As far as Indian equity markets are concerned, the million-dollar question is valuations. Benchmark indices have soared so far this year and remain near lifetime highs. Last week UBS gave a pessimistic view on how much further equity indices could climb and speculation is rife that indices are set for a correction. Lav Chaturvedi, Chief Executive Officer and Executive Director, Reliance Securities, believes that there is an upside of 10 per cent by the end of the financial year. In a candid chat with ETMarkets.com, Chaturvedi explains his rationale. Edited excerpts:

My first question is about valuations. Nifty, Sensex both are at lifetime highs. Are valuations stretched? How much of an upside are you seeing for benchmark indices?

There are two aspects to it. I want to summarise and then I will answer your question specifically. Overall on the one year forward earning basis, the market is at around 30-35% premium which is from 18x to 23x. That is the multiple that we are at. However, having said that, there are still some components which are included in benchmark Nifty in recent years like HDFC Life, SBI Life, Shree Cements carry higher P/E multiple than excluded stocks. Hence, a part of the premium has come from there. Further, improved visibility of earnings rebound post second wave of Covid-19 resulted in higher premium for the market and also from the market cap to GDP perspective.

We further note that the spread between G-Sec yield and Nifty earnings yield has gone up to historical average of 190bps, which may be a cause of concern for the near term. Overall though, the markets have run up and from here on, we would probably see another 10% jump towards the fiscal year end. That is something that we see. There could be some corrections along the way, the journey will have some blips but overall whoever is invested probably will see around 10% to 15% from here on a year-to-year basis.

From the perspective of a midcap versus small cap or a large cap; which part do you think right now holds the most value?

It is in the front end. We have seen significant growth in the largecap stocks. But it is going to be more broad-based and the midcap and smallcap stocks will probably continue the momentum given improved visibility of sustained earnings growth. However, in addition to earnings growth, investors must focus on cash flow generation and corporate governance of companies.

There will always be specific stocks and specific opportunities within the indices will probably provide opportunity and corrections will provide an entry level and another opportunity for anyone in retail or anybody who would have not entered so far.

Notably, every bull phase creates some winners, which causes midcaps to turn into largecaps. We already have many examples like Shree Cement, Tata Consumers, Avenue Supermarts, Adani Ports, Divi’s Lab, SBI Cards, among others.

There has been a flurry of IPOs so far in the year. What are the challenges of valuing these new age entrants into the market?

In 2019, from around $2.5 billion in the primary market (which is IPO) to almost $12 billion so far in 2021, it has been a phenomenal journey. LIC and Paytm are among others that could come in this year. So clearly it is a year of fundraising.

A year when a lot of primary activity is happening is very good because that provides risk capital.

The valuations with regards to overall IPOs or more specifically new age companies will probably be the function of what has been expected and what the investment horizon is. Clearly, if one goes for LIC IPO versus the Zomato or Paytm IPO will be on a completely different perspective. While LIC IPO is on today’s base and some growth rate in future, the new age technologies like Paytm or Zomato will probably be more based upon a little longer term.

Whoever is in it for the long haul…these kinds of IPOs will definitely benefit them. However, there are some players who are not for the long term. Probably more conventional IPOs will be better for them.

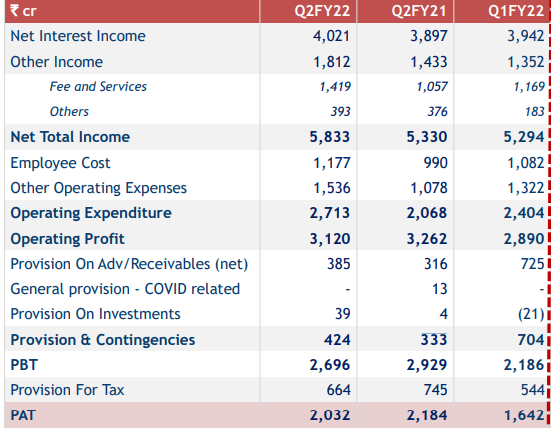

What is the earnings season telling us so far? Is the financial sector out of the woods in terms of asset quality?

