Short of lending targets, banks seek priority sector tag for retail, infrastructure, BFSI News, ET BFSI

[ad_1]

Read More/Less

This comes as most lenders are struggling to meet their priority sector targets with premium on lending certificates rising by almost 200 basis points in the last one year. At present only, regional rural banks or RRBs are suppliers of priority sector lending credit.

“We have had informal discussions with the Reserve Bank of India, and have made representation to the government as well,” said a bank executive, aware of the developments, adding that there was a need to broaden the priority sector.

At present lending towards eight sectors including agriculture, micro and small medium enterprises, export credit, housing, education, renewable energy and social infrastructure is considered eligible for priority sector loans. Commercial lenders have to mandatorily deploy 40% of their adjusted net bank credit (ANBC) towards these sectors, of which 18% is allocated towards agriculture.

The latest data from RBI indicates that overall priority sector lending for scheduled commercial banks stood at 40.54% in 2020-21 (as at the end of December 2020) even though there was a marginal shortfall for private sector and foreign banks.

“There are various subcategories within this structure and most banks are unable to meet these requirements and hence there is a need to identify new potential sectors,” the above quoted executive said adding that most big lenders resort to buying priority sector lending certificates (PSLCs) to meet their regulatory requirements. A bank running short of meeting targets can purchase priority sector lending certificates from a lender having surplus for a fee.

“Today, only regional rural banks (RRBs) are suppliers of PSLC and most sponsoring banks buy it from their RRBs,” he said, adding that non-banking finance companies or NBFCs also have underwriting limitations.

The total trading volume of PSLCs recorded a growth of 25.9% and stood at Rs 5.89 lakh crore in 2020-21 as compared with 43.1% growth a year ago.

[ad_2]

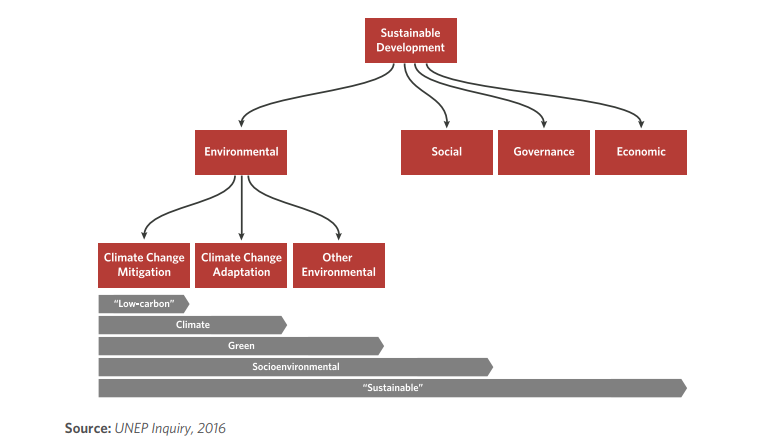

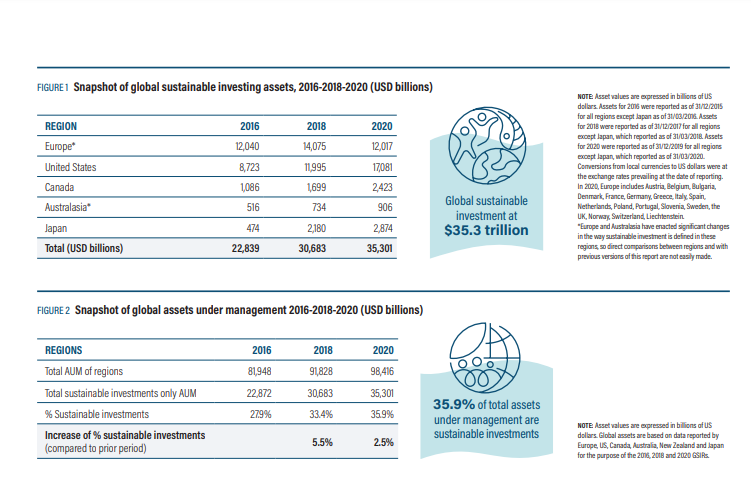

Source: Global Sustainable Investment Alliance

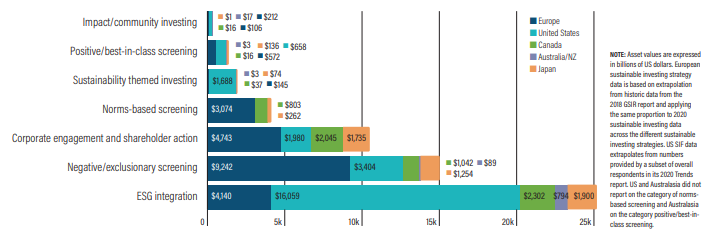

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

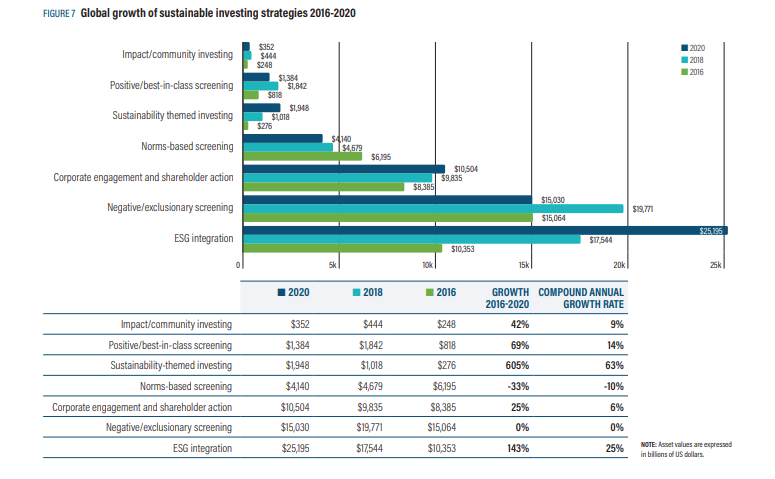

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)