2 Top Ranked Flexi Cap Fund By CRISIL To Initiate SIP In Now

[ad_1]

Read More/Less

All About Flexicap mutual funds

What led to the origin of ‘Flexi cap fund’ category?

Typically to tackle the new mandate with regard to multi-cap fund, the flexi cap fund saw its origin. As per the SEBI mandate, without any specific guidelines on allocation to the categories, there is given that at least 65% of the corpus needs to be invested in equity and equity related investments.

Flexi-cap fund: Suitable for whom?

Those investors who want to bet across market caps and but do not want to engage in regular decision of category-wise allocation, can go about adding flexi cap fund to their category.

Features of flexi cap funds

1. Offer higher liquidity with no allocation guidelines to be adhered or complied with. Fund manager can rework the portfolio considering the market dynamics.

2. Allows investor to not only chip in good quality stocks but also allows them the way to exit non-performing stocks.

3. Steady returns can be expected during the bearish market sentiment.

Why should you allocate your funds to flexi cap mutual funds?

In the equity market space, there is relative difference in performance across market caps and with no inbuilt curbs here fund manager based on their experience and understanding of the market dynamics can freely go about allocating funds across market caps for highest potential gains. Also, the remaining 35% corpus depending on the market mood can be allocated in debt, held in cash or can be deployed to take international exposure.

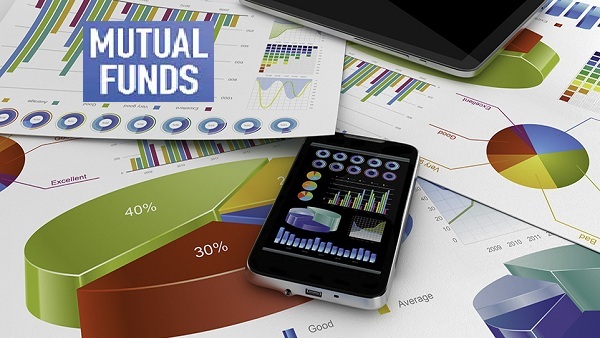

2 Flexi-cap fund accorded Rank 1 By Crisil with their Return performance

Crisil, an S&P Global company, is also into ranking mutual funds. And as per the CRISIL site, the rating agency’s CRISIL Mutual Fund Ranking (CMFR) is based on global best practices. The facility launched in June 2000 has gained high acceptance among investors, intermediaries and asset management companies.

For the ranking, CRISIL employs a mix of NAV as well as portfolio based attributes for evaluation. This provides a single point analysis of mutual funds, taking into consideration key parameters such as risk-adjusted returns, asset concentration, liquidity and asset quality.

The ranks are assigned on a scale of 1 to 5, with CRISIL Fund Rank 1 indicating ‘very good performance’. In any peer group, the top 10 percentile of funds are ranked as CRISIL Fund Rank 1 and the next 20 percentile as CRISIL Fund Rank 2.

| Flexi cap funds | CRISIL Ranking | 1-year SIP Annualised return | 3-year SIP Annualised return | 5-year SIP Annualised return |

|---|---|---|---|---|

| PGIM India Flexi Cap fund | Rank 1 or 5 Star rating | 69.59% | 42% | 27% |

| UTI Flexi Cap fund | Rank 1 or 5 Star rating | 60.96% | 37% | 25.5% |

Disclaimer:

Investing in mutual funds is risky and investors need to be cautious. Neither Greynium Information Technologies nor the author would be responsible for any losses incurred based on decisions made from the article. Investors are also advised caution as the markets have closed at an historic high.

[ad_2]