Earnings so far have been decent and hence the markets are doing well. However, input cost inflation turned out to be a key concern for the market in the last couple of days.

With regards to whether the asset quality is out of the woods or not, the financial stability report from RBI says that it may take around four to six quarters for banks or for the lending companies to recover from the complete impact of any recession or any significant event like Covid-19.

So far so good but I would like to keep an eye on this for another couple of quarters at least so that we can see how it is going to pan out but all the policy responses that have been done so far both on the monetary and fiscal space have been supportive.

But we have another couple of quarters to look out for.

We have seen that so far this month the rupee has taken quite a beating because of a combination of factors; we have oil prices, we have the US Fed talking about tapering etc. Some companies like those in the IT space could benefit from this but what are the broader market implications of depreciation of the rupee?

The rupee usually is a function of two main components; one is the internal policies — how are the interest rates and second are the external fund flows and the liquidity in addition to the crude and other commodity prices.

There was an interesting article that says that the option strike in the US is going as far as above $200 for the Brent crude. It is phenomenal to even read that.

Obviously in the near term, crude probably has an upward trajectory till some correction is brought in by OPEC.

There are two key things that are going to play for currency in the near term future; one will be what steps Fed takes to taper or in what form and fashion.

That will probably determine the liquidity flow and that is where the currency play will come.

And the second is how the local interest rates or the domestic interest rates pan out. These two combinations will probably see where the rupee goes from here. Overall, it may be hovering around the range on a bit of a weakening but it is not going to be too much.

It is going to be around the range depending on what Fed does and how the domestic interest rates pan out.

Recently even the Bank of England governor has been talking about tightening monetary policy. The Fed has given a clear timeline that by November, bond purchases will be tapered. In terms of FII flows coming into India, do you think there would be a meaningful impact once all of this starts out in the advanced economies?

As we have seen in the past, tapering in itself does not cause the reverse fund flows. It is more if something is done beyond expectations.

Whatever has already been priced in or already been considered will not cause any impact on the FIIs.

If something is done over and above what has been expected, there may be some impact. However, the good part is that India being a strong story and robust inflow; that will probably offset some of those reversals because of interest rate arbitrage or the currency.

So overall, we do not expect on a more structural basis FPIs or FIIs flows to be reversed.

Yes, there could be some few months here and there, there could be some correction based upon the event but overall we should be okay.

We have been seeing a lot of talk recently about inclusion of India’s bonds in global indices. RBI has been talking about it. Many research reports including big foreign brokerages have been talking about it. Would that be a game changer for Indian financial markets?

I personally believe it will be and if you would have noticed, there was a recent comment by the deputy governor also that inclusion of the Indian bonds in the global indices in a way is a journey towards the capital account convertibility.

That kind of the roadmap that we are heading toward is very transformational for India to have a foreign flow like that. But it comes with its own impact and as long as that has been managed, I it is going to be a big, big plus for a country like India where there will be a debt fund and infrastructure funding and a lot of that positive funds will probably flow in.

We just have to ensure that the ecosystem has been addressed in a way where we are ready for the capital account convertibility which we have been speaking about for a long time.

In the last policy, the RBI kept interest rates unchanged but it stopped its government security acquisition programme and increased the size of its variable rate reverse repos. Some have taken that as a precursor to some degree of normalisation. Do you think that RBI could run the risk of falling behind the curve if it does not do something like a reverse repo hike by December?

I personally do not believe so. Whatever is being done is along the lines of expectation. There are a lot of reports out there that actually forecast when the interest rate cycle by the central bank will start normalising to pre-Covid level.

A timeline of over the next 12 to 18 months is probably a reasonable timeline because we have to see that it is not just the price stability but it is also about the economy and the growth which needs to be balanced. Anything which is done prematurely on one dimension has an impact on the other dimensions as well?

Yes 100% India will be. I personally believe that India will be both in top 5 and top 3 with regard to the best performing market. The only thing we have to see is that hopefully it will be on a dollar basis because that is where the currency will come into play and that probably will be a much more robust story and I do believe even there we have a fair chance.