Capri Global Capital Q2 standalone net dips 21% to ₹41 crore

[ad_1]

Read More/Less

Capri Global Capital Ltd (CGCL) reported a 21 per cent year-on-year (yoy) drop in second quarter standalone net profit at ₹41 crore against ₹52 crore in the year ago period as growth in total expenses outstripped growth in total income.

While total income was up 16 per cent yoy at ₹171 crore (₹147 crore in the year ago quarter), total expenses rose 48 per cent yoy at ₹114 crore (₹77 crore).

The non-banking finance company’s loan portfolio (standalone) increased 21 per cent to ₹3,797 crore and investment portfolio was up 33 per cent to ₹553 crore.

During the reporting quarter, the company implemented resolution plans in the case of 571 accounts aggregating ₹180 crore under the RBI’s August 6, 2020, circular on “Resolution Framework for Covid-19-related Stress”.

CGCL’s consolidated net profit ( including results of Capri Global Housing Finance and Capri Global Resource) declined 14 per cent to ₹52.5 crore (₹61 crore).

Disbursals (consolidated: MSME, construction finance and housing finance) jumped over three times to ₹585 crore during the quarter against ₹190 crore in the year ago quarter.

Assets under management (consolidated) was up 27 per cent at ₹5,271 crore (₹4,147 crore).

Also read: Capri Global launches ‘Prime’ affordable housing loans

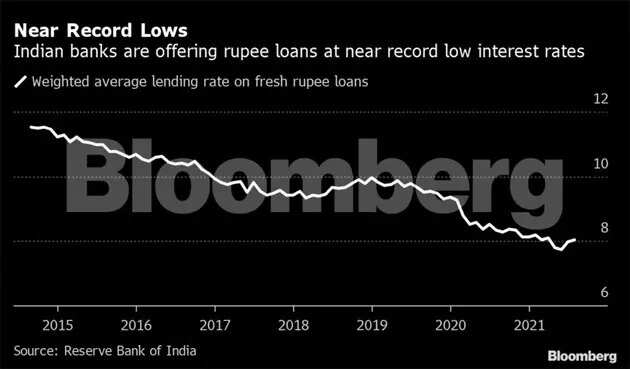

Net interest margin (NIM) declined to 9.6 per cent from 10.6 per cent in the year ago quarter. However, NIM in the reporting quarter was up vis-a-vis preceding quarter’s 9.3 per cent.

Gross stage 3 (credit impaired) assets rose to 3.26 per cent of gross advances against 2.18 per cent in the year ago quarter. However, the proportion of such assets in the reporting quarter was down vis-a-vis preceding quarter’s 3.45 per cent.

Net stage 3 assets rose to 0.61 per cent of net advances against 0.12 per cent in the year ago quarter. However, the proportion of such assets in the reporting quarter was down vis-a-vis preceding quarter’s 0.81 per cent.

[ad_2]