs 41.15.

Pressman Advertising

Pressman Advertising Ltd., founded in 1983, is a Small Cap company in the Media & Entertainment sector with a market capitalization of Rs 69.98 crore. Since the last five years, the company has had no debt. In comparison to the Nifty Smallcap 100, which returned 96.41 percent over three years, the stock returned -12.65 percent. In comparison to the Nifty Smallcap 100, which returned 96.41 percent over three years, the stock returned -12.65 percent.

Sumedha Fiscal

In the fiscal year ended March 31, 2021, PrCompany generated an ROE of 18.44 percent, surpassing its five-year average of 8.65 percent. Revenue increased by 57.41 percent year over year, the greatest in the prior three years. The stock returned 39.52 percent over three years, compared to 96.41 percent for the Nifty Smallcap 100. The company’s yearly sales growth of 10.59 percent surpassed its three-year compound annual growth rate (CAGR) of -2.65 percent.

Jullundur Motor

Since the last five years, the company has had no debt. Revenue fell 47.73 percent on a quarter-over-quarter basis, the lowest level in the last three years. The stock returned 95.01 percent over three years, compared to 96.41 percent for the Nifty Smallcap 100. Over a three-year period, the stock returned 95.01 percent, while the Nifty Auto provided investors a 26.87 percent return.

Jullundur Motor Agency (Delhi) Ltd., founded in 1948, is a Small Cap company in the Auto Ancillaries sector with a market cap of Rs 144.70 crore.

B N Rathi Securities

B N Rathi Securities Ltd., founded in 1985, is a Small Cap firm in the Financial Services industry with a market capitalization of Rs 19.20 crore. In the fiscal year ended March 31, 2021, the company generated a return on equity of 14.64 percent, surpassing its five-year average of 11.21 percent. Annual sales growth of 25.3 percent surpassed the company’s three-year CAGR of 3.65 percent. The stock returned 35.33 percent over three years, compared to 96.41 percent for the Nifty Smallcap 100.

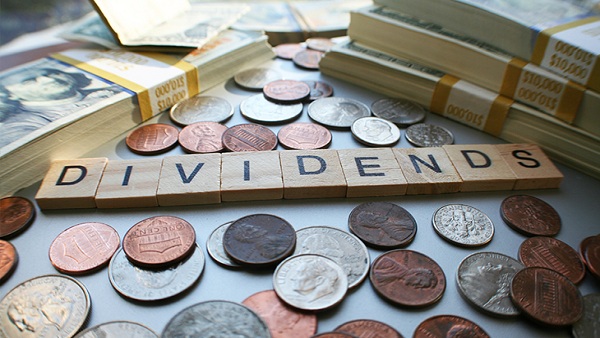

10 Best Dividend-Paying Penny Stocks In India

| Company |

Price in Rs |

Dividend Yield |

| SJVN |

28.20 |

7.8% |

| Steel City Securities |

60.15 |

4.99% |

| Choksi Imaging |

50.50 |

4.95% |

| Gothi Plascon |

26 |

3.85% |

| Rail Vikas |

30.15 |

7.56% |

| TCFC Finance |

41.15 |

3.65% |

| Pressman Advertising |

29.35 |

3.44% |

| Sumedha Fiscal |

30.75 |

3.25% |

| Jullundur Motor |

63.40 |

3.15% |

| B N Rathi Securities |

39.10 |

3.07% |

Disclaimer

Please note investing in penny stocks is subject to market risks and one needs to be cautious at this point of time as markets have gone-up sharply. Neither the author, nor Greynium Information technologies Pvt Ltd would be responsible for losses incurred based on a decision made from this article.