Top Diwali Stock Picks; 10 Stock Suggestions By Edelweiss Brokerage

[ad_1]

Read More/Less

Birlasoft Ltd

According to brokerage, Birlasoft is competing with larger IT services companies by exploiting its expertise in particular areas within broader sectors.

“Margins have improved consistently over the last few quarters, from 10% in Q1FY21 to 14-15% range currently. Better deal signings focus on niche verticals, top client growth and increased efficiency due to cutting of tail are responsible for improved profitability We expect revenues to grow by 37% over FY21-FY23E and EBIT to grow by 72% over the same period • At CMP, the stock is trading at 24.7x/119.5x FY22E/23E EPS,” the brokerage has said.

Brigade Enterprise

Brigade has increased its market share to 6% in the last five years after re-calibrating its project launch strategy. Brigade’s sales volume share in inexpensive and mid-market projects with unit sizes up to Rs1.5 crore climbed to 80% in FY21, up from 50% in the previous 3-4 years.

“We believe Brigade is best play on revival in residential market and would continue to maintain its market share given its asset light model, strong Brand and execution track record, growth capital in place, comfortable leverage position and one of best cost of borrowing industry (~8%). Furthermore, ramp up in BEL’s leasing income with large part of capex behind it would act as key catalyst in restricting the downside in its valuations,” the brokerage has said.

Home First Finance Company

With a significant market size of INR50tn in the Economically Weaker Section (EWS) and Low Income Group (LIG) categories and relatively reduced competition from banks, the small ticket / inexpensive home category remains virtually unexplored.

“We believe HFFC is well placed to capitalize on the high growth yet underpenetrated affordable housing market (projected to register ~20-25% CAGR over the medium term). The valuation discount compared to other listed small ticket housing financing companies provide further comfort on the downside. We recommend a ‘BUY’ on the stock with a 1-year target price of INR 763,” the brokerage has said.

ICICI Bank Ltd

According to brokerage, because it proactively recognized stressed assets from previous wholesale loans, the bank’s asset quality has continuously improved over the last few quarters.

“In terms of valuation, ICICI Bank is trading at 2.3x FY23E P/ABV, a 35-40% discount over large peers such as Kotak and HDFC Bank. The valuation gap ought to close, leading to an upside of 22-25% CAGR in the share price over the next two years,” the brokerage has said.

Indo Count Industries Ltd

The brokerage believes that with increasing US export orders, ICIL’s quarterly volume run-rate has reached 20-22 million metres over the last four quarters, compared to 14-17 million metres a few years ago.

“With multiple industry tailwinds such as robust US import demand, ‘China plus one’ strategy playing out, continuation of export incentives in addition to attractive valuations of ICIL at 15x on FY23E earnings estimates, which is at a 25% discount as compared to its peak multiples, we continue to prefer ICIL in the textiles space. We expect ICIL to deliver Revenue/EBITDA/PAT CAGR of 14%/22%/24% over FY21-23E,” the brokerage has said.

IndusInd Bank Ltd

The bank has a strong presence in the car finance and microfinance divisions, which account for 41% of its loan book. These are high-risk groups that were disproportionately affected by the epidemic, the brokerage said.

“The stock is currently trading at a discount to the 4 largest private banks (1.6x FY23E P/ABV). We believe that it has the potential to trade at 2.2x P/ABV, implying 30-35% returns over the next 2 years,” thr brokerage has said.

Infosys Ltd

It believes that the company is now seeing high demand, with cumulative transaction wins of more than USD 2 billion in each of the last five quarters. The largest agreement in the company’s history was a USD3.2 billion deal with Diamler in Q3FY21.

“We expect Revenue/EBIT/PAT to grow 40%/41%/42% over FY21-FY23E. We believe that margins will remain resilient owing to operating leverage, higher offshoring and elevated utilization. At CMP, the stock is trading at 31.5x/26.2x FY22E/23E EPS,” the brokerage has said.

InoxLeisure Ltd

The brokerage believes that because the vast majority of Indians will have been vaccinated by then, ILL is well-positioned to capitalise on strong pent-up demand. Furthermore, following normalization, ILL is projected to rapidly expand screens, which should help revenue growth (opened 15 screens so far in FY22E). Given Indian moviegoers’ enormous demand for the silver screen, we believe the multiplex business is a long-term viable strategy.

Max Healthcare Institute

“Further, management is focusing on (a) optimising capacity utilisation in existing facilities/resources and patient mix, (b) increasing ARPOB, (c) scaling up capital-light businesses (Max@Home and MaxLab), and (d) potential targets for M&A. We believe MHI deserves superior valuations because of its presence in premium markets and excellent business mix compared to peers. Maintain ‘BUY’ with a revised target price of INR 443/share,” the brokerage has said.

Disclaimer

The above stock is picked from the brokerage report of Edelweiss Brokerage. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution. Greynium Information Technologies, the author, and the brokerage house are not liable for any losses caused as a result of decisions based on the article.

[ad_2]

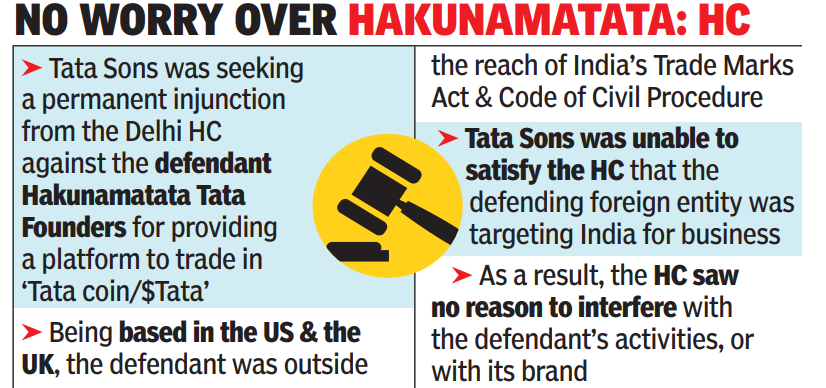

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.

The defendants in this lawsuit, filed by Tata Sons with the Delhi high court, were companies based in the US and the UK with no India presence. They were located outside the sovereign borders of India and statutorily outside the reach of the Trade Marks Act, 1999 and the Code of Civil Procedure, 1908. In this backdrop, the “intention to target India as a customer base was of paramount importance” for Tata Sons to make its case.